- 3-bureau credit monitoring and credit reports

- Up to $5 million identity theft insurance

- Antivirus, VPN and password manager

- Save up to 68% today

“Aura's comprehensive catch-all service gives you the most bang for your buck compared to the competition.“ (Jul 2025)

- 60-day money-back guarantee

- Up to $1M reimbursement

- Enjoy 52% off your first year

- Complete access to your monthly credit score

- Real-time credit monitoring alerts

- Stolen funds reimbursement up to $1M

- Regular credit monitoring & alerts

- Up to $1M reimbursement

- Lost wallet protection

- Proactive monitoring & real-time alerts

- Credit report reminders

- Repays up to $1M for stolen funds & expenses

- Risk-free with a 30-day money-back guarantee

- Up to $1 million in ID theft insurance

- Save 58% on your first term

- 3-bureau credit monitoring and credit reports

- Up to $5 million identity theft insurance

- Antivirus, VPN and password manager

- Save up to 68% today

“Aura's comprehensive catch-all service gives you the most bang for your buck compared to the competition.“ (Jul 2025)

What is Credit Monitoring?

Generally speaking, credit monitoring is any action taken to keep tabs on everything that affects your credit. Credit monitoring services tackle specific areas that are at risk of being targeted by cybercriminals. With fraud and identity theft on the rise, consumers are learning that they need to be more conscientious about reviewing their credit reports. According to the Federal Trade Commission (FTC), there were 2.8 million fraud reports in 2021, with fraud losses exceeding $5.8 billion.

In general, the top credit monitoring services keep an eye on your credit history, watching for any unusual, unauthorized, or suspicious behavior. It usually includes regular access to your credit score and credit reports from any of the three major credit bureaus in the country. The best credit monitoring app could make it more convenient to access your details at any time on the move.

A credit report is made up of several factors.

your payment history

loans you’ve taken out

your employment records

If you have a poor credit score, using the best credit monitoring service can help you highlight which areas need improvement to boost your score. You might want to improve your credit score if you tried applying for a loan but got rejected, want to upgrade your credit card status but are being held back by a poor credit score, or if you are planning to apply for a loan in the near future and want to ensure that you receive the best interest rate possible.

How Does Credit Monitoring Work?

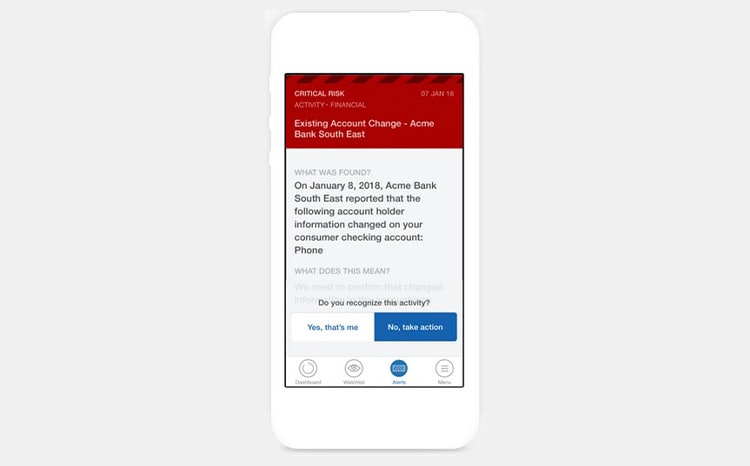

A credit monitoring service sends you an alert after tracking changes and/or actions made in your name. For example, if a loan or credit card is applied for under your name or using your social security number, the best credit security monitoring service will raise a red flag and you’ll be notified immediately for a response.

Credit monitoring companies keep track of your credit, enabling you to more easily make the improvements needed to raise your credit score. Here’s how that works:

You receive your credit report monthly, bi-annually, or quarterly, depending on the service.

Most of the best credit monitoring services highlight the areas in your credit report that need improvement.

Armed with this information, you can rebuild your damaged credit score.

Also, you can quickly amend any inaccuracies in your report, instantly improving your credit score.

Keep Tabs on Your Credit the Smart Way

In {year}, the need for staying on top of your credit is more important than ever. Whether you’re looking to clean up your credit score so that you can qualify for a better interest rate on a loan, or you want to ensure that your identity is being protected, using one of the best credit monitoring services can keep your accounts safe.

Our Top 3 Picks

- 1

Exceptional9.8

Exceptional9.8 All-in-one ID, financial, and device protection

All-in-one ID, financial, and device protection- Best for - Best identity theft protection company overall

- Starting price - $9/monthly or $108/year

- Free trial - 60-day money-back guarantee

All-in-one ID, financial, and device protectionRead Aura ReviewAura - Best identity theft protection company overall

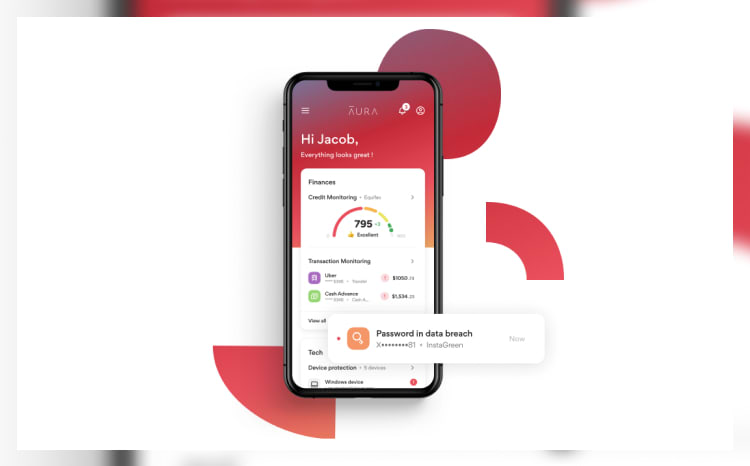

Aura provides robust protections against identity theft, including online account surveillance, financial transaction monitoring, and a secure digital "vault" for storing sensitive personal data.

The suite also features a password manager that simplifies the generation and storage of multiple robust passwords. Moreover, Aura's VPN utilizes high-grade encryption to safeguard your online activity, particularly on public Wi-Fi networks. Additionally, they offer AI-powered antivirus and safe browsing tools, which serve as a digital fortress against unwanted site trackers and fraudulent sites.

Aura monitors all three credit bureaus—Experian, Equifax, and TransUnion—as the Consumer Financial Protection Bureau (CFPB) recommends to detect identity theft. The CFPB also advises vigilance for credit check inquiries from unfamiliar companies and suspicious accounts, all of which Aura can oversee for you.

Why we chose Aura: In the event of a data breach, Aura promptly intervenes with security alerts, comprehensive fraud resolution services, and up to $1 million per person in premium identity theft insurance. The platform's sleek, user-friendly interface also showcases a "Protection Summary," conveniently displaying active anti-identity theft measures on a central dashboard.

Our experience: We were impressed with Aura's 24/7 customer support service. We appreciated that their U.S.-based fraud resolution team was always ready to assist us personally in the event of fraudulent incidents. If a breach occurs, the team would collaborate directly with us to develop a recovery plan and resolve the issue.

Aura Pros & Cons

PROS

Full suite of tools to protect your identity and finances60-day money-back guarantee for annual plan24/7 U.S.-based customer supportCONS

Fixed plans, no mixing, and matching - 2

Excellent9.2

Excellent9.2 Full-spectrum protection from Norton

Full-spectrum protection from Norton- Best for - Best for Norton antivirus users

- Starting price - $9.99

- Free trial - 60-day money-back guarantee

Full-spectrum protection from NortonRead LifeLock ReviewLifeLock - Best for Norton antivirus users

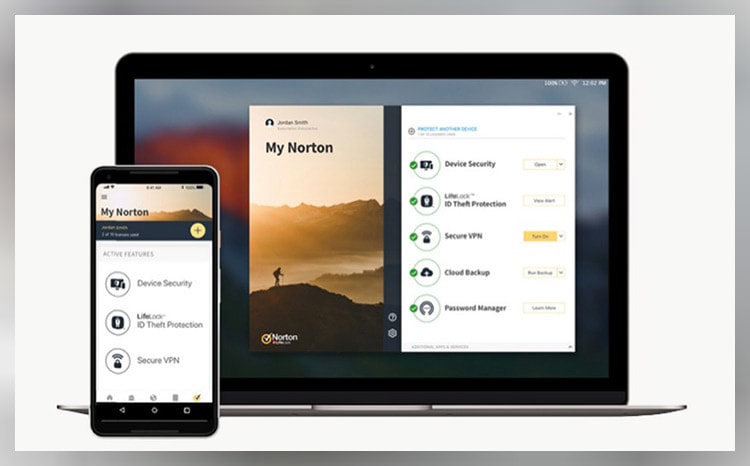

A product of anti-virus heavyweight Norton, LifeLock boasts the tech, accessibility, and ease that you’d expect from the industry-leading company. Most impressive are the plans themselves, which not only blend online security and ID theft protection but offer more flexibility than usual.

Lifelock’s plans include ID and Social Security number alerts and are offered in tandem with Norton’s 360 suite. This means that combo plans net you VPN services plus solid ID theft features like stolen funds reimbursement that ranges from $25,000 to $1 million dollars, bank account and credit card activity alerts, and even 401(k) investment account alerts on the Ultimate Plus plan.

LifeLock also offers LifeLock Junior, an affordable add-on for children under 18 that includes

Dark web monitoring and file-sharing network searches. All plans include 24/7 live member support and the aide of US-based identity restoration specialists.

LifeLock Pros & Cons

PROS

Reimbursement up to $1 millionAntivirus and protection from cyber threats60-day money-back guaranteeCONS

Only worth it if you want Norton 360Pricing can be confusing - 3

Excellent9.0

Excellent9.0 Effortless AI-backed data protection

Effortless AI-backed data protection- Best for - Best for full-spectrum protection

- Starting price - $7.20/monthly or $79.99/year

- Free trial - Free trial: Yes

Effortless AI-backed data protectionRead Identity Guard ReviewIdentity Guard - Best for full-spectrum protection

Identity Guard has safeguarded over 45 million identities and resolved more than 140,000 cases to date. They collaborate with IBM Watson's AI technology, leveraging its advanced data analysis and predictive capabilities to enhance threat detection.

The service protects your online identity by monitoring the dark web (a notorious hub for cybercrime activities) and alerting you if criminals are selling your personal information. Identity Guard also continuously monitors your personal and financial data, with their U.S.-based support team always at the ready to handle any emerging issues.

Why we chose Identity Guard: With 20 years of industry experience, Identity Guard stands out for providing effective identity theft protection and monitoring services, powered by AI. These services promptly alert you to a wide range of potential threats. They also offer up to $1 million in insurance coverage per adult to cover legal fees and replace lost funds.

Our experience: We found that even Identity Guard's most budget-friendly plan provides top-tier protection from ID fraud. We were particularly impressed by the inclusion of dark web monitoring in this entry-level subscription package.

Identity Guard Pros & Cons

PROS

Monitors credit score with all 3 credit bureausUtilizes IBM’s Watson AI tech for optimal performance$2,000 emergency cash fundCONS

No 24/7 customer service3-credit reporting only with premier plans