In a Nutshell

pros

- Full service available

- Multi-factor/biometric authentication

- Audit guarantee service

cons

- Cheaper alternatives to paid plans

- Poor reviews on Trustpilot

TurboTax at a Glance

Pricing

Expert Help

Mobile app

Customer Support

Filing Fees

TurboTax offers a range of different plans. Once you’ve signed up, you can complete your return yourself or receive help from TurboTax’s advisors.

If you choose to receive professional guidance, you’ll have 2 options. With the first, you’ll get support from advisors via live chat, video calls, and phone, as well as having a tax professional review your completed return.

Alternatively, you can opt for a full-service plan whereby an advisor will complete your return on your behalf.

As well as e-filing, TurboTax offers its services through CDs or downloadable plans, which enable you to install its software on your device and complete your return if you’re not connected to the internet.

Optional Add-Ons

After you’ve completed your federal tax return, TurboTax will ask whether you’d like to complete your state tax return through its service. If you choose to do so, its software will transfer the information you’ve entered for your federal tax return into the relevant documents for your state taxes. You may also need to provide additional pieces of information to allow the system to check whether you qualify for further deductions.

Even more so, roughly 37% of filers qualify for filing a Form 1040 return with limited credits, meaning they can submit their tax returns using only the IRS Form 1040, without the need to attach additional forms or schedules.

How much does TurboTax cost?

The cost of TurboTax’s service will depend on the plan you choose and the level of support you receive.

If you choose to complete your own tax return, you’ll pay the below.

Federal TurboTax Online

* ~37% of taxpayers qualify. Simple Form 1040 returns only (no schedules except for Earned Income Tax Credit, Child Tax Credit and Student Loan Interest).

Federal TurboTax Live

*Simple Form 1040 returns only (no schedules except for Earned Income Tax Credit, Child Tax Credit and Student Loan Interest)

** Price estimates are provided prior to a tax expert starting work on your taxes. Estimates are based on initial information you provide about your tax situation, including forms you upload to assist your expert in preparing your tax return and forms or schedules we think you’ll need to file based on what you tell us about your tax situation. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return. Prices are subject to change without notice and may impact your final price.

State TurboTax Online

* ~37% of taxpayers qualify. Simple Form 1040 returns only (no schedules except for Earned Income Tax Credit, Child Tax Credit and Student Loan Interest)

State TurboTax Live

* Simple Form 1040 returns only (no schedules except for Earned Income Tax Credit, Child Tax Credit and Student Loan Interest)

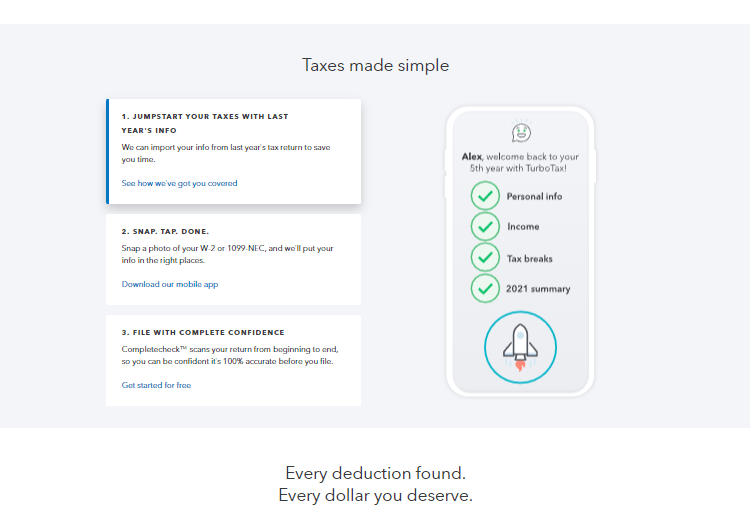

How does TurboTax work?

Whichever plan you choose, the first step is to provide your email address and some basic information about yourself and your finances. In many cases, you may not need to submit your W-2 or 1099 as TurboTax can import information from more than a million financial institutions and employers.

Based on these initial details, TurboTax will search through more than 350 possible deductions to ensure you receive the maximum possible refund before submitting your return electronically. If you need to amend your return after filing, you can do so via your online account.

Should you receive an audit letter, TurboTax’s support guarantee will offer you guidance from a trained tax professional to help you understand the notice and answer any questions.

Overall, we found TurboTax’s website extremely user-friendly with a clear and accessible explanation of its services.

Is TurboTax reliable and safe?

With the slogan “security is built into everything we do”, TurboTax operates multi-factor authentication on all platforms. This means you’ll need to enter both your password and a one-time code sent to one of your trusted devices to access your account.

The company also promises that all its tax returns are completed correctly and will reimburse any IRS penalties, plus interest, that result from an error on its part.

Worryingly, however, the company has a rating of just 1.6 out of 5 on Trustpilot, with some users complaining about the level of customer service. And although it has a rating of A+ on the Better Business Bureau, TurboTax isn’t accredited by the agency.

Help and Support

The level of customer support you receive will depend on the plan you choose.

If you opt for a plan that includes support from TurboTax’s advisors, its Live Help button will allow you to live chat with a tax professional as you fill in your return. Alternatively, you can set up a video call.

In one particularly attractive feature, the company offers access to bilingual advisors who can work with its Spanish-speaking customers.

If you’re not a TurboxTax customer, you can contact the company through its online query form. There is also a detailed selection of FAQs on its website and an active online community that allows you to discuss tax-related issues.

Likewise, there is a blog on its website, which covers a wide range of tax-related topics and is updated on an almost daily basis.

What about the TurboTax app?

Like similar services, TurboTax allows you to access all its services via a mobile app. To protect your security when using the app, you can install Touch ID, which enables you to add fingerprint recognition to your account.

As TurboTax was created by financial software company Intuit, it is compatible with other apps in Intuit’s product suite. For example, Intuit’s TaxCaster app, which operates on the same calculator as TurboTax, can provide you with an estimate of your tax refunds. Likewise, customers can sync their accounts with the ItsDeductible app to keep track of their charitable donations.

Bottom Line

TurboTax offers up-to-date software, professional tax advisors, and an audit guarantee scheme for every tax return, making it an attractive option for many.

Ultimately, determining the value of TurboTax may lie in the level of confidence you have in filing your taxes and whether you’d be willing to pay a little extra for peace of mind.

FAQs

Can I file for an extension through TurboTax?

Yes, you can file for an extension through its Easy Extension website.

When will I receive my refund?

Although TurboTax can’t guarantee timings, its website states that it typically takes around 21 days to receive a refund after the IRS accepts your return.

Can I file through TurboTax if I’m a non-US resident?

Yes. TurboTax has partnered with Sprintax.com to help non-residents file their 1040NR tax forms.