In a Nutshell

pros

- No minimum balance or monthly fees

- Create multiple checking accounts to manage funds

- Integrates with Quickbooks Online, Xero, and Gusto

cons

- Accounts payable requires upgrade

- No multi-currency accounts

Overview

Relay at a Glance

What is Relay?

Relay is an all-in-one banking and accounting platform for small businesses that brings together multiple services. The platform partners with Thread Bank and Evolve Bank & Trust to offer checking and savings products. It partners with Profit First to help you manage money in your accounts. Relay also offers integrations for Quickbooks Online, Xero, and Gusto to streamline accounting and payroll.

Relay offers a very attractive free plan that includes all of the platform’s features except for accounts payable management. I’ve found a lot to like about the free plan and haven’t turned up any hidden fees. It’s a great choice for businesses that need checking and savings accounts or want a better solution to manage their funds.

Relay’s paid Pro plan offers faster bank transfers, free wire transfers, and automated payments for vendor bills. It’s a good option for growing businesses with a lot of suppliers to manage.

Relay features

Checking accounts

Relay offers fee-free business checking accounts through Thread Bank and Evolve Bank & Trust.

You can open up to 20 accounts and use them for different business purposes. For example, one account can hold funds for paying suppliers, another can hold funds for payroll, and another can hold funds for employee spending. You can order up to 50 Visa debit cards across your accounts and set spending limits on each of them.

One thing to note is that all Relay checking accounts are US dollar-denominated. There are no multi-currency or international accounts available through Relay. However, you can send international wire transfers. Funds will be exchanged for the recipient’s currency during the transfer.

Your business’s accounts (including checking and savings accounts) are FDIC insured for up to $2.5 million per business.

Savings accounts

Relay also offers up to two fee-free business savings accounts. Balances on your account earn 1%-3% APY depending on your balance:

Balances up to $50,000 earn 1.0% APY

Balances from $50,000 to $250,000 earn 1.5% APY

Balances from $250,000 to $1 million earn 2.0% APY

Balances over $1 million earn 3.0% APY

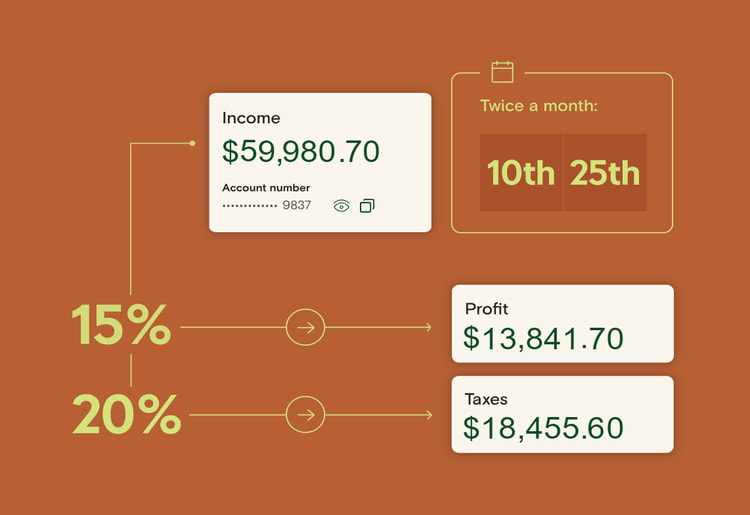

Profit First integration

Profit First is software that allows you to set up automated rules for how money should flow between your business bank accounts. You can use Profit First within Relay’s platform to create custom rules for transferring funds between your accounts.

As an example, you can automatically transfer 10% of funds from your “revenue” checking account to an “equipment purchase” account each month. You can also use Profit First to make sure you always have enough funds to cover payroll in your payroll account.

Accounting and payroll Integrations

Relay integrates with accounting platforms Quickbooks Online and Xero and with payroll platform Gusto. Quickbooks Online and Xero can automatically import data from your checking and savings accounts. Gusto will alert you before running payroll if there aren’t enough funds in your payroll account.

Relay also integrates with Plaid or Yodlee, which enable you to link other financial accounts such as Wave, Freshbooks, Expensify, and Venmo.

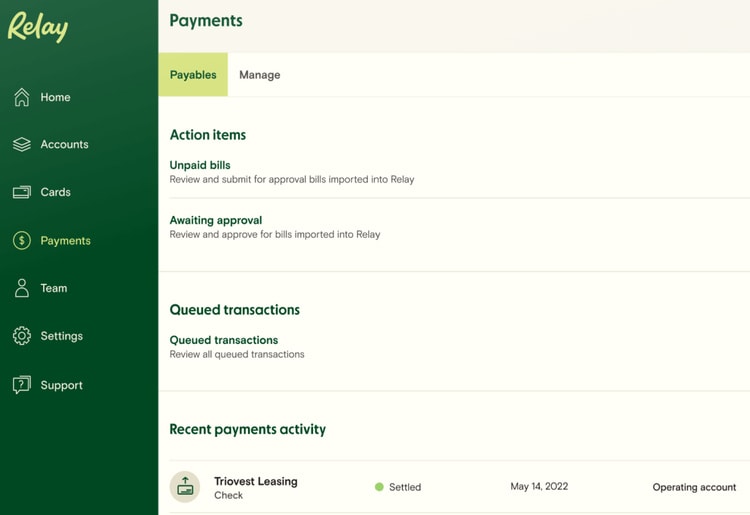

Accounts Payable

With a Relay Pro account, you can import invoices from Quickbooks Online and Xero and pay them. Relay allows you to securely collect and store vendor information, such as W-9 forms, and enables you to set up automated expense approval workflows.

When it’s time to make a payment, you can pay bills by electronic transfer, wire, or physical check. Relay will automatically reconcile payments across your checking accounts and Quickbooks Online and Xero to simplify accounting.

Is Relay Safe and Reliable?

Relay uses Secure Sockets Layer (SSL) encryption to protect your online account. You can also set up two-factor authentication.

If you create Relay accounts for your employees, multiple permission levels are available to control what access they have to your financial accounts. These include read-only, deposit-only, cardholder, bill payer, and administrator.

Your business’s funds are FDIC-insured for up to $2.5 million across your accounts. Relay achieves this by holding funds at multiple FDIC-insured banks, never exceeding $250,000 (the standard FDIC insurance limit) at any bank.

How Relay Works

Relay offers an online dashboard where you can monitor all your bank accounts, set up automations with Profit First, set up payments to vendors, and manage your employees’ accounts. It’s easy to get an overview of your account balances or download complete statements for individual accounts.

How to Get Started with Relay

You can sign up for Relay online. You’ll need to provide your name, email, phone number, and Social Security number along with the name, address, and Employer Identification Number of your business. You’ll also need to upload a copy of your passport or driver’s license and a copy of your business license or incorporation documents.

Once your account is created, you’ll be presented with an onboarding checklist. This walks you through setting up checking and savings accounts, linking existing accounts your business owns, integrating your accounting software, and issuing debit cards for your team. The checklist makes all of this very easy.

I found that creating an account with Relay takes about 10 minutes. You should budget around an hour to complete the full onboarding checklist.

Relay Customer Service

Relay offers customer service by phone and email from 9am-8pm (ET) every day. I called and was connected to a helpful service agent in less than a minute. I also sent Relay and email and received a response within a few hours.

Relay’s website has a detailed online knowledge base that walks through how to set up your account, how to add integrations, how to manage payments, and more. I found the knowledge base to be a very useful and well-thought-out resource.

How to Cancel or Pause a Relay Subscription

You can cancel a Relay Pro subscription at any time from your account settings. Relay Pro is billed monthly, so you’ll retain access to Pro features until the end of your active billing month.

If you want to close your Relay account altogether, you’ll need to contact customer support. This involves closing your business bank accounts, so you’ll need to transfer funds to alternative accounts before leaving Relay.

Is There a Relay App?

Relay has a free mobile app for iOS and Android. It enables you to monitor your account balances and transactions, initiate payments, and deposit checks with a photo. You can also set debit card limits and freeze cards at any time. I found the app to be easy to navigate and liked having the ability to view transactions on the go.

The only notable thing you can’t do with the Relay app is set up automated rules for transferring funds with Profit First.

Relay Pricing

Relay offers a free plan that includes all features except for account payable management. You can still use Relay to pay vendors, but the software won’t automatically import invoices from your accounting software and you can’t set up expense approval workflows.

Relay Pro costs $30 per month and adds accounts payable features. It also includes same-day bank transfers and free outgoing wire transfers (outgoing wires cost $5-$10 each with the free plan).

Cost Per Month

$0

$30

Checking and Savings Accounts

✓

✓

Accounting Integrations

✓

✓

Accounts Payable

✓

✓

ACH Delivery Time

1-2 days

Same day

For most businesses, Relay’s free plan is a great deal. Many banks don’t offer free checking and savings accounts, let alone advanced management tools to go with them. It’s only worth upgrading to the Pro plan if you have a lot of suppliers and invoices to manage.

Relay Alternatives

Price

$30 per month

By quote only

$12.50-$75 per month

$15-$78 per month

Free trial

Free plan

No

30 days

30 days

Bank account integration

✓

✓

✓

✓

Payroll

Via Gusto integration

✓

✓

Via Gusto integration

CRM Integration

X

✓

✓

X

Multi-Currency

X

✓

X

✓

Relay vs Netsuite

Oracle Netsuite is an all-in-one enterprise resource planning (ERP) platform. It includes an accounting module along with modules for project management, customer relationship management, human resources, and more. Netsuite is much more expensive than Relay and better suited to large businesses.

Relay vs Quickbooks

Quickbooks is an advanced accounting and payroll software that offers bank accounts. It’s more expensive than Relay, but it also includes more features for managing your business such as mileage tracking, invoicing, and receipt capture. I think Quickbooks is worth it if your business needs more than just money management tools.

Relay vs Xero

Xero is a user-friendly accounting software. Unlike Relay, it doesn’t offer bank accounts, although you can integrate your existing accounts. Xero stands out for helping you invoice clients in multiple currencies, so it’s a great option for businesses that operate internationally.

Bottom Line

Relay is an excellent financial management platform for small businesses. You can use it to open business checking and savings accounts, integrate your accounting and payroll software, and manage accounts payable.

Overall, I think Relay is worthwhile for the majority of small businesses. The free plan is quite impressive and brings together a lot of the features that business owners need. The Pro plan is suitable for businesses with a lot of vendors to manage, but most businesses won’t need to upgrade to get value from Relay.