ADP offers one of the most comprehensive selections of features, providing an all-in-one solution for growing businesses who need a better way to manage payroll.

Beyond the standard payroll management and processing there are a number of features for payroll administrations and HR representatives to take advantage of including:

There are also a range of special features, including:

Rather than wrestle with tax compliance and take risks with the IRS, ADP will file handle the payment of all payroll related taxes. This includes handling the deductions automatically from employee paychecks as well as timely payments of tax obligations as needed.

ADP’s compliance program guarantees that all taxes will be accurate as long as your team has provided accurate payroll data for each employee. If an error is discovered, ADP handles any fees or fines from the government—if fault is found with its processing.

Part of tax compliance with ADP also involves new employee reporting at the state and federal level, and will process W2s (employees) and 1099s (contractors) at the end of each year for a small additional fee.

ADP offers a number of standard payment options including giving employees the ability to receive direct deposit payments. If you prefer to pay employees by check you can either print paychecks on site complete with paystub or ADP can provide check stuffing and mailing services.

Check signing and stuffing services are available with an Enhanced Payroll bundle and are not a standard service offering.

ADP offers multiple ways to track pay and handle payment for employees ranging from contract workers to hourly and salaried employees. You can customize how payroll is completed with custom pay cycles such as weekly or bi-weekly, or on specific dates each month. Running any off-cycle payments won’t interfere with or cancel regular payroll cycles for your team.

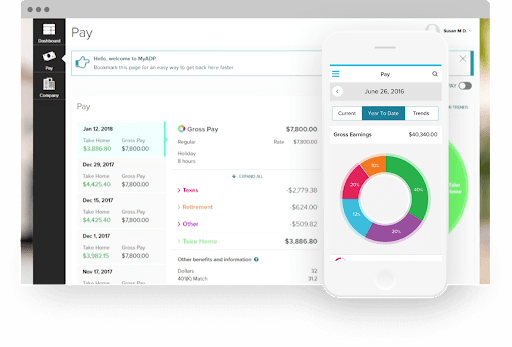

One of the benefits of a cloud-based platform is usability. ADP walks you through setting up your payroll deductions and earning, with simple wizards that prevent errors during the setup process.The simplified interface for administration as well as for employee access makes it easy to find and manage information or update records.

Managing payroll is a simple 3-step process involving entering payroll data for employees, previewing the payroll for approval with a summary of entries once completed. If time tracking is utilized through ADP, any time entered for employees is automatically calculating, making payroll processing that much easier.

The simplified, tabbed interface makes it easy to move between company and employee records for easy record updates, communicate with employees with internal messaging or to fetch data and reports.

Prices vary greatly for outsourced payroll services from ADP, primarily based on the number of employees. Other factors also come into play, as ADP offers 4 different payroll processing bundles, each offering progressively more features.

The Essential payroll bundle provides all the basic payroll and tax filing services a small business may need, while the Enhanced Payroll offers more comprehensive features including more payment options.

The Complete bundle delivers ADP’s latest HR tools such as live HR support, employee handbook wizard, proactive compliance alerts, HR guidance and forms, and a job description wizard. HR Pro then tops off the bundles with a comprehensive suite of HR tools such as a proactive HR support team, employer/employee training, and business/marketing tools and consulting.

ADP does not publish its prices publically, but according to price quotes we got from the company, the average cost to process payroll per employee for companies with fewer than 50 employees is $388 annually.

ADP’s small business payroll service is geared toward companies with anywhere from 1 to 50 employees. The ADP solution simplifies payroll and HR with a comprehensive set of easy-to-use tools, all backed by ADP’s small business expertise. It’s a good option for businesses that need a reliable payroll processor backed by a solid brand name.

Top10.com's editorial staff is a professional team of editors and writers with dozens of years of experience covering consumer, financial and business products and services.