- Limited time offer - Get $75 off + 1 month free

- Thousands of verified 5-star ratings

- Trusted network of 25,000+ contractors

- 8M+ service requests successfully completed

- $150 off any plan

- Free roof coverage

- 2 extra months free

- Plans start at $29.99 a month

- $4 billion paid in homeowner claims

- Video chat with repair Experts for real-time help*Video chat feature available as a benefit to AHS members with select plans. See ahs.com for hours and details.

- Limited time offer: Get $200 off + 2 free months

- Customizable plans with 35+ add-ons

- 24/7 customer service + user-friendly mobile app

- Special offer: Get $50 off + 1 month free

- Covers HVAC to electrics

- 24/7 availability guaranteed

- Get $250 off with code FLASH250

- 24/7 service requests

- Will replace systems that can't be repaired

- Get a free quote

- Nationwide trusted technicians

- Reliable 24/7 home protection

- Free 30-day trial + $100 off + 1st month free

- 90-day workmanship warranty

- A+ BBB rating

- Certified technicians

- 35+ years of home maintenance experience

- 24/7 US-based customer support

- Pays 97.5% of claims

- Flexible cancellation policy

- Get 1 month free

What Does Home Warranty Offer to a Homeowner?

You just purchased your dream house along with the all the perfect décor that turns your dream house into your dream home. It's been a few months and everything is unpacked and placed in its designated spot within your new home. So you turn your attention to rebuilding your savings account since it was depleted from the biggest and most important purchase of your life. However, within a few months of living in your dream home, you experience a costly unexpected expense when your heater blows out during the winter.

With a new mortgage payment and a limited amount in savings, you're looking at numerous financial options on how to pay for this unexpected expense. Fortunately, you purchased a home protection plan that will cover this expense as well as any major systems and appliances that may need repair or replacement in your home.

What Does a Home Warranty Include?

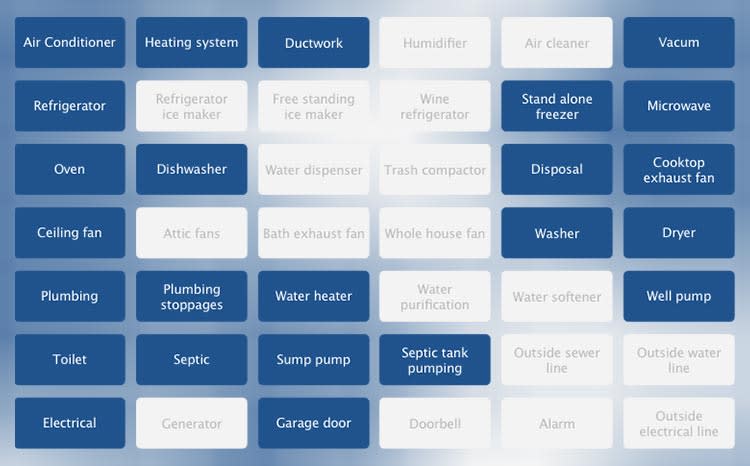

Home warranties typically include coverage the following major appliances and systems:

- Central air conditioning systems

- Central heating systems

- Humidifiers

- Interior electrical systems

- Refrigerators

- Ranges, ovens, and cooktops

- Dishwashers

- Built-in microwaves

- Water heaters

- Plumbing systems

- Garbage disposals

- Washers and dryers

- Garage door openers

- Roof leaks

When Do You Need a Home Warranty?

Home warranties are offered to all homeowners whether they are new or existing. Typically, home warranty plans are offered to the home-buyer when they are purchasing a new home. However, if the buyer decides not to purchase home warranty insurance simultaneously with their home purchase, then they can secure a home protection plan at a later date. There is no time restriction as to when a homeowner can decide to purchase a warranty plan.

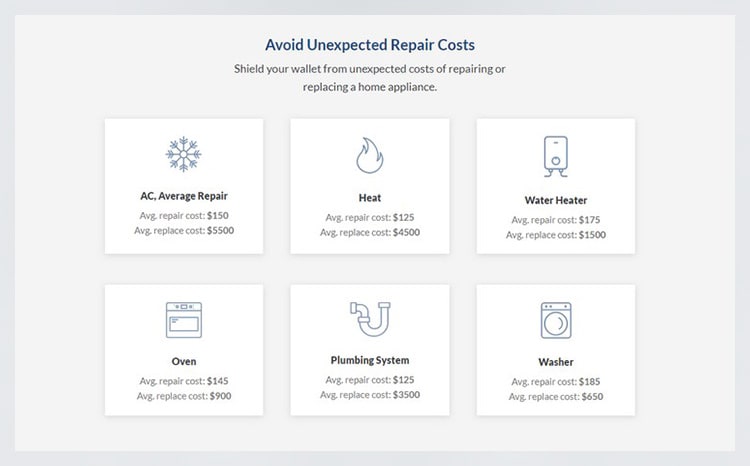

The Cost Involved With a Warranty for Your Home

Typically, a home warranty costs a couple hundred dollars, which can be paid in a lump sum amount during the purchase of a new home. This lump sum payment would be collected at the time closing costs are due for the newly purchased home. However, the seller, real estate agent or a family member or friend can purchase home warranties on behalf of a home-buyer. If a home appliance insurance claim is filed then the homeowner may be responsible for paying a service fee or deductible that typically ranges from $50 to $100. Please note, home warranty companies have different contract agreements therefore, fee amounts may vary.

Home Warranty Process

Filing a claim is a very simple process. Prior to filing your claim, review your insurance contract to verify the item that you need to repair or replace is covered under your plan. Once you verify this information, you'll complete the following steps:

- Contact your home warranty insurance company to file a claim.

- The warranty company will review their home warranty plans to verify that you have a plan that covers the item in question.

- The warranty company will schedule an appointment for you with a local contractor.

- The contractor will diagnosis the situation and makes a recommendation to repair or replace the item in question.

- Repairs and replacements will be carried out.

- You will pay a cost in the form of a service fee to the warranty company.

- Process is complete.

Conclusion

As there are many providers to choose from that have a variety of plan options; the best home warranty companies depend on how they can meet the needs of your home. The best way to select the right home protection plan for you is by doing your research on what each company has to offer with their plans. For instance, if you have a home with older appliances then you may be interested in locating a plan that has home appliance insurance. Want to learn more before choosing? Here are some tips and tricks to get you up-to-date.

Convinced? Check out our expert written reviews for information on the top providers for home warranty. Once you've selected the plan that best fits your needs, you'll join the many homeowners that have peace of mind because they are protected by one of the top home warranty companies.

Our Top 10 Best Home Warranty Companies - Quick Reviews:

- 1

Save on premiums with full coverage and round-th...

Save on premiums with full coverage and round-th...- Best for - Homeowners seeking affordable full-home coverage

- Average annual premium - $562 - $657

- Service requests - 24/7 online and by phone

Save on premiums with full coverage and round-the...Read Choice Home Warranty ReviewChoice Home Warranty stands out with its two straightforward plans and uniform $100 service fee. Its Basic Plan covers essential home systems and appliances, while the Total Plan covers air conditioning, refrigerators, and washers. It’s also our top home warranty for plumbing since it covers your entire plumbing system, including your water heater and garbage disposals. It also covers parts of your electrical system that regulate water pressure.

As Jake Hill, CEO of DebtHammer, notes, Choice Home Warranty is "especially helpful for owners of older homes" since it doesn't "deny coverage based on the age of your home's systems or appliances."

Choice Home Warranty offers substantial protection, covering up to $3,000 per successful claim. Plus, you get your first month free if you purchase any single-payment home warranty plan.

Why we chose Choice Home Warranty: Choice Home Warranty's straightforward plan structure and single $100 service fee make it our top option. In addition to its homeowner plans, CHW provides professional coverage for buyers and sellers. It also offers a 30-day trial, so you can try its services risk-free before fully committing.

Client perspective: Irene Smith (53) notes, "My last repair for my garage door was the best experience I’ve had in all the years I've had home warranty service. “ She also adds that the service person was on time, explained the issues, and fixed a major problem in about 15 minutes. “It was quick, professional, and couldn’t have been easier.”

Choice Home Warranty Pros & Cons

PROS

Offers 30-day guarantee on covered repairsFirst month free with purchase of any single payment planEasy online claims processCONS

Limited add-on coveragesNot available in Washington - 2

Select offers affordable premiums and fees

Select offers affordable premiums and fees- Best for - Customers seeking affordable premiums and fees

- Average annual premium - $432–$756

- Service requests - 24/7 online and by phone

Select offers affordable premiums and feesRead Select Home Warranty ReviewSelect Home Warranty provides competitively priced coverage for most major appliances and systems. Their premiums start at just $36/month, which is more affordable than other home warranty companies.

Jennifer Spinelli, real estate professional, investment advisor, and founder and CEO of Cash For Houses, calls Select Home Warranty "reliable and trustworthy." She adds that she no longer worries about "costly repairs or replacements due to breakdowns or malfunctions."

Three different plans are available and all of them include free roof leak coverage. However, Select Home Warranty's services aren't available in Nevada, Washington, or Wisconsin.

Why we chose Select Home Warranty: Their affordable premiums and minimal fees elevate them above their competitors. It's also convenient that they offer two months free with their annual plan.

Our experience: We were particularly impressed with Select Home Warranty's 24/7 friendly phone support and free roof leak coverage.

Select Home Warranty Pros & Cons

PROS

Affordable premiums and fees24/7 phone supportFree coverage for roof leaksCONS

Low coverage limitsNot available in Nevada, Washington, or Wisconsin - 3

Customizable plans with adjustable service fees

Customizable plans with adjustable service fees- Best for - Customizable plans

- Average annual premium - $500–$700

- Service requests - 24/7 online and by phone

Customizable plans with adjustable service feesRead American Home Shield ReviewOperating since 1971, American Home Shield is the largest and most established company in the US home warranty market, with over two million members.

Tommy Gallagher, former investment banker and founder of Top Mobile Banks, was "impressed with the range of contractors they have available and the quality of service they provide."

Choose from their three customizable plans—ShieldSilver, ShieldGold, and ShieldPlatinum. The ShieldSilver plan only covers 14 major systems, while the ShieldGold plan covers 23.

For additional perks, ShieldPlatinum comes with complete system and appliance coverage. This includes cost-saving add-ons like free HVAC tune-ups, unlimited A/C refrigerant, coverage for rooks leaks and code violations, and higher payout caps for repairs and replacements.

Why we chose American Home Shield: They operate in 47 states and Washington DC, and you can customize your plan. American Home Shield automatically covers duplicate items, plus older items with rust or corrosion.

Our experience: We found American Home Shield to be an excellent option for anyone seeking highly customizable plans and access to an extensive network of contractors. We could easily find a plan that suited our needs.

American Home Shield Pros & Cons

PROS

Highly customizable plansIncludes undetectable pre-existing conditionsCovers older items, including rust and corrosionCONS

No guarantee for repair timesNot available in Alaska, New York City, or Hawaii - 4

Live chat customer service

Live chat customer service- Best for - Homeowners looking for reliability, reviews & quick claims process

- Average annual premium - $365–$699.99

- Service requests - 24/7 online and by phone

Live chat customer serviceRead Liberty Home Guard ReviewWith high ratings and great reviews, Liberty Home Guard has a reputation for delivering reliable service to customers.

They have three plans available (Systems Guard, Appliance Guard, and Total Home Guard) with optional financial protection for roof leaks, standalone freezers, generators, carpet cleaning, and power washing. New policyholders also get free limited roof leak protection and two free months of coverage.

Liberty Home Guard's exceptional claims process sets them apart from other home warranty providers. They have a 24/7 call center and guarantee to assign a contractor to a claim within 24 to 48 hours. They also have a network of over 10,000 qualified technicians in all 50 states.

Liberty Home Guard has launched a comprehensive mobile app, revolutionizing how homeowners manage their home warranty accounts, file claims, and access real-time information. The app offers features like effortless access to warranty details, efficient claims management, streamlined payment tracking, seamless communication with technicians, real-time notifications, and a wealth of knowledge on home maintenance.

Why we chose Liberty Home Guard: Liberty Home Guard's rates start at just $1/day, and their technicians arrive within 24 to 48 hours of claim submissions.

Our experience: We were pleased with Liberty Home Guard's reliability, rapid claims processing, and excellent customer service.

Liberty Home Guard Pros & Cons

PROS

Excellent customer serviceCurrently offers two free monthsHighly rated by customersCONS

Not available in WisconsinFewer technicians compared to other companies - 5

Comprehensive coverage for all your appliances

Comprehensive coverage for all your appliances- Best for - Comprehensive appliance coverage

- Average annual premium - $550-$720

- Service requests - 24/7 online, by phone during normal business hours

Comprehensive coverage for all your appliancesRead Home Warranty of America ReviewHome Warranty of America has comprehensive policies that cover most appliances and indoor systems. Offering up to $15,000 in annual coverage for repairs and replacements, they also have 24/7 online or phone service requests and a 30-day money-back guarantee.

They may be a little pricier than some competitors, but you get a lot for your money—all plans come with a deductible per-service visit.

Why we chose Home Warranty of America: Home Warranty of America provides nationwide service and is good value for money when covering all appliances.

Our experience: We were impressed with Home Warranty of America's extensive coverage and efficient customer service. It was easy to set up a plan, and we appreciated their 30-day money-back guarantee.

Home Warranty of America Pros & Cons

PROS

Covers most home appliancesHigh coverage limits30-day money-back guaranteeCONS

30-day waiting period10% cancelation fee - 6

Covers items regardless of age

Covers items regardless of age- Best for - High payout caps

- Average annual premium - $360–$546

- Service requests - 24/7 phone and online claims service No limit on number of service requests

Covers items regardless of ageRead First American Home Warranty ReviewFirst American Home Warranty is an ideal choice for those seeking robust home protection for their systems and appliances. The company has been in business since 1984 and claims it's saved homeowners over $219 million in repair costs.

Coverage comes in the form of two basic plans and a premium plan. First American Home Warranty's best features include that they protect items regardless of age and replace faulty items with brand-new equivalents if they can't repair them.

Why we chose First American Home Warranty: First American Home Warranty offers specialized plans for both real estate professionals and service providers. They also have 24/7 claims service, fully vetted tradespeople, and a transparent application process.

Our experience: We liked First American Home Warranty's response times, which were significantly faster than other companies.

First American Home Warranty Pros & Cons

PROS

24/7 claims serviceFully vetted tradespeopleLow pricing and service feesCONS

Difficult to understand pricing breakdown without a personal quoteTheir app is poorly rated - 7

HSC offers unique coverage options nationwide

HSC offers unique coverage options nationwide- Best for - Homeowners looking for extensive coverage options

- Average annual premium - $552-$799

- Service requests - 24/7 online, by phone during normal business hours

HSC offers unique coverage options nationwideRead Home Service Club ReviewHome Service Club (HSC) offers two service plans: Standard and Comprehensive. The Standard plan covers 18 basic appliances and systems, while the Comprehensive plan covers 33. Optional add-ons, such as pool and roof coverage, are available for an extra fee.

HSC's unique plans include pest damage and utility line cover, setting them apart from other home warranty services. You can also choose your service fee amount from three options ($65, $95, and $125), and all repairs have a 90-day guarantee.

However, HSC charges higher service fees and premiums than average. You must also live in a single-family residence, condo, townhouse, or multi-family property to qualify for a plan.

Why we chose Home Service Club: HSC has a broad selection of optional add-ons, including coverage of gas lines, grinder pumps, ductwork, pools, and spas. Additionally, the company's services are available nationwide with no exclusions.

Our experience: We appreciated that HSC provides coverage for pest damage, which many competitors don't.

Home Service Club Pros & Cons

PROS

Provides coverage for pest damageAvailable nationwide90-day workmanship guarantee on all repairsCONS

High base premiums and service feesDon't list pricing on the website - 8

Build your own custom home warranty policy

Build your own custom home warranty policy- Best for - Customizable warranty policies

- Average annual premium - From $500

- Service requests - 24/7

Build your own custom home warranty policyRead Elite Home Warranty ReviewElite Home Warranty offers highly customizable home warranty policies. You can choose from three warranty packages and dozens of optional add-ons, or build a completely custom policy that protects the appliances and home systems you’re most concerned about. You can also customize your coverage limits and service visit copay. Overall, Elite Home Warranty policies are comprehensive and affordable.

Elite Home Warranty is one of only a handful of home warranty providers that lets you choose your own service technician. The company also has a nationwide network of contractors and can dispatch them within 24-48 hours of your claim. You can file a claim 24/7 online, over the phone, or through the Elite Home Warranty mobile app.

Elite Home Warranty Pros & Cons

PROS

Choose custom coverage limitsIn-network service technicians or choose your ownFile claims 24/7, online, by phone, or through the appCONS

Copay for service visits can be up to $130 each timeWorkmanship guarantee for service visits is only 30 days - 9

Unlimited coverage for your home’s systems

Unlimited coverage for your home’s systems- Best for - Unlimited coverage for home systems

- Average annual premium - $550-$1,050

- Service requests - 24/7

Unlimited coverage for your home’s systemsRead Mike Holmes Protection ReviewMike Holmes Protection offers customizable home warranty policies that provide unlimited coverage for your home systems and up to $6,000 in coverage for your appliances. The company has a network of more than 11,500 contractors and certified technicians and responds to claims 24/7.

Why we chose Mike Holmes Protection: Mike Holmes Protection is more expensive than competitors, but you get peace of mind knowing that even the most costly repairs will be covered in full. The company also has outstanding reviews from homeowners thanks to its speedy response to claims.

Our experience: I found the Mike Holmes Protection support team to be highly responsive and very helpful. I also like that you can get a free quote and sign up online in just a few minutes.

Mike Holmes Protection Pros & Cons

PROS

Unlimited coverage for repairs to home systemsMultiple plans with many add-onsGreat reputation for making fast repairsCONS

Available in 36 states onlyPremium costs are higher than the industry average - 10

High annual coverage limit in 48 states

High annual coverage limit in 48 states- Best for - Customers seeking high coverage limits and fast service

- Average annual premium - $239.88-$720

- Service requests - 24/7 online and phone

High annual coverage limit in 48 statesRead 2-10 Home Buyers Warranty Review2-10 Home Buyers Warranty has 40 years of experience in the home warranty industry. It offers 3 plan tiers for $19.99 per month, $51 per month, and $60 per month. Service fees are adjustable, ranging from $65–$100 per visit, but the base fee is $85. 2-10 HBW offers a generous $25,000 annual coverage limit, so you’re protected in case of multiple appliance or system failures.

To start, simply visit 2-10 HBW’s website or call customer service. You can purchase a warranty anytime, whether you are buying, selling, or currently living in your home. Support is available 24/7, and you can expect a service call within 24–48 hours of submitting your claim.

Benefits:

Annual coverage limit up to $25,000

Covers everyday wear and tear

Refund for service fee if an item isn’t covered

Customers receive discounts on GE and Whirlpool appliances

Plans and Pricing:

2-10 Home Buyer’s Warranty offers three plans and optional add-on coverage.

Simply Kitchen: Covers six kitchen appliances

Complete Home: Covers 22 appliances and home systems, including all those covered by the Simply Kitchen plan

Pinnacle Home: Covers 32 appliances and home systems, including all those covered by the Complete Home plan

States Serviced:

2-10 Home Buyers Warranty is availalbe in 42 states, but is not available in Alaska, Hawaii, Montana, New Hampshire, North Dakota, Oklahoma, South Dakota, and Wyoming.

2-10 Home Buyers Warranty Pros & Cons

PROS

Available in 48 contiguous statesPurchase a plan anytime$25,000 annual coverage limitCONS

Expensive annual premiumHigh base service fee