In a Nutshell

pros

- Lets you work with any ASE-certified facility

- 24/7 customer service

- Free 30-day money-back guarantee

cons

- Pricing is not displayed on the website

- No plan customization options

Overview

Total Auto Protect at a Glance

What is Total Auto Protect?

Total Auto Protect is an extended car warranty provider located in Wilmington, Delaware. The company supports vehicles from a variety of different manufacturers and lets you get repairs done at any ASE-certified facility across the country. This saves you the stress of being stuck with an in-network technician you’re not sure you can trust.

It’s also great for drivers who have seen their manufacturer's warranty expire, but still want the peace of mind that a warranty provides. Without this type of coverage, unexpected repairs can leave you thousands of dollars out of pocket.

In total, the company offers three plans—Total Plus, Total Convenience, and Total Premier. Here's a closer look at each of them:

(best for those on a budget)

Engine

✔

✔

✔

Transmission

✔

✔

✔

Drive axle

✔

✔

✔

Electrical

✔

✔

✔

Cooling

✔

✔

✔

Brakes

✔

✔

✔

Trip interruption

✔

✔

✔

Dead battery

✔

✔

✔

Out of gas

✔

✔

✔

Parts and labor

✔

✔

✔

Towing

✔

✔

✔

Locksmith

✔

✔

✔

Rental car

✔

✔

✔

24/7 roadside assistance

✔

✔

✔

AWD/4x4

✔

✔

Steering

✔

✔

Heating

✔

Air conditioning

✔

Fuel system

✔

ABS

✔

Hi-tech electronics

✔

Suspension

✔

Optional add-ons

Total Auto Protect doesn’t mention any optional add-ons on its website.

Plan exclusions

There are several exclusions for Total Auto Protect plans, including:

Pre-existing conditions

Acts of God

Illegal repairs or alterations

Accidents

Damage as a result of negligence

Wear and tear

Is Total Auto Protect Safe and Reliable?

Total Auto Protect has over a decade of experience in the industry and works directly with customers, as opposed to through an administrator.

The company works with reputable facilities and leading brands (such as Pep Boys, Midas, Goodyear, and Maaco). It also has solid reviews and a 4.3-star rating on Trustpilot. Customers love the ease of use it provides, as well as the strong customer service and support.

How Total Auto Protect Works

Total Auto Protect coverage lets you work with any ASE-certified repair facility to fix a wide variety of vehicle-related issues. The company pays the facility directly and there’s no need to work with a third party at any stage.

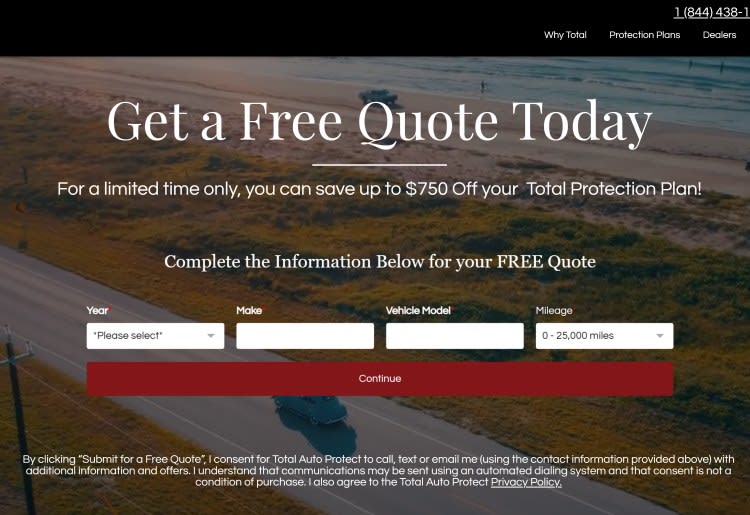

How To Get Started With Total Auto Protect

To get started, visit the company website, click “Get a Quote,” and fill out the form. It asks for information like your vehicle's make, model, mileage, and year. You’ll also need to provide your name, contact information, and ZIP code.

After submitting the form, a representative will reach out and offer you a quote. You can also call the company directly and speak to an agent, who will answer any questions you might have.

To help the process go smoothly, make sure to have the relevant information handy, such as the mileage of your vehicle, how much you drive, and how many years of coverage you want. Once you have the right policy for your needs, you can pay with your credit card. You’ll pay for the entire policy upfront unless you opt for a month-to-month plan.

How to file a claim with Total Auto Protect

The claims process is easy with Total Auto Protect. You just need to bring the vehicle to any facility certified by the National Institute for Automotive Service Excellence (ASE) and present your Total Auto Protect policy info to the service provider. Make sure to reach out to Total Auto Protect and receive authorization before any work gets done.

The company pays the facility directly, and you’re only responsible for paying your deductible. There’s no limit to the number of claims you can make. The company is also quick to respond to claims and can assist you throughout the process.

Total Auto Protect Customer Service

Total Auto Protect offers customer service over the phone or via email. The team picks up calls promptly. When I reached out via email with a few questions, I heard back the same day.

The company provides 24/7 support, so you can always get assistance no matter when your question or concern arises.

Total Auto Protects’s website also has a short but helpful FAQs page that covers topics like transferring coverage, paying claims, and canceling a contract.

How To Cancel Total Auto Protect

If you’re unhappy with the service, the company offers a 30-day money-back guarantee that grants you a full refund. If the 30 days have passed, you’ll receive a pro-rated refund based on the amount of unused time remaining on your contract.

To cancel, you just need to reach out to the company over the phone or via email and request a cancelation.

Is There a Total Auto Protect App?

No, the company doesn’t have a mobile app.

Total Auto Protect Pricing

The company offers three levels of protection: Total Plus, Total Convenience, and Total Premier. However, the company doesn’t publicly list its prices, and the cost of a plan depends on several different factors. These include the age of the vehicle, the mileage, how much you drive, the contract term, how comprehensive the coverage is, and the type of vehicle you have.

For example, a new car with low mileage that's rarely driven will usually be more affordable to protect than an older car that’s driven thousands of miles.

I enquired about two years of coverage for a 2021 Toyota Corolla with under 25,000 miles. Quotes were in the range of $1,649 for the Total Plus plan to $1,888 for the Total Premier plan.

I also got a month-to-month quote of $159, which is an option for those who don’t want to commit to a multi-year contract.

The standard service call fee/deductible with Total Auto Protect is $100, but it varies on a case-by-case basis. Overall, the company’s pricing is competitive with the industry average, and the cost seems fair for the coverage it provides. There are often promotions or sales events that can bring down prices even lower, too.

The cheaper plan is good for someone with a newer car who just wants basic protection, whereas the top-of-the-line plan is a solid choice for drivers who have slightly older vehicles and want comprehensive bumper-to-bumper coverage if things go wrong.

Optional add-ons

Total Auto Protect doesn’t publicly list any optional add-ons to customize plans.

Total Auto Protect Alternatives

Price

Varies depending on numerous factors

Variable

Varies by provider

No quotes were available at this time. Premium based on the plan you choose.

Technicians

Any ASE-certified repair facility

Any ASE-certified mechanic

Any ASE-certified mechanic

Any ASE-certified shop or dealership

Customer service hours

24/7

7am-9pm (CT) Mon-Fri, 9am-5pm (CT) on Sat

24/7

24/7

Service call fee/deductible

Varies (standard is $100)

$0

None

No rates were available at this time

Total Auto Protect vs Endurance Car Warranty

Both Total Auto Protect and Endurance have a money-back guarantee and include perks like roadside assistance in all of their plans. Each gives you the freedom to choose where you get repairs done, but Endurance has more restrictive customer service hours. Endurance also has a 60-day waiting period after opening the policy before you can make a claim, whereas Total Auto Protect’s is 30 days.

Total Auto Protect vs Complete Car Warranty

Both these companies offer 24/7 support and let you get repairs done at any ASE-certified facility. However, while Total Auto Protect administers its plans directly, Complete Car Warranty is a service that helps you compare over a dozen plans from different providers.

Total Auto Protect vs American Dream Auto Protect

Both Total Auto Protect and American Dream Auto Protect offer coverage for a wide range of vehicle types, 24/7 support, and money-back guarantees. While both have FAQs on their websites, American Dream Auto Protect’s are much more comprehensive. The standard service call fee for Total Auto Protect is $100, whereas American Dream doesn’t publish its service call fees.

Bottom Line

Total Auto Protect is definitely worth considering if you want an extended car warranty. It can cover a variety of different vehicles, gives you the freedom to choose where you get repairs done, and offers 24/7 support. While I’d like to see the company be more transparent about pricing on the website, it’s a solid option with good reviews and comprehensive coverage.