- 3-bureau credit monitoring

- Credit reports and monthly credit scores

- Easily lock and unlock your credit file

- Save up to 68% today

“Aura is a good choice for you if you want a long-list of credit and identity theft monitoring services at a competitive price point.“ (Jan 2024)

- 60-day money-back guarantee

- Up to $1M reimbursement

- Enjoy 52% off your first year

- Constantly monitors billions of data points

- Fast alerts for stolen credit cards

- Special offer: Save 73% on Ultra Protection

- Scam Protection and Identity Theft Insurance

- View your digital footprint

- Try for only $1

- Proactive monitoring & real-time alerts

- Credit report reminders

- Stolen funds reimbursement up to $1M

- Quickly lock or unlock your credit

- Up to $1M identity theft coverage

- 30-day money-back guarantee

- 3-bureau credit monitoring

- Credit reports and monthly credit scores

- Easily lock and unlock your credit file

- Save up to 68% today

“Aura is a good choice for you if you want a long-list of credit and identity theft monitoring services at a competitive price point.“ (Jan 2024)

What is a credit freeze?

A credit freeze is one way to protect yourself against identity theft. It entails restricting access to your credit report to minimize the chance of identity thieves opening new accounts in your name. You’ll need to give personal consent for your credit to be viewed.

Since creditors need to view your credit report before approving any new accounts opened in your name, a credit freeze is one way to stay ahead of fraud and is especially smart if you suspect that someone has already gained access to your personal information.

So, what is the best way to freeze your credit? The most secure approach is to place a credit bureau freeze with all three major credit bureaus—Experian, TransUnion, and Equifax—to ensure that no one can access your credit report without your explicit permission.

Are there any downsides to a credit freeze?

A credit freeze won’t affect your credit in any harmful way. It doesn’t affect your credit score and won’t pose any difficulties in renting an apartment or applying for insurance. You’ll still be able to open new accounts, though you’ll have to lift the freeze temporarily in order to do so. If you ever need to regain access to your credit file, understanding how to unfreeze your credit is just as important as freezing it.

How to freeze your credit:

Learning how to freeze your credit is free and relatively simple to do. You’ll need to contact the 3 major credit bureaus separately and provide your SSN, birthday, and personal information. You’ll be given a password, which is what you’ll also use to unfreeze all 3 credit bureaus when needed.

If you’re looking for how to freeze all 3 credit reports, you must contact Experian, TransUnion, and Equifax directly. A security freeze on all 3 credit bureaus ensures that no one, including lenders and identity thieves, can access your credit report unless you lift the freeze yourself.

Understanding how to freeze your credit is a simple and smart way to prevent fraud and identity theft. The best ID theft protection services on the market utilize unique data and advanced technologies to monitor credit card transactions, the Dark Web, social media, and more. Their goal is to immediately detect when your information is stolen, offered for sale, or used fraudulently, in order to mitigate the damage of ID attacks as much as possible. Once you are alerted about an attack, these services will help restore your identity, reimburse you for stolen funds, and offer expert support around the clock.

Protecting Your Child’s Credit

If you are a parent, consider also freezing your child’s credit file. A credit freeze for minors is an essential step to prevent identity theft, as a child’s Social Security number can be misused for years before fraud is detected. Parents and legal guardians can request a credit freeze for minors through the three major credit bureaus.

How to unfreeze my credit when needed

When you’re ready to apply for new credit, knowing how to unfreeze your credit is just as important as knowing how to freeze your credit. You can temporarily lift the freeze by contacting each of the three credit bureaus and using the password or PIN you were provided when you first placed the freeze. If you need to unfreeze all 3 credit bureaus at once, be sure to make requests with Experian, Equifax, and TransUnion individually.

By taking proactive measures and learning how to freeze credit, you can better protect your financial future. Whether you need to freeze credit reports or lift a freeze when applying for new credit, these steps ensure that you stay in control of your financial security.

Freezing Your Credit for Free vs. Paid Credit Protection Services

Many consumers wonder how to freeze your credit for free and whether paid services offer any additional advantages. The truth is that placing a credit freeze through the three major credit bureaus—Experian, TransUnion, and Equifax—is completely free. Federal law mandates that consumers can request a security freeze all 3 credit bureaus at no cost. This is a great option for those who want to take control of their financial security without incurring any expenses.

However, while a credit bureau freeze prevents new accounts from being opened in your name, it does not protect against all forms of identity theft. For example, it won’t stop criminals from misusing your existing credit cards, filing fraudulent tax returns, or applying for government benefits in your name. This is where paid identity protection services come in.

Advantages of Paid Credit Protection Services

If you’re looking for more comprehensive protection beyond just learning how to freeze your credit for free, paid credit monitoring services offer several advantages:

24/7 Identity Theft Monitoring – Unlike a credit freeze, which only blocks access to your credit reports, paid services continuously monitor your Social Security number, bank accounts, and personal data for suspicious activity.

Dark Web Surveillance – Paid services scan black-market sites, hacker forums, and other sources to detect if your personal information is being bought or sold.

Fraud Alerts and Instant Notifications – If any unusual activity is detected, premium identity protection plans notify you immediately, allowing you to act before the damage is done.

Identity Restoration Support – If your identity is stolen, paid services provide professional assistance to help you recover and restore your financial accounts.

Insurance and Reimbursement – Many paid plans offer up to $1 million in identity theft insurance to cover legal fees and stolen funds.

Choosing the best credit freeze service can provide peace of mind for those seeking extra layers of security. These services go beyond a basic credit freeze, offering real-time monitoring, expert fraud resolution, and proactive alerts for suspicious activity.

While knowing how to freeze your credit for free is a powerful tool to prevent unauthorized access to your credit file, investing in a paid identity protection service can provide an extra layer of security, ensuring round-the-clock monitoring and rapid response to any threats.

This content was adapted using AI tools and includes human validation to ensure accuracy and quality.

Our Top 3 Picks

- 1

exceptional9.8

exceptional9.8 All-in-one ID, financial, and device protection

All-in-one ID, financial, and device protection- Best for - Best identity theft protection company overall

- Starting price - $9/monthly or $108/year

- Free trial - 60-day money-back guarantee

All-in-one ID, financial, and device protectionRead Aura ReviewAura - Best identity theft protection company overall

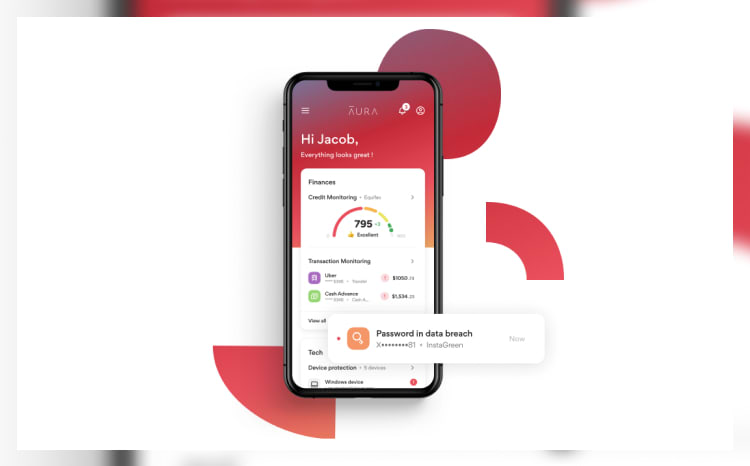

Aura provides robust protections against identity theft, including online account surveillance, financial transaction monitoring, and a secure digital "vault" for storing sensitive personal data.

The suite also features a password manager that simplifies the generation and storage of multiple robust passwords. Moreover, Aura's VPN utilizes high-grade encryption to safeguard your online activity, particularly on public Wi-Fi networks. Additionally, they offer AI-powered antivirus and safe browsing tools, which serve as a digital fortress against unwanted site trackers and fraudulent sites.

Aura monitors all three credit bureaus—Experian, Equifax, and TransUnion—as the Consumer Financial Protection Bureau (CFPB) recommends to detect identity theft. The CFPB also advises vigilance for credit check inquiries from unfamiliar companies and suspicious accounts, all of which Aura can oversee for you.

Why we chose Aura: In the event of a data breach, Aura promptly intervenes with security alerts, comprehensive fraud resolution services, and up to $1 million per person in premium identity theft insurance. The platform's sleek, user-friendly interface also showcases a "Protection Summary," conveniently displaying active anti-identity theft measures on a central dashboard.

Our experience: We were impressed with Aura's 24/7 customer support service. We appreciated that their U.S.-based fraud resolution team was always ready to assist us personally in the event of fraudulent incidents. If a breach occurs, the team would collaborate directly with us to develop a recovery plan and resolve the issue.

Aura Pros & Cons

PROS

Full suite of tools to protect your identity and finances60-day money-back guarantee for annual plan24/7 U.S.-based customer supportCONS

Fixed plans, no mixing, and matching - 2

excellent9.3

excellent9.3 Full-spectrum protection from Norton

Full-spectrum protection from Norton- Best for - Best for Norton antivirus users

- Starting price - $9.99

- Free trial - 60-day money-back guarantee

Full-spectrum protection from NortonRead LifeLock ReviewLifeLock - Best for Norton antivirus users

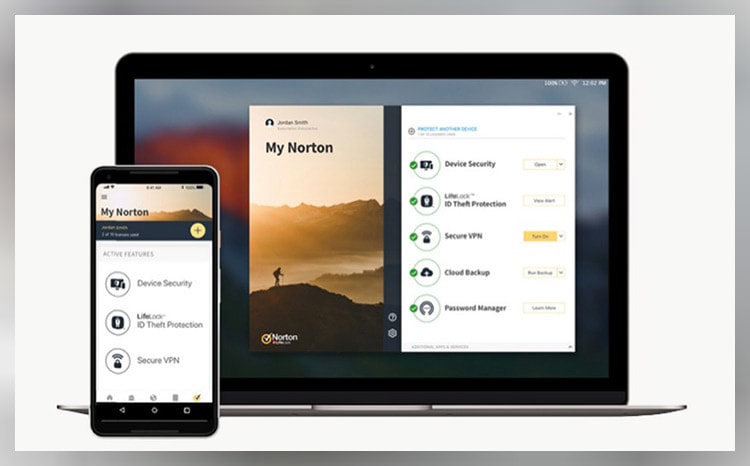

A product of anti-virus heavyweight Norton, LifeLock boasts the tech, accessibility, and ease that you’d expect from the industry-leading company. Most impressive are the plans themselves, which not only blend online security and ID theft protection but offer more flexibility than usual.

Lifelock’s plans include ID and Social Security number alerts and are offered in tandem with Norton’s 360 suite. This means that combo plans net you VPN services plus solid ID theft features like stolen funds reimbursement that ranges from $25,000 to $1 million dollars, bank account and credit card activity alerts, and even 401(k) investment account alerts on the Ultimate Plus plan.

LifeLock also offers LifeLock Junior, an affordable add-on for children under 18 that includes

Dark web monitoring and file-sharing network searches. All plans include 24/7 live member support and the aide of US-based identity restoration specialists.

LifeLock Pros & Cons

PROS

Reimbursement up to $1 millionAntivirus and protection from cyber threats60-day money-back guaranteeCONS

Only worth it if you want Norton 360Pricing can be confusing - 3

very good8.8

very good8.8 Effortless AI-backed data protection

Effortless AI-backed data protection- Best for - Best for full-spectrum protection

- Starting price - $7.20/monthly or $79.99/year

- Free trial - Free trial: Yes

Effortless AI-backed data protectionRead Identity Guard ReviewIdentity Guard - Best for full-spectrum protection

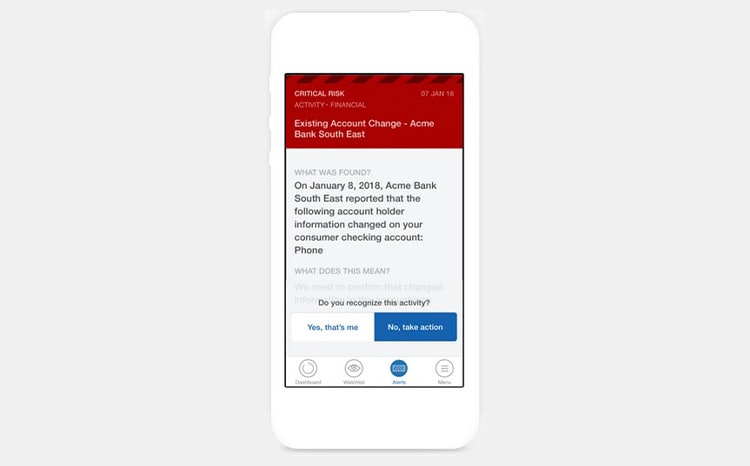

Identity Guard has safeguarded over 45 million identities and resolved more than 140,000 cases to date. They collaborate with IBM Watson's AI technology, leveraging its advanced data analysis and predictive capabilities to enhance threat detection.

The service protects your online identity by monitoring the dark web (a notorious hub for cybercrime activities) and alerting you if criminals are selling your personal information. Identity Guard also continuously monitors your personal and financial data, with their U.S.-based support team always at the ready to handle any emerging issues.

Why we chose Identity Guard: With 20 years of industry experience, Identity Guard stands out for providing effective identity theft protection and monitoring services, powered by AI. These services promptly alert you to a wide range of potential threats. They also offer up to $1 million in insurance coverage per adult to cover legal fees and replace lost funds.

Our experience: We found that even Identity Guard's most budget-friendly plan provides top-tier protection from ID fraud. We were particularly impressed by the inclusion of dark web monitoring in this entry-level subscription package.

Identity Guard Pros & Cons

PROS

Monitors credit score with all 3 credit bureausUtilizes IBM’s Watson AI tech for optimal performance$2,000 emergency cash fundCONS

No 24/7 customer service3-credit reporting only with premier plans