After surveying over 1,000 people, we learned that 42% of people would be willing to jump ship from their current mobile provider in favor of finding lower monthly plan costs.

Our results revealed that many are happy with their current provider and explore the reasons behind this high satisfaction rate. We examined factors like price sensitivity, upgrade preferences, and the growing trend of bundled services. Stay tuned to learn more about our findings and discover how to find the perfect mobile plan for your needs and budget.

Additional Key Findings:

- People are 2x more likely to switch their mobile provider for a lower monthly cost than for more data for the same price.

- Eighty percent of cellphone users are currently satisfied with their provider.

- Thirty-six percent have tried bundled services, combining streaming service discounts with their mobile plan.

- When switching providers, 47% are looking for a phone upgrade, while 47% prefer to keep their current phone.

- Sixty-three percent of people would consider switching mobile carriers for deals on streaming services bundled with cell service.

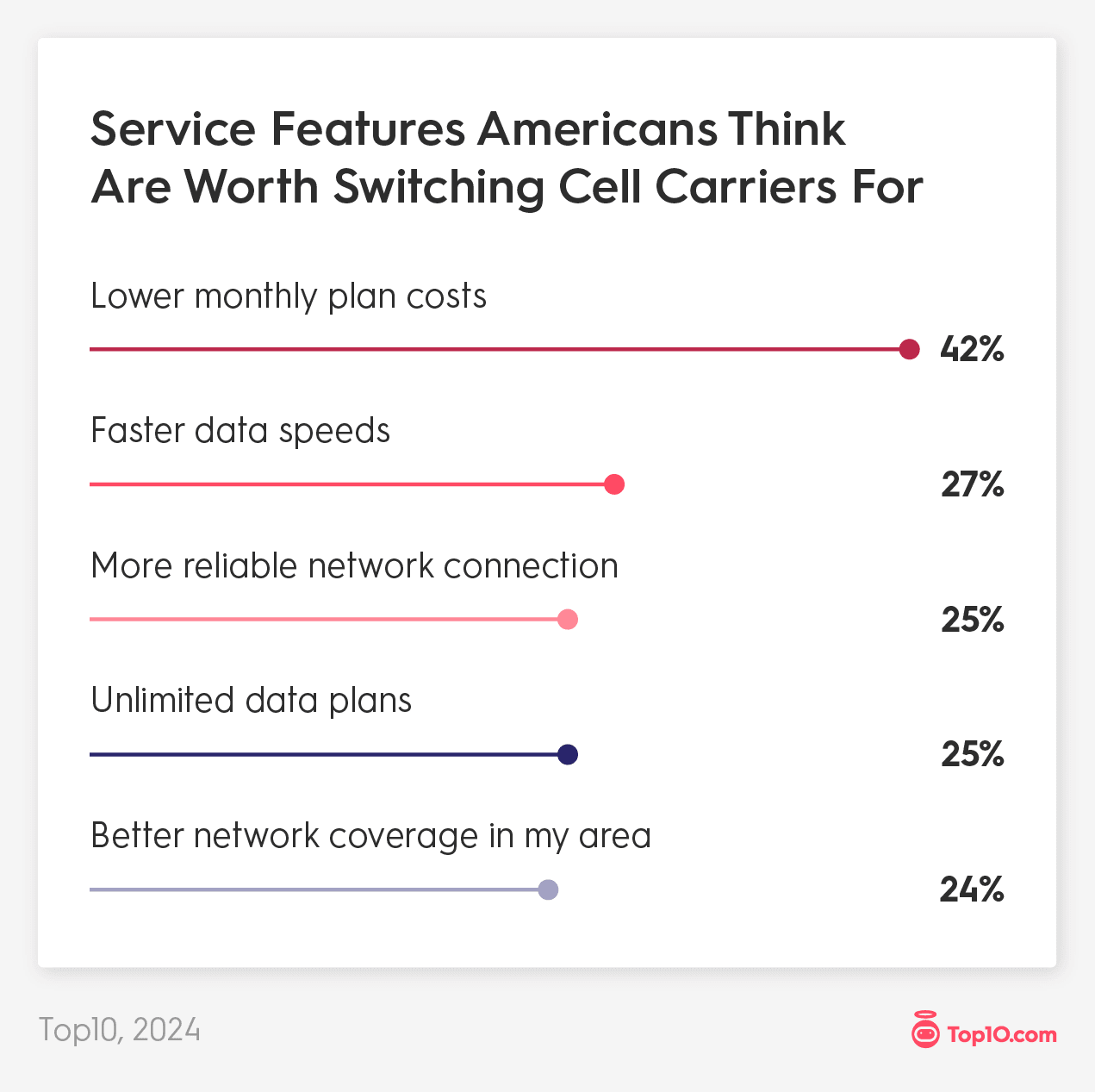

42% Say Lower Monthly Plan Costs Would Make Them Switch Carriers

We discovered that the promise of lower monthly plan costs was the biggest motivator for jumping from one provider to another for 42% of people. It was interesting to note that, among the top eight reasons survey participants selected, the three main themes were costs/fees, data needs, and the mobile network.

Specifically, the top eight features that would lead people to switch are:

- Lower monthly plan costs (42%)

- Faster data speeds (27%)

- More reliable network connection (25%)

- Unlimited data plans (25%)

- Better network coverage in my area (24%)

- No hidden fees or surprise charges (21%)

- Family mobile plan discounts or bundled services (20%)

- More data for the same price (19%)

The list reveals that people are twice as willing to switch their mobile provider for lower monthly plan costs as those who’d switch for more data for the same price.

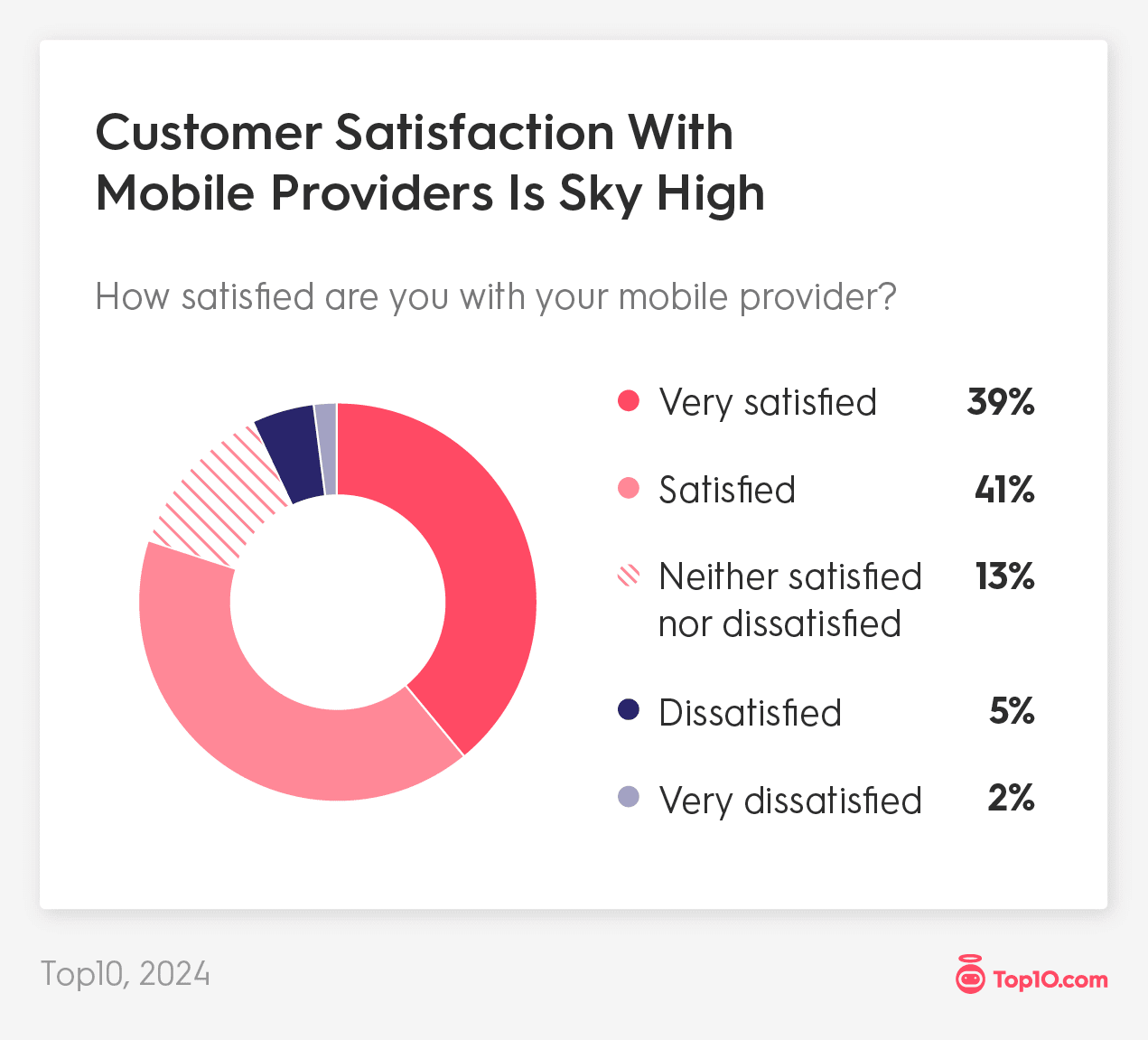

80% of People Are Happy With Their Current Mobile Provider

A massive 80% of cell phone owners said they were satisfied overall with their mobile provider. More specifically, 41% said they were “satisfied,” while 39% indicated they were “very satisfied.”

When we examined the responses of the Big Three’s customers (Verizon, T-Mobile, and AT&T), we found that Verizon was the best at keeping its customers satisfied. A total of 85% of its patrons said they were either “satisfied” or “very satisfied.” Compare that to 78% of T-Mobile customers and 78% of AT&T subscribers feeling generally satisfied.

We also found a large proportion of satisfied customers among eight smaller providers. The top three with the most respondents who were either “satisfied” or “very satisfied” include:

- Mint Mobile - 96.67%

- Tello - 80%

- PureTalk - 80%

Based on these satisfaction levels, it came as no surprise that 48% of all survey participants said they were unlikely to switch their cell carrier within the next year.

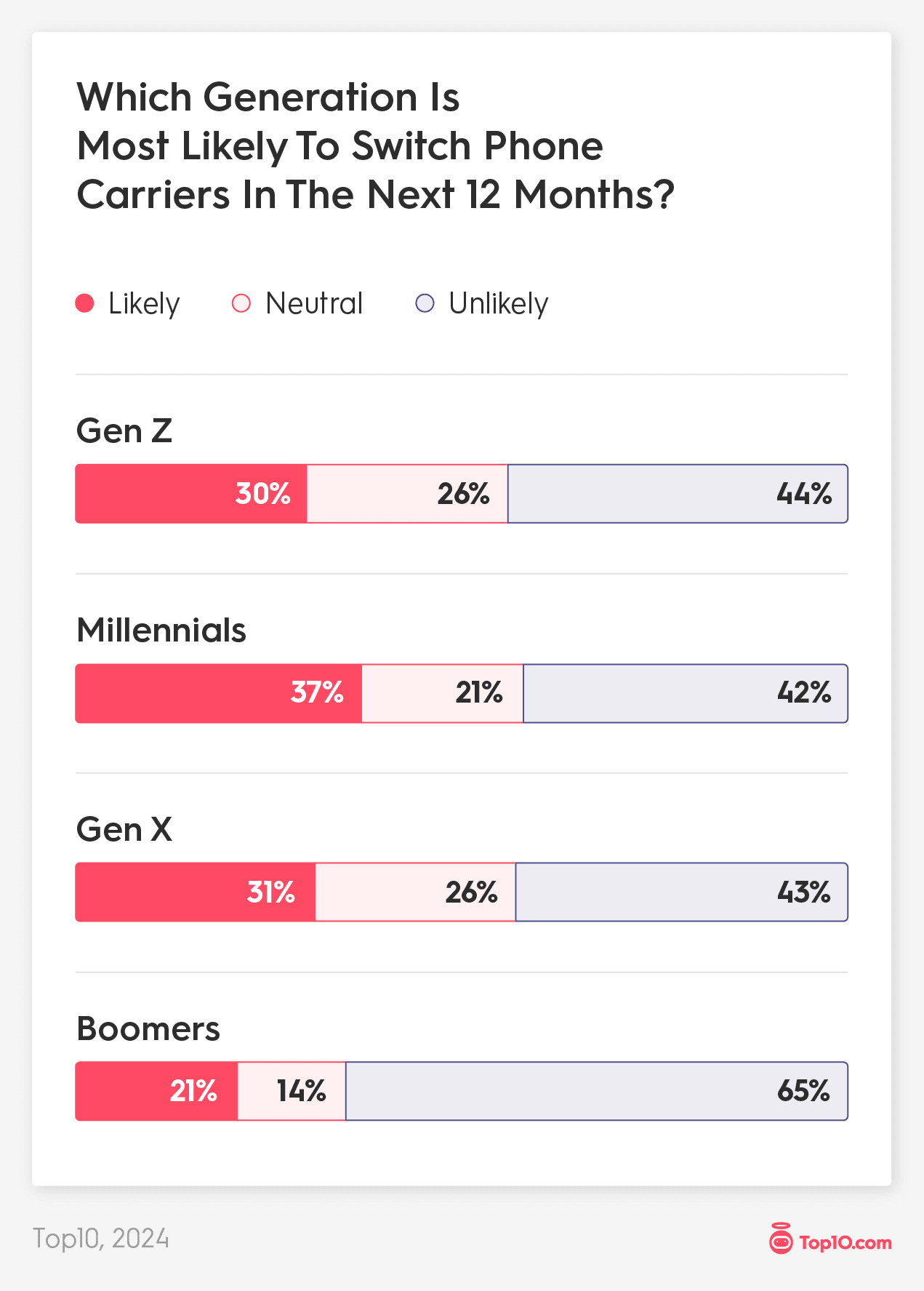

Millennials Most Likely, Boomers Least Likely to Consider Changing Mobile Provider

To gauge the public’s plans for their future cell service, we asked how likely they were to switch providers within the next year. Thirty percent said they were likely, 48% were unlikely, and 22% said they were neutral on the topic.

We found that millennials are the most likely group to make the jump, with 37% saying they were considering it. Gen Z and Gen X fell evenly in the middle, at 30% and 31%, respectively.

Baby Boomers were the least likely to make a change, with only 21% saying it was likely. In fact, 45% of seniors said they were very unlikely to switch within the coming year.

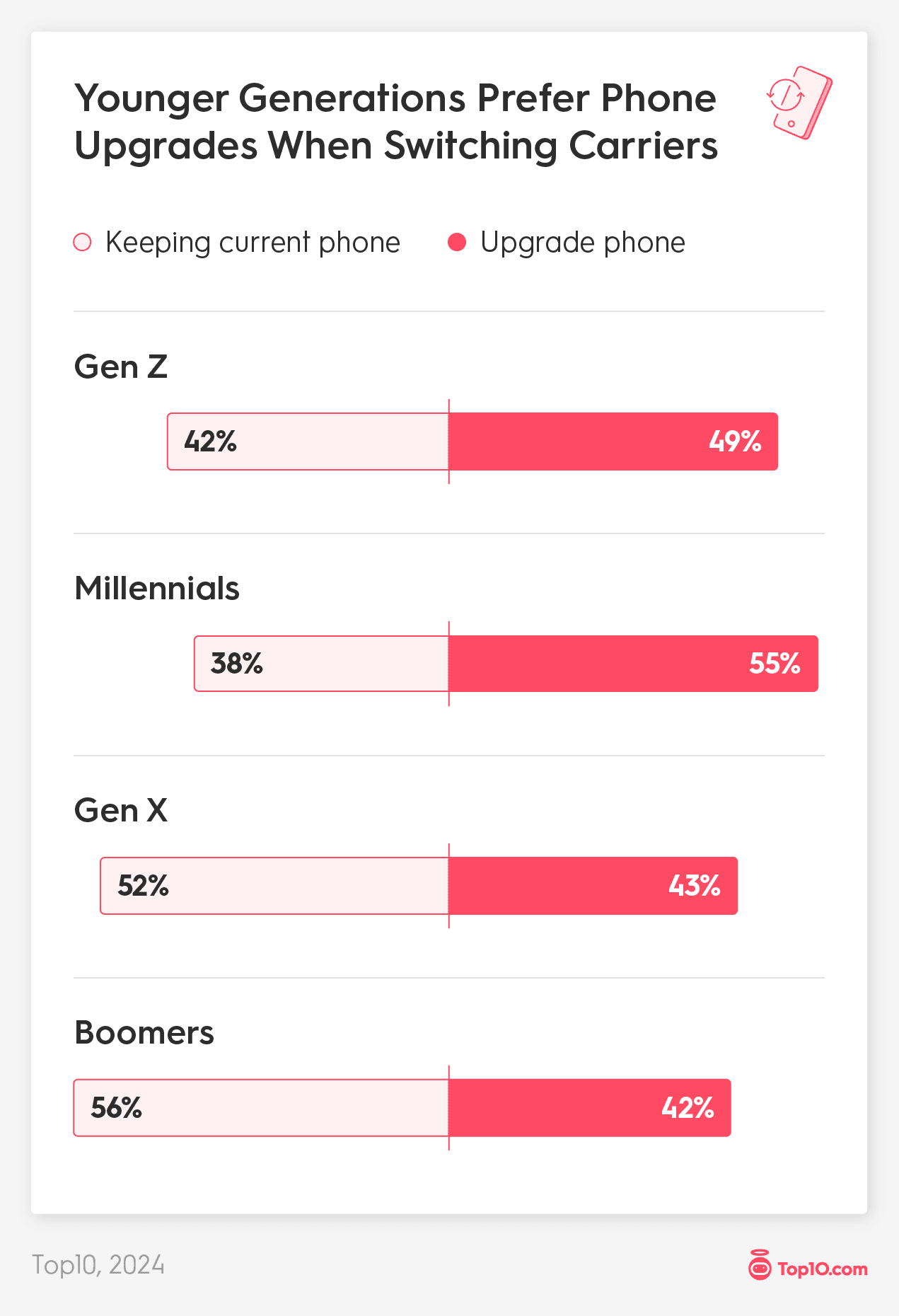

Phone Upgrades Appeal to 47% When Considering Switching Providers

It may come as no surprise that people are looking for upgrades when they switch mobile providers. According to research out of Harvard Business School, people tend to unconsciously try to break their current products to justify getting an upgrade.

What we found surprising in our study was an even split among people who would choose to upgrade their phone versus those who’d choose to keep their current model, with 47% each. The remaining 6% opted to purchase a new phone from a third-party retailer.

This desire for the newest tech upgrade may partially explain why the release of the iPhone 15 in late 2023 drew large lines at Apple stores across the globe. It’s interesting to note that, at the time, some analysts claimed that the heightened demand was because 250 million iPhones hadn’t been upgraded in the previous four years.

When we looked more closely at our results, we discovered a distinct divide along generational lines about getting an upgrade vs. keeping a phone.

People under the age of 45 are big fans of the upgrade options, according to 55% of Millennials and 49% of Gen Zers. In contrast, 52% of Gen Xers and 56% of Baby Boomers said they’d prefer to keep their current phones.

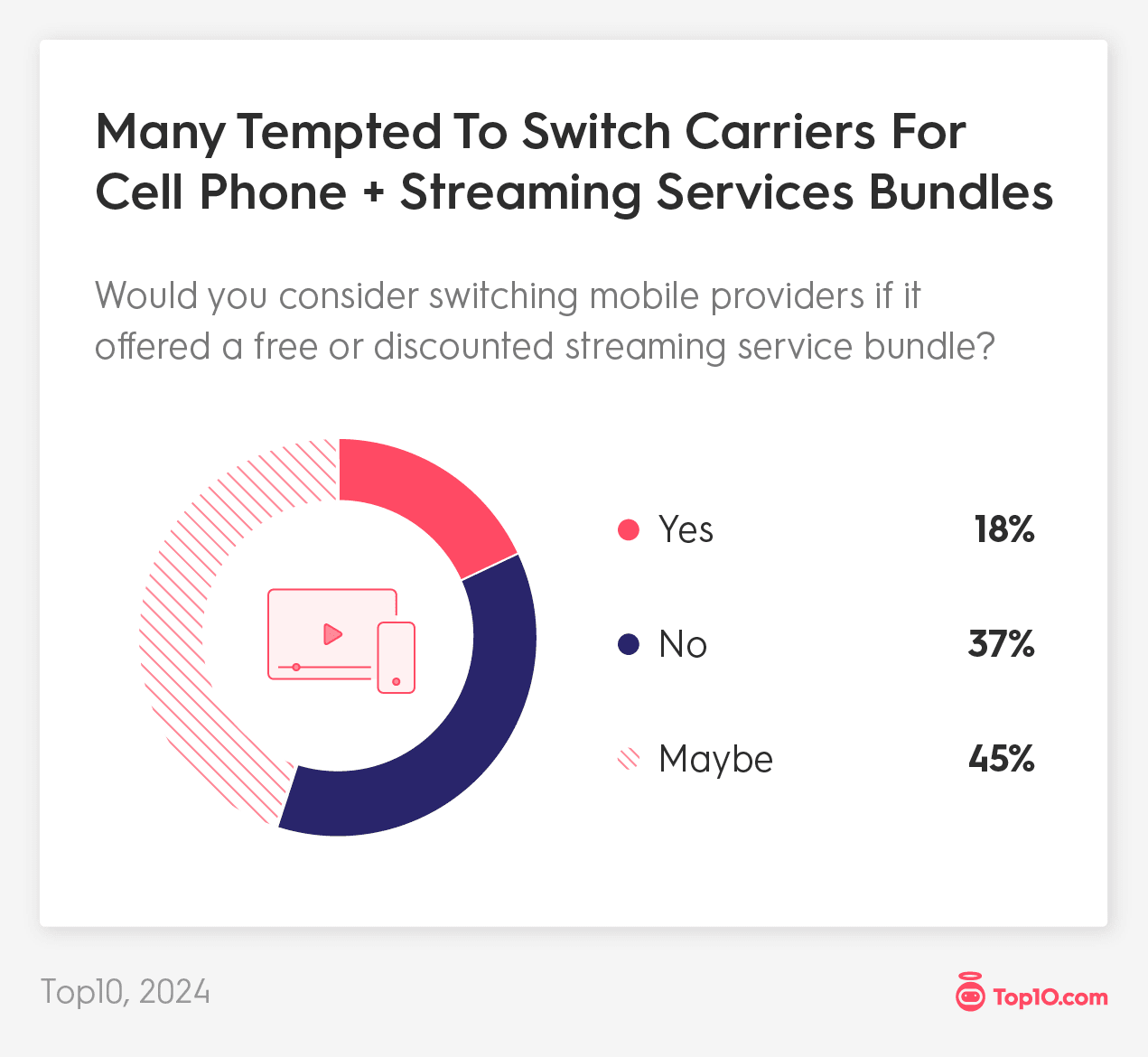

63% Would Consider Jumping Carriers for a Streaming Bundle

Finding ways to entice consumers to switch carriers is an ongoing challenge for mobile providers. One recent strategy has been bundling cell service with the streaming services viewers love.

When we asked people if they would consider switching their cell provider for a streaming bundle, 63% said they would at least consider it. Only 18% were truly excited about the idea and willing, but 45% said they would maybe give it a try.

We also asked if any of them had already taken advantage of these bundles. Thirty-six percent of participants said they have, leaving 64% who have not.

Millennials have experimented with streaming bundles the most, with 43% having tried it. Forty percent of GenX and 38% of Gen Z have also given it a shot. But only 17% of Baby Boomers have prioritized trying a streaming bundle with their cell service.

As we examined the responses based on each respondent’s current mobile provider, we noted that it’s the smaller providers who have had greater success with bundling streaming services with cell service.

The average percentage of customers from the Big Three who’ve tried streaming bundles versus the average among the eight small providers we measured is 36% to 58%, respectively. The best adoption rates of streaming bundles among the small providers include:

- US Mobile - 94%

- PureTalk - 80%

- Ultra Mobile - 67%

- Tello - 60%

- Xfinity Mobile - 55%

Take the Time To Find the Right Mobile Plan for Your Needs

While our survey revealed a high satisfaction rate with current providers, it also highlighted a valuable opportunity. Switching your cell carrier can potentially result in significant cost savings and exciting perks for those willing to explore other options.

A little research before your purchase can go a long way in finding the mobile provider that perfectly fits your needs and budget. Make time to compare mobile plan features like data allowances, network coverage, and pricing so you can make a confident decision.

Methodology

The survey of 1,085 adults aged 18+ was conducted via SurveyMonkey Audience for Top10 on June 6, 2024. Data is unweighted and the margin of error is approximately +/-3% for the overall sample with a 95% confidence level.

Customers of the Big 3 (AT&T, Verizon, and TMobile customers) accounted for 75.86% of survey respondents. The smaller mobile providers measured in the survey included:

- Xfinity Mobile

- Cricket Wireless

- Mint Mobile

- Boost Mobile

- US Mobile

- Tello

- PureTalk

- Ultra Mobile