ID theft protection is more important than ever with the reported financial losses due to fraud escalating by $1.5 billion from 2019 to 2020.

To safeguard against this growing threat, it's essential to understand the various ways your identity can be compromised. So, I'll walk you through the steps you can take if your personal information, particularly your Social Security Number (SSN), falls into the wrong hands.

» Discover the best identity theft protection for online shoppers.

What to Do if Your Social Security Number Is Stolen

Discovering that your Social Security Number (SSN) has been stolen can be alarming, but there are effective steps you can take to mitigate the damage. The sooner you catch it, the better.

If you don't use a professional ID theft protection service like LifeLock—which deploys a 24/7 professional team to guide you—you can do the following when your SSN is stolen:

Immediately Notify Credit Bureaus

Contact the major credit bureaus (Equifax, Experian, and TransUnion) to place a fraud alert on your credit reports. This makes it more difficult for identity thieves to open accounts in your name. You can also consider requesting a credit freeze, which completely restricts access to your credit report.

Contact the Federal Trade Commission (FTC)

Visit the FTC's dedicated identity theft website. Fill out the form to receive a personalized recovery plan that'll guide you through the steps to protect yourself from fraud and recover your identity.

Alert the Internal Revenue Service (IRS)

Inform the IRS that your SSN has been stolen to prevent criminals from using it to fraudulently file a tax return in your name. You can also contact the IRS for guidance on securing your tax records.

Inform the Social Security Administration

Report the theft to the Social Security Administration. They can offer advice on how to protect your Social Security benefits and provide assistance if your SSN is being misused.

Monitor for Unusual Activities

Keep a close eye on your credit reports and financial statements. Be alert for any signs of fraudulent activity, such as unknown accounts or charges. If you receive mail about unfamiliar financial transactions, benefits you didn’t apply for, or mail addressed to someone else but sent to your address, investigate immediately.

Report the Theft to Local Authorities

File a report with your local police department. Having a police report provides solid evidence that you're not the one behind these actions. It's crucial for disproving any allegations that may arise in the future.

Contact places where your SSN was misused

If you discover that your SSN has been used fraudulently, contact the relevant businesses or institutions immediately to inform them of the situation.

While these steps are crucial in protecting your identity after your Social Security Number has been stolen, managing them can be overwhelming and time-consuming. For comprehensive, hassle-free protection and expert guidance every step of the way, consider using a proven ID theft protection service like Lifelock.

How Your SSN Can Be Stolen

With the rise of digital data storage and online transactions, the avenues through which your SSN can be compromised have significantly expanded.

From sophisticated cyberattacks to more direct methods of deception, understanding the various ways your SSN can be stolen is the first step in safeguarding your identity.

» Educate yourself on the ways hackers can steal your identity.

Data Breaches from Large Institutions

Unlike in the past, where obtaining a physical SSN card was necessary, modern thieves exploit data breaches at large institutions, and these breaches can leak SSNs. For example, third parties gained access to over 30,000 PayPal users' personal information in late 2022.

Phishing Emails and Fraudulent Requests

A common method of SSN theft is through phishing attacks. These deceptive emails masquerade as legitimate requests from trusted entities, asking for personal information, including your SSN.

They often employ emotional manipulation, such as creating a false sense of urgency about a family member in trouble, to provoke a quick and less cautious response. This exploitation of emotional vulnerability is a key tactic in persuading people to divulge their SSNs and other sensitive information.

Third-Party Impersonation

Impersonation of trusted third parties, like banks, is another tactic. Criminals send emails claiming a data breach and request your SSN, banking, and other personal information.

These emails prey on the trust you have in these institutions, leading to the inadvertent disclosure of sensitive details.

How to Avoid Identity Theft

Protecting yourself from identity theft involves a blend of practical steps and vigilant digital practices.

Here’s how you can safeguard your identity:

Use an ID Theft Protection Service

Services like LifeLock actively monitor your financial accounts and personal information, alerting you to potential misuse of your data on the internet. This monitoring helps identify and respond to threats, helping you to address and recover from the effects of identity theft.

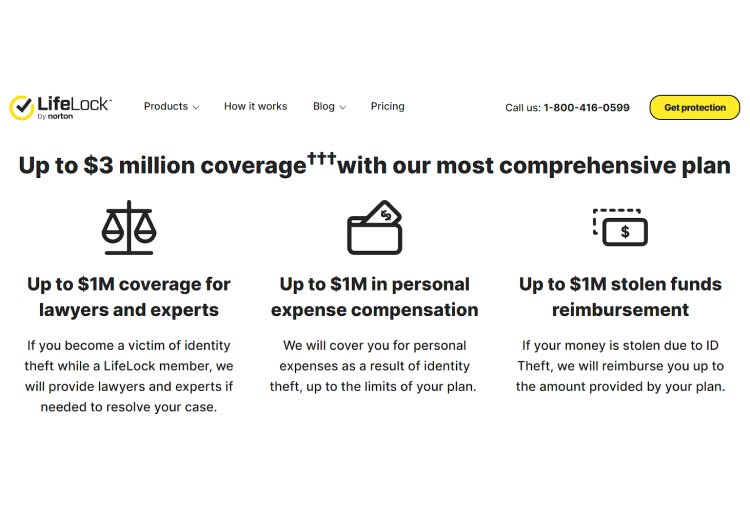

LifeLock's array of features includes reimbursement of up to $1 million and alerts for potentially suspicious activities with advice on how to address them. LifeLock also monitors the dark web and keeps an eye on credit inquiries, tracking any changes to your official mailing address—a common tactic used by identity thieves.

These features offer a layered approach to security, addressing various ways in which your SSN and other personal details can be exploited.

» Want to learn more? Read full Lifelock review

Keep Your Social Security Card Safe

Avoid carrying your Social Security card with you. Instead, keep it in a secure location and only take it out when absolutely necessary.

Refrain from making unnecessary photocopies of your Social Security card or other sensitive documents. When disposing of documents containing personal information, ensure they are shredded or destroyed to prevent them from being misused.

Be Cautious with Personal Information

When online, carefully consider where and why you are entering your personal information, especially your Social Security number. If it's not mandatory, don’t provide it. This includes being wary of requests for even the last four digits of your SSN.

Recognize that identity theft usually involves a combination of personal details like your full name, address, security questions, and passwords. Protect these details diligently.

Avoid Phishing Scams

Be alert to phishing attempts, where you might be emotionally manipulated into providing personal information. Always verify the authenticity of links in emails or messages.

Understand the Nature of Fraud

Fraudulent activities can be personal or part of larger-scale attacks, often carried out by automated bots seeking vulnerabilities. Be aware that fraud is typically reactive; attackers frequently shift tactics and exploit new security holes.

Be Proactive

In the event of suspected identity theft or fraud, promptly contact the institution through which you may experience financial loss. Collaborate with their investigations and fraud teams.

While the perpetrator may not always be found, being proactive and documenting your actions can help reduce your liability and disprove any wrongful allegations against you.

Your Role in Protecting Your SSN

It's your responsibility to ensure your SSN isn't used detrimentally. In my workplace, people report their social security being stolen, but unless it's used nefariously, there's little we can do.

The best defense against identity theft is a proactive and cautious approach. Regularly monitoring your financial statements and being circumspect about where and how you share your personal information can significantly reduce the risk of identity theft.

» Think it won't happen to you? Check out these ID theft stories from real victims.