What Are Merchant Services?

Merchant services is a broad term that refers to merchant processing services giving a business the capability to accept payment using a customer's credit card. The merchant services provider (MSP) is the one who actually makes the transaction happen while complying with security requirements.

Merchant services providers are also referred to as credit card processors (CCP). MSPs act as the intermediary between your business and your customer’s credit or debit card account.

This is how it works:

- A customer will swipe their credit card or enter their credit card information to make a purchase from your store.

- Your point of sale (POS system) software sends the data to your chosen MSP.

- The MSP contacts the customer's credit card association to check that they have enough credit to pay for the purchase.

- The card association checks with the customer's bank, and then (hopefully) sends the MSP a reply approving the transaction.

- The MSP completes the transaction and sends you a receipt for the customer.

Tips for Choosing the Best Merchant Service Provider

With many options available on the market, there are vital factors to consider when choosing a merchant service provider:

Cost

Merchant services offer different pricing models and rates. It is important to review what’s on offer to determine if it fits your needs. Hidden costs or unexpected processing fees may drain your budget.

Payment options

Check whether the merchant service provider offers several payment solutions for processing transactions from debit cards, credit purchases, and mobile payments. There might also be an Independent Sales Organization (ISO)—a third-party credit card processing service—managing transactions on your behalf, but for a share of your sales.

Equipment/Hardware

Ask what equipment is offered, such as card readers, POS systems, and handheld devices, like tablets. They may be included in your contract, or you may have to pay for them separately. The setup should take a few business days to finalize.

Customer support

When something goes wrong, you’ll need help managing your merchant account or when conducting transactions. Your merchant service should have a comprehensive customer support system to resolve challenges faster and prevent any business disruptions.

Ease of use and scalability

Consider how straightforward it is to use the merchant service and whether you’ll need to scale your business in the future

When to Invest in Merchant Services

Merchant services are vital for Ecommerce and service-oriented businesses. Digitization has reduced cash transactions in favor of credit cards, debit cards, and digital payments. Therefore, it’s recommended to find a solution that can handle in-person and online transactions while meeting all the legal and financial requirements for transferring funds from the buyer to your seller account.

Failing to invest in a merchant service solution means that customer experience will be diminished, and your business won’t earn the revenue that matches its potential. Merchant services are flexible to fit your business model. For example, if you’re in retail, you may prefer mobility, meaning you’ll want portable options that can process customer transactions on the spot. High-risk businesses—those that experience a lot of credit card chargebacks—can also find a solution, albeit expensive, for processing their customer transactions.

Another reason to invest in merchant services is the extensive features, such as invoicing tools, app integrations, virtual terminal, shopping cart, payment processing hardware, and more. Many merchant services are scalable, enabling you to take advantage of the services and features to grow your business.

However, there are cost considerations, and each merchant service provider has its own rates and fees that may work well for you or hurt your budget. Try different pricing options, such as flat fees, monthly rates, or per-charge transactions, to determine what works best for your business.

Merchant Services Fees and Rates

Merchant service fees and rates depend on the merchant account service fees, payment processing fees, and equipment costs. Some merchant account providers have setup fees, but the better ones don’t. A provider may offer bundled pricing, per-transaction pricing, or a flat monthly rate, and there may also be markup fees.

The standard merchant account service fees include the following:

A gateway fee of around $10 per month or from $0.10 per transaction to process online credit card payments.

A statement fee of $5 for billing statements and customer support.

A PCI compliance fee of around $100 annually for securing customer data.

A chargeback fee starting at $15.

Payment processing fees involve an interchange rate plus pricing, which is usually from around 1.5% per transaction. Finally, the payment method can also affect the cost. Swiping the card may be charged differently compared to an online transaction.

Equipment costs include POS systems, card readers, and other appliances needed for your business, and they may be expensive. You can opt for a virtual terminal like PayPal to save money.

Types of Merchant Service Providers

Merchant service providers offer various different services and come in 3 different types:

Merchant account provider

If you’re looking to receive money from a credit or debit card transaction, you need a solution that processes the funds from your account and deposits them into the seller’s bank account. A merchant account provider is a bridge enabling that transaction. Some merchant account providers only offer a merchant account but not with any card processing capabilities.

Payment services provider

Payment processing services, like PayPal, offer alternatives to dedicated merchant accounts. They offer lower account fees because you won’t receive a unique merchant identification (ID). These services are different because you’re not bound to the contract agreements found with a merchant account.

Payment gateway provider

Online transactions are only possible through a payment gateway. This is a technology that automatically connects all parties involved to process payments instantly. Payment gateway providers can either open a merchant account for you on their service or link to your existing merchant account to conduct transactions.

What Are the Benefits of Accepting Credit Cards Online?

Accepting credit cards and other forms online is crucial for your business as many customers prefer to pay that way. It opens new revenue streams, enhances customer experience, and offers a fast, secure payment option. It’s straightforward to set up if you find the ideal merchant service provider, and the cost is competitively priced.

People enjoy the convenience of shopping online and having items delivered or services rendered, so having a credit card payment processing solution makes it easier for the customer. You can integrate Buy Now buttons on your website to get a sales lead to purchase something using a credit card. The credit card option may entice impulse buyers to perform the transaction or spend more than they would if they were using cash.

You can maintain cash flow through credit card payments that are settled immediately rather than being vulnerable to the risk of bad checks. If you’re sending invoices, some online payment processors generate links or instant payment buttons for customers to input their credit card data and settle the transaction immediately.

What Are Payment Processing Contracts?

A payment processing contract is an agreement between a merchant and a payment processor—such as a merchant services provider—that outlines the fees, rates, and liabilities involved in providing the service. The contract lengths range from month-to-month to three-year terms, and there may be a termination fee if you decide to end the contract early.

The contract will detail the fees owed to credit card companies like Visa or MasterCard for processing transactions, this is known as the interchange rate. It will describe the Payment Card Industry and Data Security Standard (PCI DSS) compliance fees, which are essential for showing that your business is secured for debit and credit card payments.

The payment processing contract will also present equipment leasing costs for hardware like credit card readers. These provide instant and safe processing of a swiped or keyed-in card.

Since salespeople aren’t required by law to disclose all fees involved, you might end up signing an expensive contract filled with hidden fees. Therefore, you’ll have to check what fees you’ll be obligated to pay per month and per transaction with the merchant service provider.

How To Set Up a Merchant Service Account

Once you’ve registered your business and opened a business bank account, you can search for a merchant service provider to open a merchant account. Compile your business records and financial statements, and get a copy of your credit score to provide insights on whether your business will be a credit risk for the provider.

Compare merchant service providers to select one that suits your business’s needs. Determine what payment method you’d like to use, from card transactions, ACH, online payments, and mobile transactions etc. Check the features and the customer support available. Analyze the pricing, fees, and contract lengths to avoid signing long-term deals that don’t work for your business.

Finalize your application, submit it for review, and wait for the outcome. Review the contract terms before signing the deal. Wait a while, and you’ll be notified if you’ve successfully opened an account.

What is the Best Credit Card Processing Company for a Small Business?

Paying by credit card is the norm these days, so adding credit card processing capabilities can be a real boost to your income.

Small businesses can choose online credit card processing, a conventional credit card reader, or a mobile credit card processor that integrates with a smartphone or tablet.

Conventional card readers can be best if you make a lot of face-to-face sales. If most of your credit card transactions take place online, then an online CCP and payment gateway will be the most useful.

Sole traders and mobile businesses, like electricians or entertainers, might find that a mobile CCP that works with their smartphone serves them best.

There isn’t one credit card processor that is the best for everyone, because every business is different. What’s best for a large retail store with many branches isn’t necessarily best for a small Ecommerce business.

However, here are some things to look for to help you find the best credit card processors for your business:

A CCP that has experience serving your sector.

A CCP that can service all your needs in one—for example, if you have an online store and a brick and mortar store, look for an MSP that can process both face-to-face and online transactions.

Hidden fees. Many companies practice ‘bait and switch’ where the price you see advertised doesn’t include all of the real costs.

Compare fees carefully. Because there are a few different transparent pricing models, it can be difficult to compare like with like. An MSP that seems to offer great value at first glance might actually cost more in the long run, especially if comparing a flat rate pricing model.

Check the minimum monthly transaction amount and make sure that you expect to meet it.

Pay attention to whether the rates go up or down according to your volume of sales. If you make a lot of transactions, you'll want a CCP that lowers the fee as sales increase, but if you make just a few high-value sales per month, you'll want the lowest fees to apply to the lowest sales volume.

What to Expect in 2025

Advances in financial technology (fintech) mean that 2023 will see greater innovations in the merchant services sector. There may be next-generation Application Programming Interface (API) integrations, cryptocurrency use, and blockchain technology adoption to record transactions and store data.

Global economic problems like inflation, high-interest rates, and recession will challenge merchant service providers, as many businesses will struggle with cash flow issues and diminished revenues. Merchant service providers will need to evaluate their pricing structures to remain competitive and retain their customers.

Customer experience will always be at the forefront of any business operation. Therefore, merchant services should develop novel solutions, provide ample customer support, and find opportunities to reward customers through loyalty programs.

Mobile payments and wallets have become predominant in the smartphone age, and better user interfaces and solutions should be developed to make using merchant services on mobile phones convenient.

Other Merchant Service Providers We Reviewed

Can’t find what you’re looking for? Here are some other Merchant Services Providers we’ve reviewed, so you can choose the best one for your needs:

Our Methodology: How We Rated the Best Merchant Services

Every business has specific needs, and you must find a convenient and affordable merchant service with top features that are tailored to your company’s requirements.

We’ve selected the top merchant services on the market that are consistently mentioned and conducted detailed reviews. Furthermore, we’ve rated the best merchant services using the criteria below:

Pricing and rates

Best and extensive features

The business type that would benefit from the service

Service contract lengths: short, month-to-month, three years, contractless services

Free equipment included in the contract, such as card readers

Types of credit and debit cards allowed

Ability to perform an online transaction

Approval and funding speeds

Same day approval

Same day funding

Usability on handheld devices plus mobile payments

Quality of customer support and its availability 24/7

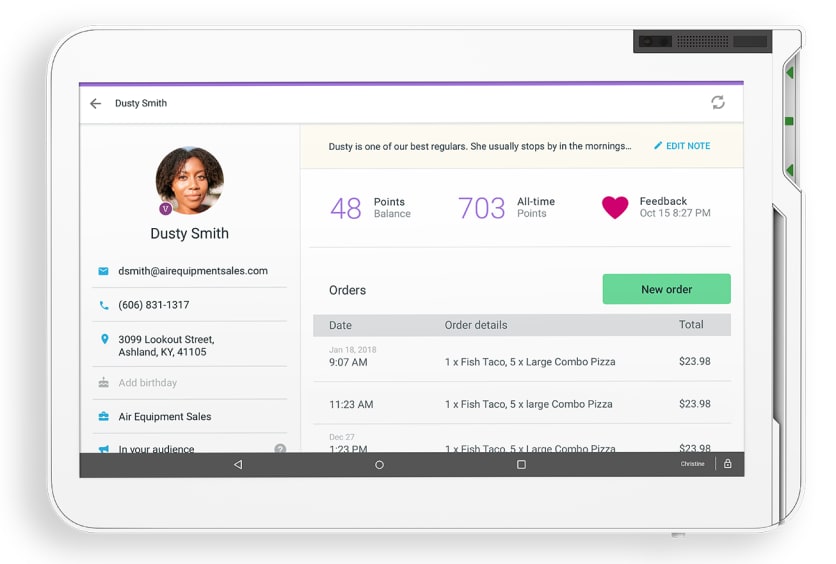

Merchant software user interface and experience

Bottom Line

Our picks for the top 10 best merchant services are Leaders Merchant Services, Paysafe, Merchant One, Flagship, Clover, ProMerchant, Stripe, Square, Chase For Business and creditcardprocessing.com.

Merchant services can streamline your business operations by processing card and online transactions faster and more securely. By utilizing merchant services, you can provide your customers with superior service and a positive user experience.

The services are convenient, agile, and competitively priced, giving businesses multiple options for solving their payment needs.

Merchant accounts are bank accounts designed for business or commercial purposes, enabling companies to process electronic payments from credit and debit cards or another payment method, such as mobile. It’s particularly essential to have a merchant account if you’re running an online business, as it’s the only way to collect customer payments.

The cost of merchant services depends on your merchant account provider, service fees, assessment fees, and the interchange rate for processing various brands of credit and debit cards. Service fees can be monthly, per transaction, or related to leasing equipment.

Yes. You can open an account with a payment service provider like Stripe or PayPal to process your credit card transactions. Moreover, you can use a mobile payments app and a card reader to swipe your credit card and finalize the transaction.

There are alternatives to using a merchant account. If your business doesn’t qualify, you can try payment service providers like Stripe, set up in-store POS systems like Square, or use mobile payments software to handle all your card transactions. High-risk businesses can search for merchant account services that cater to their needs but charge higher fees.

A merchant account is similar to a bank account. It is where the money from a transaction is sent after processing a customer’s credit card. Whereas, a payment gateway is a technological pathway where the buyer’s funds are transferred from their account into your merchant account to complete a purchase transaction.

A payment gateway is an application or technology enabling you to provide the financial information needed to perform a transaction and for the merchant to process your funds to complete the purchase. It connects a customer to the issuing bank and processes the credit card type to send money to the acquiring bank of the merchant account.

.20210623075645.png)

-min.20210215123731.png)