- Identity and SSN alerts

- Stolen funds reimbursement up to $1M

- Enjoy 52% off your first year

- 24/7 live support

- Monitors personal info on over 10K websites

- US-based restoration agents available 24/7

- 60-day money-back guarantee

- Proactive monitoring & real-time alerts

- Credit report reminders

- Repays up to $1M for stolen funds & expenses

- Instant alerts for suspicious activity

- $1M identity theft insurance

- 3-bureau credit scores & reports

- Tracks 3 credit monitoring bureaus

- SSN protection takeover alerts

- 100% satisfaction guarantee

- Mobile app for iOS & Android

- Up to $2 million in reimbursement

- Licensed private investigators & 24/7 support

- Identity and SSN alerts

- Stolen funds reimbursement up to $1M

- Enjoy 52% off your first year

- 24/7 live support

Am I at risk of identity theft?

Data breaches are on the rise. According to the Identity Theft Resource Center, just in 2017 alone, the personal records of 179 million people were exposed through data breaches. You can also fall victim to “low-tech” phishing or malware attacks that instantly put your personal information at risk.

Is an Identity theft protection tool worth the investment?

If you’re looking for a firm layer of security, like LifeLock, to make you feel safer while online shopping, paying your bills online, sharing personal information on social media, and more, then yes—an identity theft protection service is definitely worth the investment. While some people may see these solutions as “nice-to-have” rather than “must-have,” they might be interested in learning that many of them offer free trial periods of up to 30 days or discounts on your first annual subscription.

How do these tools work?

The best identity theft protection services on the market utilize unique data and advanced technologies to monitor credit card transactions, the Dark Web, social media, and more. Their goal is to immediately detect when your information is stolen, offered for sale, or used fraudulently, in order to mitigate the damage of identity theft attacks as much as possible. Once you are alerted about an attack, these services will help restore your identity, reimburse you for stolen funds, and offer expert support around the clock.

Here are some features and capabilities offered by the best identity theft protection services on the market today:

| Monitor & Detect | Alert | Restore |

|---|---|---|

| Credit card transactions | Detect changes in your credit score | Identity Restoration Specialists |

| Dark Web | Be alerted when your information is stolen or offered for sale | Up to $1M reimbursement of stolen funds |

| Social media | Learn of social media activity using your name or photos | Coverage for lawyers and experts |

| Court records & bookings | Learn of crimes reported in your name | Lost wallet protection |

| The US Postal Service | Know if your mail has been redirected | 24/7 member support |

| SSN | Find out about addresses associated with your Social Security Number | |

| Banks | Detect attempts to take over your account or loans taken in your name | |

| Sex offenders | Learn if an offender moves into your neighborhood | |

| Driver’s license | Learn if someone uses your driver’s license fraudulently |

Not all identity theft protection services have all of these capabilities. To find the best one to meet your needs, just go through the chart above or read LifeLock reviews - one of the top services on the market.

It’s your identity—protect it

With so much activity taking place online in this day and age, our personal information is “up for grabs”—from your credit card number to your address, Social Security number, bank information, personal photos, and more. A good identity theft protection service ensures that determined scammers keep their hands off your precious personal information. Read LifeLock reviews today to help you make your decision.

Our Top 3 Picks

- 1

exceptional9.8

exceptional9.8 Full-spectrum protection from Norton

Full-spectrum protection from Norton- Best for - Best for Norton antivirus users

- Starting price - $9.99

- Free trial - 60-day money-back guarantee

Full-spectrum protection from NortonRead LifeLock ReviewLifeLock - Best for Norton antivirus users

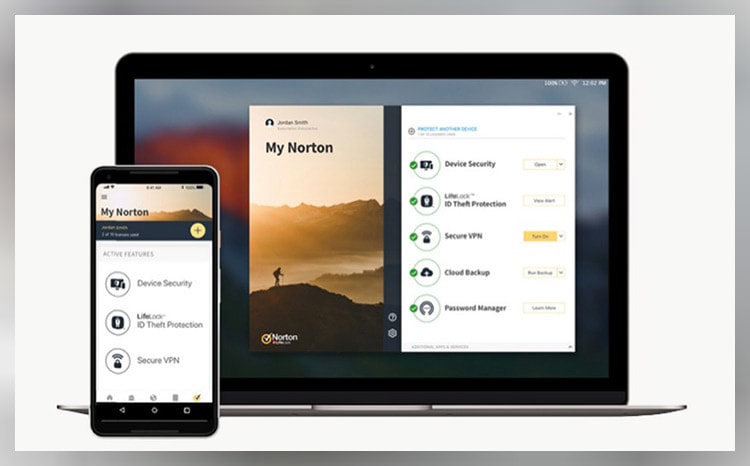

A product of anti-virus heavyweight Norton, LifeLock boasts the tech, accessibility, and ease that you’d expect from the industry-leading company. Most impressive are the plans themselves, which not only blend online security and ID theft protection but offer more flexibility than usual.

Lifelock’s plans include ID and Social Security number alerts and are offered in tandem with Norton’s 360 suite. This means that combo plans net you VPN services plus solid ID theft features like stolen funds reimbursement that ranges from $25,000 to $1 million dollars, bank account and credit card activity alerts, and even 401(k) investment account alerts on the Ultimate Plus plan.

LifeLock also offers LifeLock Junior, an affordable add-on for children under 18 that includes

Dark web monitoring and file-sharing network searches. All plans include 24/7 live member support and the aide of US-based identity restoration specialists.

LifeLock Pros & Cons

PROS

Reimbursement up to $1 millionAntivirus and protection from cyber threats60-day money-back guaranteeCONS

Only worth it if you want Norton 360Pricing can be confusing - 2

excellent9.4

excellent9.4 Continuous monitoring and alerts

Continuous monitoring and alerts- Best for - Best for anyone who has or wants Norton antivirus

- Starting price - $9.99/month

- Free trial - 60-day money-back guarantee

Continuous monitoring and alertsRead Norton ReviewNorton - Best for anyone who has or wants Norton antivirus

LifeLock operates under Norton, a well-recognized leader in online security. While usage of other Norton products isn't a prerequisite, their products do integrate seamlessly if utilized. This service rapidly identifies potential threats and alerts you via call, text, or email. Furthermore, it ensures a dedicated ID restoration specialist is always available to assist with issue resolution.

LifeLock offers three subscription plans with varying degrees of protection. The standard plan provides $1,050,000 coverage, identity alerts, dark web monitoring, and single-bureau credit monitoring. In contrast, premium plans offer up to $3 million in insurance, crime alerts in your name, and protection against phone account takeovers.

While LifeLock includes three-bureau credit monitoring only in its top-tier annual package, daily updates are available for single-bureau monitoring. Furthermore, this product is an ideal add-on for existing Norton users, as some online security features like VPNs are bundled with Norton’s antivirus product, not LifeLock.

Why we chose LifeLock: Underpinned by Norton, LifeLock offers robust protection against identity theft. Its design is user-friendly and easily navigable. Notably, even the most basic membership tier includes 24/7 live member support, providing consistent, reliable assistance whenever necessary.

Our experience: We were impressed with LifeLock’s comprehensive insurance options, always-available customer support, and cost-effective pricing structures. However, we identified room for improvement—three-bureau credit monitoring should be standard across all their subscription plans for comprehensive credit monitoring.

Norton Pros & Cons

PROS

Includes Norton antivirus softwareOffers 3-bureau credit monitoringUser-friendly mobile appCONS

No family plan availableExpensive compared to other services - 3

excellent9.0

excellent9.0

- Best for - Best for people seeking to recover their identity

- Starting price - $6.75/month

- Free trial - No

Read Zander Identity Theft ReviewZander Identity Theft - Best for recovering your identity

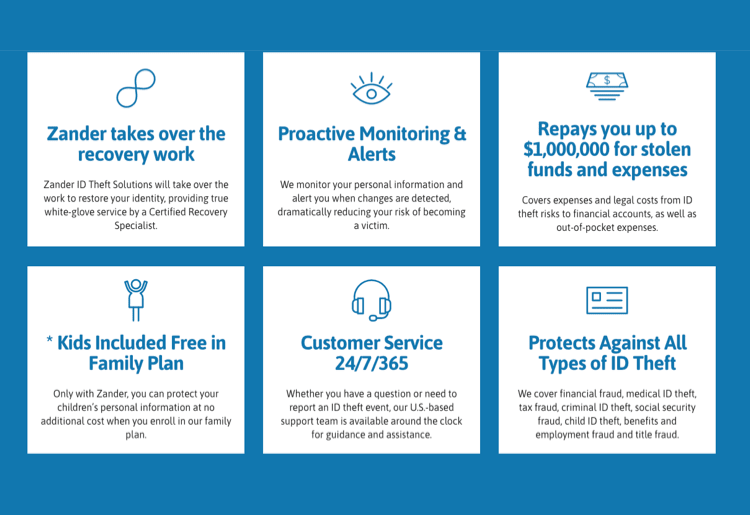

Zander Insurance's anti-identity theft service diligently scans the dark web to prevent criminals from selling personal information such as your Social Security and driver's license numbers. The company offers plans for both individuals and families. Notably, their family plans cover two adults and up to 10 children at no additional cost.

Their top-tier package, the Elite Cyber Bundle, includes online security features such as a VPN and antivirus protection. This service also defends against all forms of identity theft, including financial fraud, medical fraud, and child identity theft. Additionally, it's endorsed by radio personality and financial guru Dave Ramsey.

The unique selling point of Zander Insurance is its focus on premium recovery service. They provide a dedicated U.S.-based recovery team and up to $1 million per person in insurance coverage. However, to maintain low prices, they don't offer credit or financial transaction monitoring, which they believe individuals can manage independently through banks and credit bureaus.

Why we chose Zander Insurance: Their emphasis on top-tier identity recovery services, such as full-service recovery, makes them an excellent choice for those at an elevated risk of identity theft. This includes previous victims of ID theft, individuals who frequently conduct online transactions, and those active on multiple social media accounts.

Our experience: We were impressed by Zander Insurance's commitment to personalized identity recovery and premium identity theft insurance, particularly given their long-standing reputation as trustworthy insurance providers. We also appreciated that Zander provides access to a trained team of specialists ready to address any identity breaches promptly.

Zander Identity Theft Pros & Cons

PROS

Unlimited family planOne of the most affordable optionsComprehensive recovery services, including lost wage coverageCONS

No credit monitoringNo free trial period