- Antivirus and WiFi Security VPN protection

- Up to $5 million identity theft insurance

- Fraud alerts in real time

- Save up to 68% today

- 60-day money-back guarantee

- Up to $1M reimbursement

- Enjoy 52% off your first year

- Constantly monitors billions of data points

- Dark web monitoring & SSN alerts

- Special offer: Save 73% on Ultra Protection

- Scam Protection and Identity Theft Insurance

- View your digital footprint

- Try for only $1

- Quickly lock or unlock your credit

- Up to $1M identity theft coverage

- 30-day money-back guarantee

- Proactive monitoring & real-time alerts

- Credit report reminders

- Repays up to $1M for stolen funds & expenses

- Real-time credit card & ID breach alerts

- Create a new identity & email for online use

- Covers unlimited devices

- Regular credit monitoring & alerts

- Up to $1M reimbursement

- A+ rating from the Better Business Bureau

- Antivirus and WiFi Security VPN protection

- Up to $5 million identity theft insurance

- Fraud alerts in real time

- Save up to 68% today

What is the Dark Web?

The internet can be split into three main parts: the surface web, which is searchable through Google and other search engines, the deep web, which contains everything that isn’t searchable, and the dark web.

The dark web contains a wide selection of legal and illegal websites. These aren’t indexable (can’t be found with search engines) and can only be accessed with the TOR web browser.

Many dark web websites deal with—or even facilitate—criminal activities, including identity and credit card theft. The nature of the dark web means that it’s difficult for law enforcement and other authorities to track down people participating in illegal activities.

It is worth noting here that it’s perfectly legal to use the dark web, and many people use it for legitimate purposes. For example, its anonymity means that it’s widely used by whistleblowers and political dissidents to reveal sensitive information.

What Happens if My Information Gets Onto the Dark Web?

It’s very easy for your information to get on the dark web. If it has been stolen or leaked at any time—such as during a website or database hack—it will likely find its way onto the dark web. Different types of personal information are sold or shared, including the following:

Social security number (SSN)

Name and address

Account login details

Driver’s license and passport details

Financial information

One of the most common ways that criminals use this information is to create fake identities. For example, they could create a driver's license and other ID documents and use these if they are arrested or need a “clean” ID.

It’s also quite common for criminals to steal credit card and other financial information. This can be used to embezzle money or other assets.

How Do I Protect Against Dark Web Identity Theft?

Wondering what to do if your information is on the dark web? Or what to do if your SSN is on the dark web? The good news is that there are a few clear actions that you can take to protect against dark web identity theft.

One thing that you should be doing if you’re worried is using an identity theft protection service. These are designed to monitor the web and alert you if fraudulent or suspicious activity is detected.

Many of the leading identity theft protection services come with powerful dark web monitoring, which is designed to detect any unauthorized use of your personal information. Some come with financial fraud insurance and most include tools to help you resolve identity theft issues.

What to Consider When Choosing a Dark Web Identity Theft Protection Service

For starters, it’s important to choose an identity theft protection service that comes with dark web monitoring tools. We’d also suggest setting your budget before you start searching for a program to ensure you don’t spend more than you can afford.

It’s also a good idea to take a close look at what tools different programs offer to help you resolve identity theft issues. Some even include professional recovery assistance if your info is detected on the dark web.

Many dark web identity theft protection services come with a selection of other tools. For example, you might get access to a VPN, a password manager, and antivirus software as part of your subscription.

Last, but not least, we’d suggest a platform that includes identity theft insurance. Some providers offer up to $1,000,000 in identity theft insurance, which will help you recover stolen funds.

Our Top 3 Picks

- 1

exceptional9.8

exceptional9.8 All-in-one ID, financial, and device protection

All-in-one ID, financial, and device protection- Best for - Best identity theft protection company overall

- Starting price - $9/monthly or $108/year

- Free trial - 60-day money-back guarantee

All-in-one ID, financial, and device protectionRead Aura ReviewAura - Best identity theft protection company overall

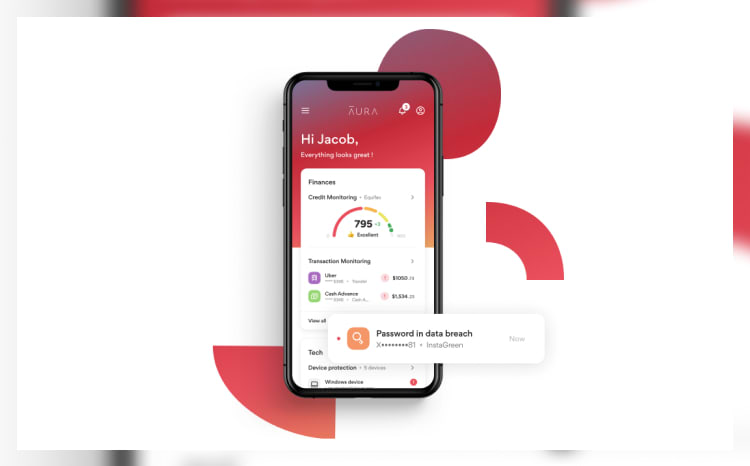

Aura provides robust protections against identity theft, including online account surveillance, financial transaction monitoring, and a secure digital "vault" for storing sensitive personal data.

The suite also features a password manager that simplifies the generation and storage of multiple robust passwords. Moreover, Aura's VPN utilizes high-grade encryption to safeguard your online activity, particularly on public Wi-Fi networks. Additionally, they offer AI-powered antivirus and safe browsing tools, which serve as a digital fortress against unwanted site trackers and fraudulent sites.

Aura monitors all three credit bureaus—Experian, Equifax, and TransUnion—as the Consumer Financial Protection Bureau (CFPB) recommends to detect identity theft. The CFPB also advises vigilance for credit check inquiries from unfamiliar companies and suspicious accounts, all of which Aura can oversee for you.

Why we chose Aura: In the event of a data breach, Aura promptly intervenes with security alerts, comprehensive fraud resolution services, and up to $1 million per person in premium identity theft insurance. The platform's sleek, user-friendly interface also showcases a "Protection Summary," conveniently displaying active anti-identity theft measures on a central dashboard.

Our experience: We were impressed with Aura's 24/7 customer support service. We appreciated that their U.S.-based fraud resolution team was always ready to assist us personally in the event of fraudulent incidents. If a breach occurs, the team would collaborate directly with us to develop a recovery plan and resolve the issue.

Aura Pros & Cons

PROS

Full suite of tools to protect your identity and finances60-day money-back guarantee for annual plan24/7 U.S.-based customer supportCONS

Fixed plans, no mixing, and matching - 2

excellent9.3

excellent9.3 Full-spectrum protection from Norton

Full-spectrum protection from Norton- Best for - Best for Norton antivirus users

- Starting price - $9.99

- Free trial - 60-day money-back guarantee

Full-spectrum protection from NortonRead LifeLock ReviewLifeLock - Best for Norton antivirus users

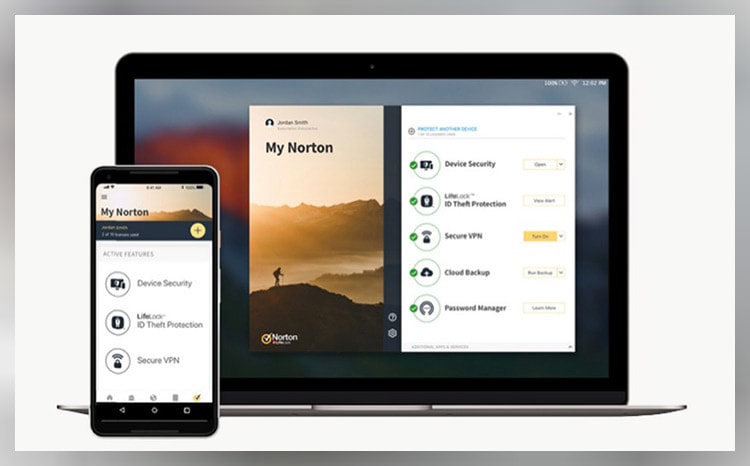

A product of anti-virus heavyweight Norton, LifeLock boasts the tech, accessibility, and ease that you’d expect from the industry-leading company. Most impressive are the plans themselves, which not only blend online security and ID theft protection but offer more flexibility than usual.

Lifelock’s plans include ID and Social Security number alerts and are offered in tandem with Norton’s 360 suite. This means that combo plans net you VPN services plus solid ID theft features like stolen funds reimbursement that ranges from $25,000 to $1 million dollars, bank account and credit card activity alerts, and even 401(k) investment account alerts on the Ultimate Plus plan.

LifeLock also offers LifeLock Junior, an affordable add-on for children under 18 that includes

Dark web monitoring and file-sharing network searches. All plans include 24/7 live member support and the aide of US-based identity restoration specialists.

LifeLock Pros & Cons

PROS

Reimbursement up to $1 millionAntivirus and protection from cyber threats60-day money-back guaranteeCONS

Only worth it if you want Norton 360Pricing can be confusing - 3

excellent9.1

excellent9.1 Effortless AI-backed data protection

Effortless AI-backed data protection- Best for - Best for full-spectrum protection

- Starting price - $7.20/monthly or $79.99/year

- Free trial - Free trial: Yes

Effortless AI-backed data protectionRead Identity Guard ReviewIdentity Guard - Best for full-spectrum protection

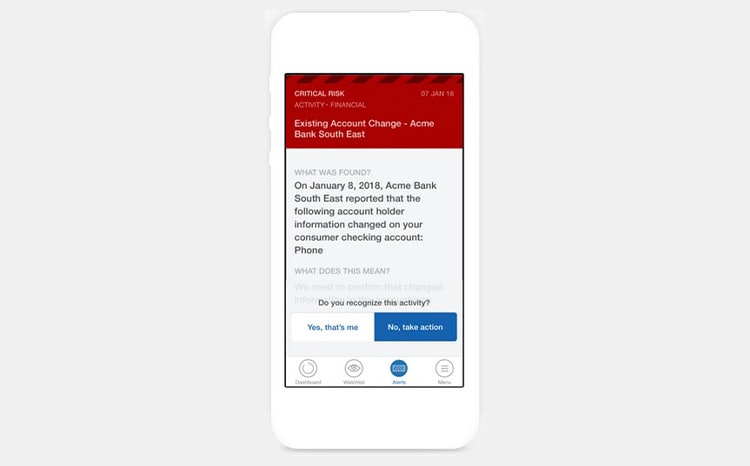

Identity Guard has safeguarded over 45 million identities and resolved more than 140,000 cases to date. They collaborate with IBM Watson's AI technology, leveraging its advanced data analysis and predictive capabilities to enhance threat detection.

The service protects your online identity by monitoring the dark web (a notorious hub for cybercrime activities) and alerting you if criminals are selling your personal information. Identity Guard also continuously monitors your personal and financial data, with their U.S.-based support team always at the ready to handle any emerging issues.

Why we chose Identity Guard: With 20 years of industry experience, Identity Guard stands out for providing effective identity theft protection and monitoring services, powered by AI. These services promptly alert you to a wide range of potential threats. They also offer up to $1 million in insurance coverage per adult to cover legal fees and replace lost funds.

Our experience: We found that even Identity Guard's most budget-friendly plan provides top-tier protection from ID fraud. We were particularly impressed by the inclusion of dark web monitoring in this entry-level subscription package.

Identity Guard Pros & Cons

PROS

Monitors credit score with all 3 credit bureausUtilizes IBM’s Watson AI tech for optimal performance$2,000 emergency cash fundCONS

No 24/7 customer service3-credit reporting only with premier plans