In a Nutshell

pros

- 30-day money-back guarantee

- Data is secured thanks to 256 bit cloud encryption

- Versions suited for both home and business use

cons

- Comparably expensive

- Can run slowly on older hardware

Quicken at a Glance

Products

Features

Promotions

Integrations

Customer Support

Quicken at a Glance

Best for: Versatile accounting and budget management

Price range: From $31.19 per year

Key features: Budget tracking and bill management

Apps: Windows and Mac plus Android, iOS, and web UI

Integrations: Online banking platforms as well as GetApp and QuickBooks

Quicken Ease of Setup and Use

Whether users sign up for the Windows or Mac versions, getting the program set up is as easy as downloading an executable file and following through with the installation steps. While Quicken can sync data to the cloud, this process can be completed while users are offline and disconnected from the central database.

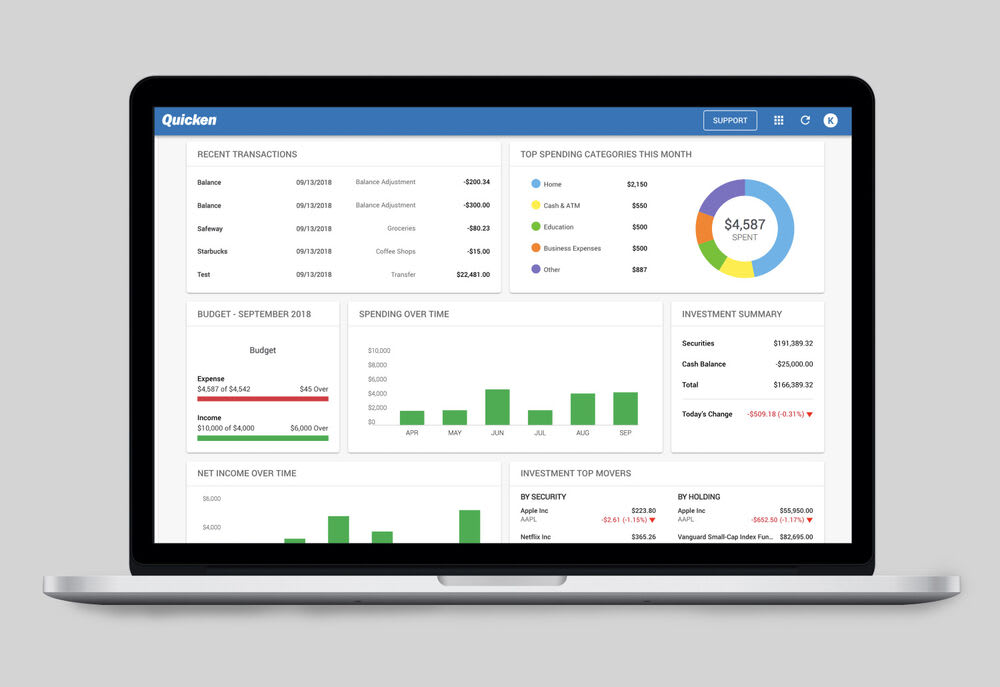

How easy is Quick to use? Take a look at the attractive dashboard and judge for yourself. The program features an easy color-coded information layout that makes plucking out information, such as spending by category, completely simple. Monitoring trends is also straightforward thanks to the bar chart based display for information over time. On both desktop platforms, Quick is definitely an intuitive and attractive tool to use.

Quicken Pricing and Plans

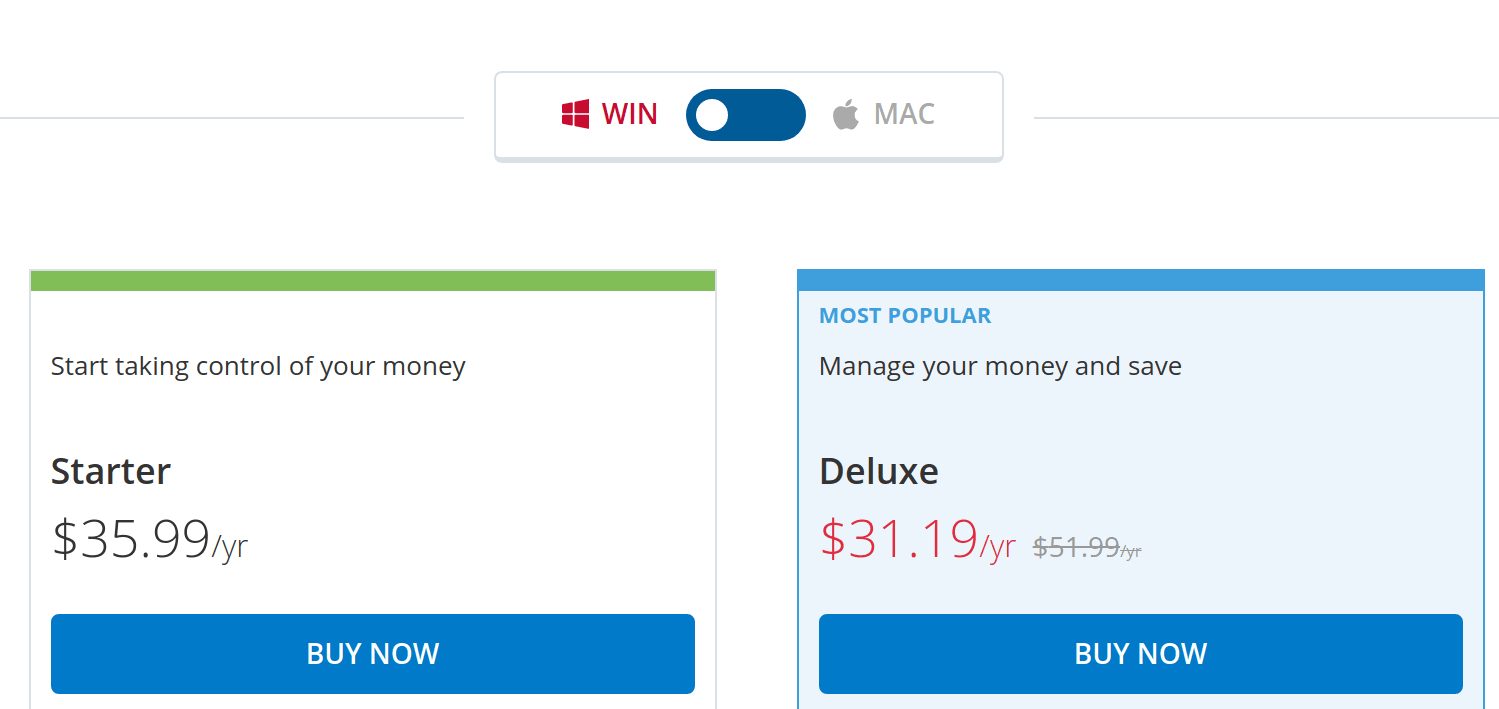

Whether users wish to sign up for the Windows or Mac editions, they can take advantage of the same pricing structure:

Starter

$35.99

All accounts in one place

Budget management

Deluxe

$31.19

Customized budget

Debt tracker

Saving goals

Premier

$46.79

Free online bill payment

Priority access to customer support

Home and business (Windows only)

$62.39

Everything in Premier plus:

- Separate business and personal expenses

- Custom invoice emailing

Given that these prices all reflect the cost of annual subscriptions, we think that this makes Quicken a pretty good deal. And of course it has to be pointed out: any budgeting / accounting tool can very quickly pay for itself (many times over!). Once you’ve gotten a better handle on what you’re spending, it’s much easier to stick to a budget. We think that Quicken represents fair value for money across its subscription tiers.

Quicken Features

Quicken is a great expense tracking tool that makes it really easy for users to get their personal finances and savings plans under control. It integrates with online banking solutions and accounting platforms in order to help users with:

Money management

Budgeting

Investment tracking

Planning for retirement

Consolidate Your Financial Accounts

If you’re managing your money online, whether in a bank or another savings institution, and you’re in the US, then it’s a pretty safe bet that Quicken can connect to it and help you make sense of what you’re doing with your money. The platform connects to an impressive 14,000 financial institutions and allows users to:

Track and analyze their total savings

Monitor credit card debt

Track the size of their investment portfolio

Net Value Calculator

With Quicken you can easily see the net value of your home or other assets being tracked through the platform by tracking both the value of the underlying asset and the value remaining to be paid in the mortgage that is being paid off.

Get Your Info Anywhere

Quicken can be accessed from three different user interfaces:

Through the web UI: This is logging in through the website. Anywhere that users have access to the internet and a supported web browser they can log in.

Through smartphone apps for Android and iOS.

Through desktop tools for Windows and MacOS.

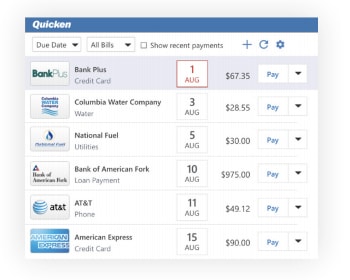

Bill Tracker

One of Quicken’s main features is tracking and paying online bills. Users can connect utility bills and other standing orders that integrate with the platform. The Bill Dashboard presents a visual overview of what bills are due and when and users can even issue same-day payments to more than 11,500 billers.

Check Pay

For users that need to pay their bill by check, the Check Pay feature allows anybody in the US to print, check, and mail a bill to an issuing entity.

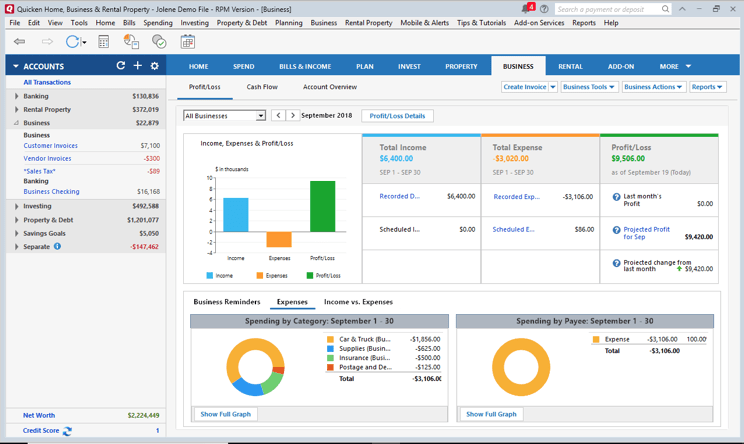

Manage Business Finances

Quicken is also a capable solution for managing business finances and users that are signed up to the home and business tier can access its business features:

Tracking assets and liabilities in order to generate a balance sheet

Separate tracking of business and personal expenses even when these are mixed into the same account

Storage and management of contracts, receipts, and other business documents

Quicken Integrations

Quicken integrates with:

More than 14,000 financial institutions

More than 11,500 billing entities

Additionally the tool can connect with:

Zillow (home valuation tool)

Quickbooks (accounting tool, via data converter)

Other platforms

Quicken Mobile Apps

Quicken has mobile apps for both iOS (iOS 9 or higher supported) and Android. Windows Phone and Blackberry are not supported. The smartphone apps provide the full range of functions available through the other means of accessing the platform and can be downloaded through the official app stores. At the time of writing, Quicken’s rating on Google Play came in at a three star average.

Quicken Customer Support

Quicken customer support is available between 05:00 and 17:00 PT (Pacific Time) Monday through Friday. There is an online wait time checker so users can get an idea for expected holding times before initiating calls. Additionally there is an online user community and self support documentation designed to assist users who need to resolve non-personalized issues.

Bottom Line

Quicken is a very capable platform with a yearly subscription model for those looking to get on top of their personal finances, expenses, and bills. Many users find that they can save money by using a tool like this and getting on top of their budget.