How to Choose an Online Business Check Service

The best places to buy business checks provide businesses a way to significantly cut costs without sacrificing quality or security. In fact, by ordering checks online, a business can save anywhere from ⅓ to ½ the cost of buying checks from a bank. There are many check printing companies from which to order, but the question remains, how do you choose the right online business check service?

Here's a quick guide on what to consider when choosing an online business check service:

- Reliability and Security: Ensure the service offers top-notch encryption and fraud detection mechanisms.

- Customization Options: Look for the ability to customize checks to reflect your brand's identity.

- Integration with Accounting Software: Check if the service smoothly integrates with your current financial systems to simplify accounting workflows.

- Cost-Effectiveness: Compare prices, paying close attention to any hidden fees for customization, expedited printing, or delivery.

There are also other benefits to buying checks from an online provider, such as special features that vary from service to service. It’s important to compare check printing services before ordering checks to see who provides the most value for money.

How Do You Order Checks Online?

To order checks online, follow these straightforward steps:

Choose a Place: Research and select a reputable online check provider or bank that offers check services aligning with your needs.

Choose a Design: Browse through the available check designs. Some providers offer options ranging from classic styles to more personalized or business-specific themes.

Determine How Many You Need: Estimate the quantity of checks you require. Ordering in bulk can often save you money, but consider your storage capabilities and usage rate.

Enter Your Information: Carefully input your banking details, including your account and routing numbers. You'll also need to provide personal or business information as it should appear on the checks.

Pay Attention to Shipping Schedule: Review the provider's shipping options and schedules. If you need your checks promptly, look for expedited shipping options, but be aware these may come at an additional cost.

How Much Do Online Business Checks Cost?

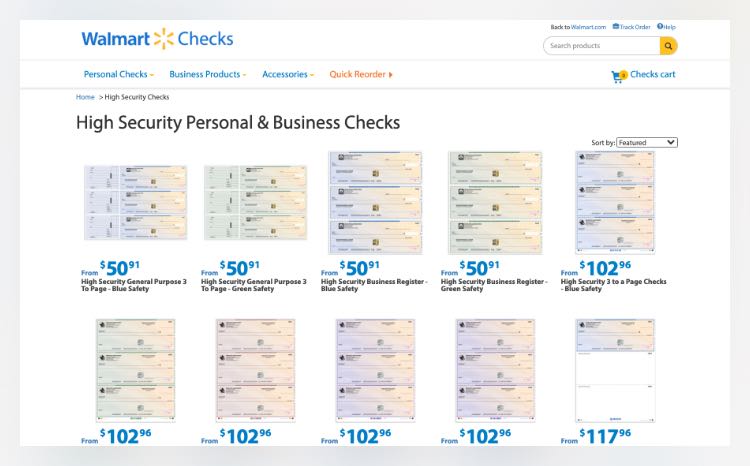

There are many different types of checks suitable for different needs. Business checks can cost anywhere from $50 for a 50-check pack to a more executive-style voucher check, which may run for about $700 for a 250-pack. You can also expect to see business checks priced per check—priced anywhere from $0.09 per check and up.

While you’re sure to save money ordering checks online, as opposed to from the bank, there is some variance between the check types and the various services. As a general rule, laser checks will cost you more than manual checks, and checks with extra features, such as high-security checks, will come at a premium. You'll also pay more for additional products, like deposit slips, address labels, and return address labels.

When comparing prices, it is important to ensure that you know how many checks are included in a set to compare apples to apples. Also, many services offer a bulk discount, with the price of checks going down the more you order.

Money-Back Guarantee

You must be able to get your money back if any part of your order has not been carried out properly and your check contains false information. Because of the sensitive nature of payments and bank information, you cannot afford to have an erroneous account number, routing number, name, or address on your business checks. Of course, you should double and triple-check your information before submitting your order, and the service should have a mechanism in place to ensure that they have the correct information before printing. However, mistakes still happen occasionally and you must know you will be compensated if your checks are unusable.

Shipping Time and Cost

Shipping times vary for different services, and you will often have different shipping options at different prices at a given provider. Times can range from 2 to 14 days and beyond. Cost generally depends on the weight of your order and your location within the U.S. Bear in mind that customized orders, particularly ones that require a check designer can add as much as 10 days to the process.

How Do You Get Cheap Checks?

Securing cheap business checks requires some research. Start by comparing prices across online check printing companies, which often offer lower prices than banks due to reduced overhead costs. Look out for new customer discounts, bulk order deals, and seasonal promotions that can significantly reduce costs. Additionally, opt for basic designs and avoid unnecessary customizations or add-ons, as these can increase the price. However, always ensure that low cost doesn't compromise the security features of your checks.

Is it Safe to Order Business Checks Online?

When dealing with sensitive information such as the finances of your business and your bank account information, you want to ensure that the check company you are ordering from is safeguarding your information. While it is convenient to provide your banking information for your checks online, it should only be done so if the company has taken the proper precautions and encrypted your personal information.

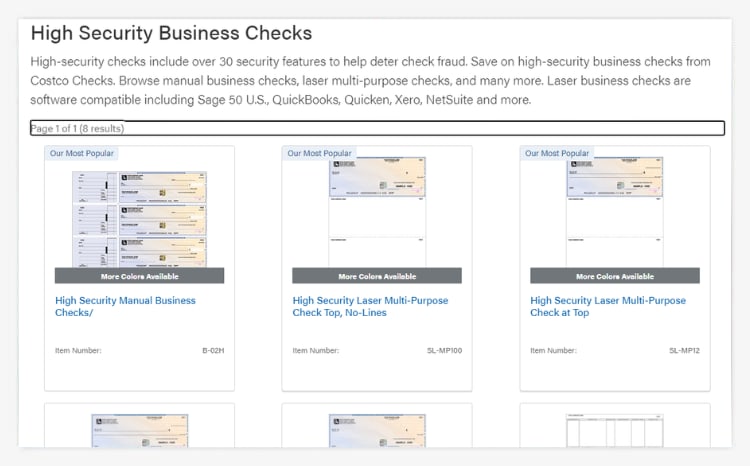

In addition, you want to ensure that the checks you're receiving adhere to the Check Payment Systems Association's (CPSA) security specifications. If your transactions are particularly sensitive and you require more security assurances, it is suggested that you opt for high security checks.

What Types of Company Checks Are There?

Choosing the right check ordering service for your business starts with understanding the types of checks you need. From software-compatible laser checks that effortlessly integrate with your financial management software like QuickBooks or Quicken, to manual checks that you can fill out anywhere, there's a check type for every business scenario.

- Standard Business Checks: These are basic checks used for general business transactions, such as paying vendors, suppliers, or bills.

- Voucher Checks: These checks include an attached voucher or stub that provides additional information about the payment, such as the purpose of the payment or the invoice number. They are useful for record-keeping.

- Payroll Checks: Designed with payroll in mind, these checks come in manual and laser options and feature pre-printed deduction captions to streamline the management of local, state, and federal taxes.

- Multi-Purpose Checks: Versatile checks that can be used for various types of transactions, combining features of both standard and voucher checks.

- Software Compatible Laser Checks: These act as computer checks. Load them into a printer and use your PC or Mac to handle the rest, ensuring a seamless deposit process through compatibility with your preferred accounting software.

- Manual Checks: Ideal for on-the-spot payments, these checks give you the flexibility of handwriting details. They're available in various forms, including 3-to-a-page for binder organization or compact sizes for travelers.

- Business Expense Checks: Used specifically for business-related expenses, these checks often come with detailed expense tracking features.

- High-Security Checks: Elevate your fraud protection with advanced security features, including watermarks, heat-sensitive ink, invisible fluorescent fibers, chemically sensitive paper, and anti-copy technology.

- Travelers Checks: Pre-printed checks are used primarily by businesses to provide employees with secure funds for travel expenses.

Beyond these types, services also offer different tracking methods for your checks, like side stubs or duplicate copies. Look into accessories such as endorsement stamps, binders, or deposit tickets for that extra professionalism.

Some services let you stamp your brand’s identity directly onto your checks with special designs or your company logo.

Remember, the right check can not only fit your current needs but also elevate your business's operational efficiency and security. Review your check supply today and consider how upgrading or switching your check type could benefit your business’s financial management tomorrow.

Bottom Line

In a nutshell, choosing an online business check provider is a savvy move for any business aiming to save money without skimping on quality or security. Whether it's payroll or secure transactions, there’s an option for you. Key takeaway? Go for a provider that nails the perfect mix of reliability, customization, and software compatibility, all while keeping your data locked down tight. Finding the right service means smoother, safer, and more cost-effective financial management for your business.