In a Nutshell

pros

- Automatic tax filings and direct deposits included

- Integrates well with popular POS systems

- Mobile app access for payroll on the go

cons

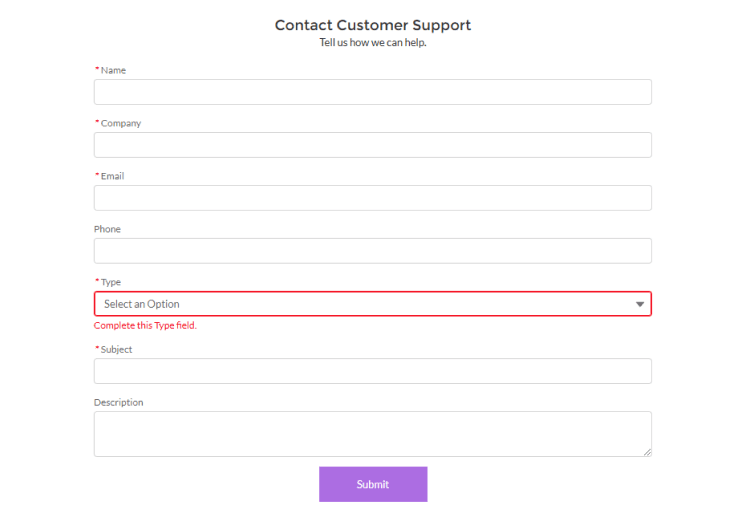

- Customer support mainly via online form

- Off-cycle payrolls only run on the web version

What Is Homebase?

Homebase is an all-in-one platform built for small businesses, bringing payroll, scheduling, time tracking, and team communication together in one easy-to-use app. Designed with hourly teams in mind, it saves owners valuable time by automating tasks like tax filings, direct deposits, and record-keeping.

With Homebase, small business owners can handle complex tasks like payroll processing and tax compliance, reducing data errors and keeping records up-to-date. The app also simplifies reporting and supports employee self-service, so teams can check their schedules, hours, and pay details independently. For tracking PTO and vacation, Homebase automatically calculates accruals and updates balances - ensuring accuracy across pay periods and removing guesswork.

Homebase Features

Homebase provides a range of features tailored to make payroll and team management smooth, accurate, and efficient for small businesses.

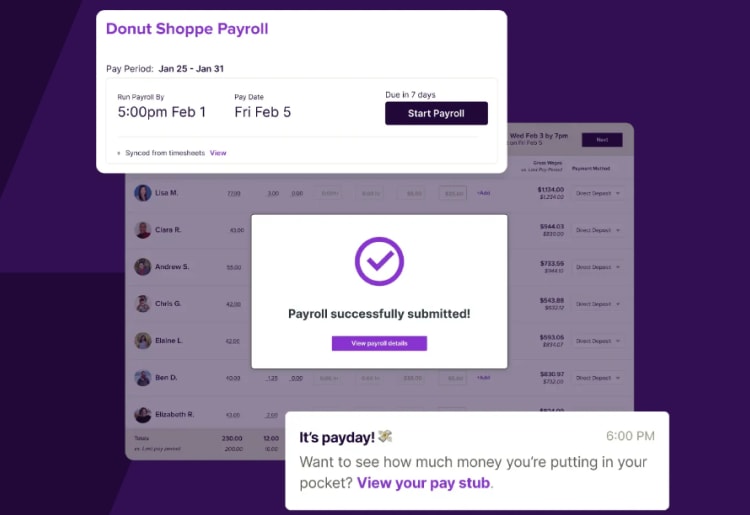

Payroll Processing

Homebase’s payroll processing keeps things efficient and accurate, so you can run payroll in just a few clicks. It handles tax calculations, direct deposits, and end-of-year W-2s and 1099s automatically. Autopayroll covers recurring pay periods without any manual steps, while next-day pay options give you flexibility for urgent needs.

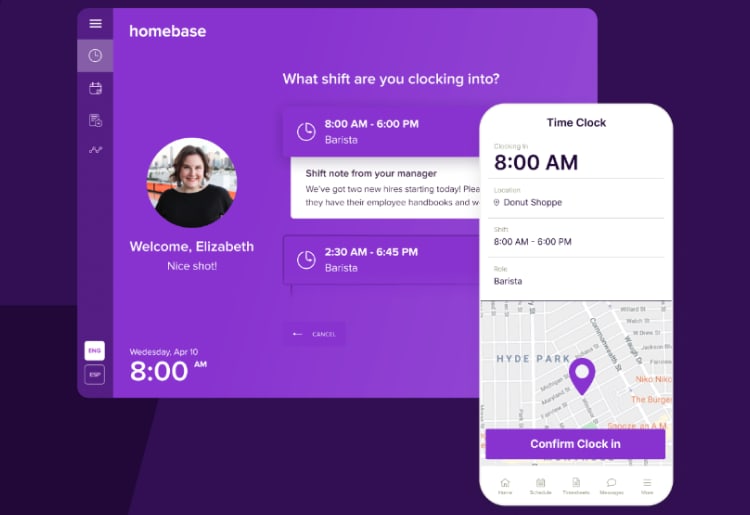

Time and Attendance Management

Homebase’s time-tracking tools simplify managing hours, breaks, and overtime across shifts. Digital time clocks prevent early clock-ins and flag overtime, while alerts keep you updated on late arrivals. Approving PTO requests directly in the app keeps everything organized and cuts down on potential errors from manual entries.

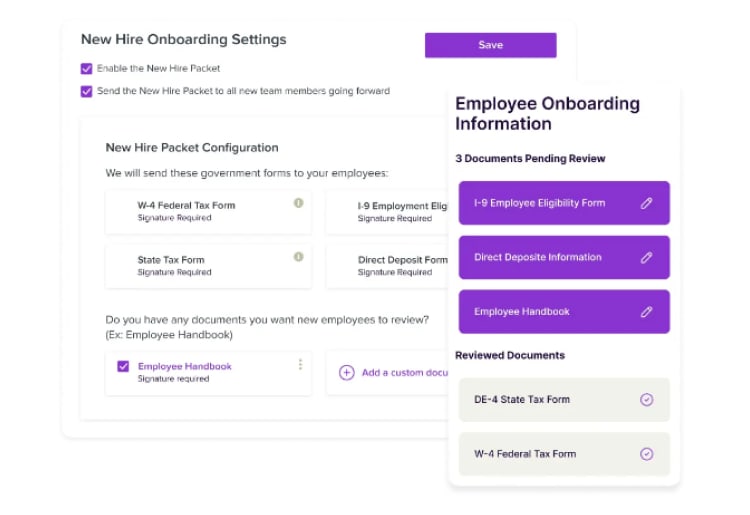

HR Management

Homebase’s HR tools handle onboarding, document management, and essential compliance tasks. You can have new hires complete forms and e-sign paperwork, keeping all documents in one place for easy access. It also stores employee details, including job titles, pay rates, and essential info, so you don’t have to dig around to find what you need.

Benefits Management

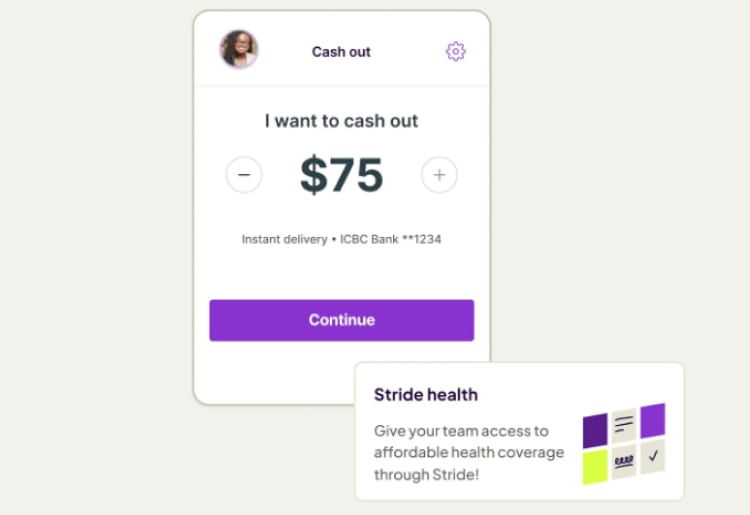

Homebase supports your team’s financial wellness by offering PTO tracking with automatic balance updates and accruals. The app includes free budgeting tools and early access to earned wages, helping your employees manage finances more easily. Additionally, it partners with Stride to provide access to affordable health, dental, and vision insurance options without increasing employer costs.

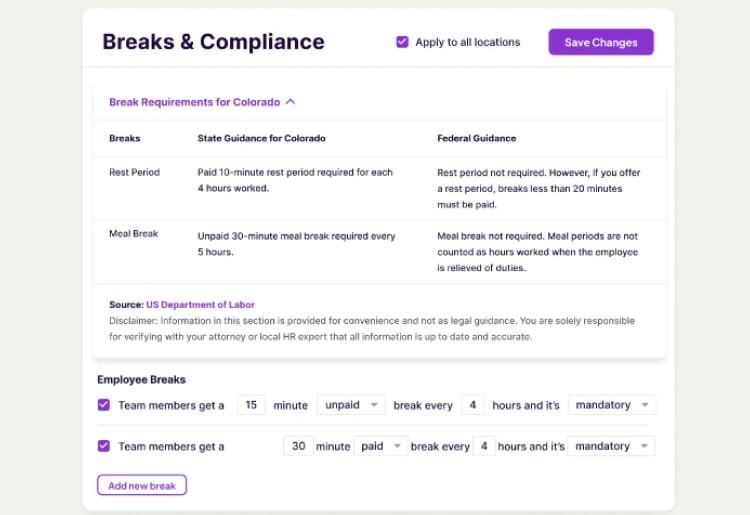

Compliance Management

Homebase stays current with federal, state, and local regulations, taking care of tax compliance and labor law requirements. It automatically calculates taxes, manages payroll filings, and stores essential timecard records to meet FLSA record-keeping standards. Compliance updates happen behind the scenes, so your payroll and HR practices stay aligned with changing laws and reporting needs.

Is Homebase Safe and Reliable?

Homebase takes security seriously, packing in features that keep your data safe every step of the way. Data in transit is encrypted with TLS, while two-step authentication and instant security alerts help lock down account access. Permissions settings let you control who can view sensitive information, and an onsite security team runs regular audits to keep everything up-to-date.

How Homebase Works

With Homebase you can navigate payroll processing in just a few clicks, with tools like Autopayroll to run pay periods automatically and options for next-day pay when things need a quick turnaround. The app’s intuitive design - available on both web and mobile - means tracking hours, approving PTO, and running payroll can all happen from one place, even on the go.

Homebase also integrates with popular POS systems like Clover and Square for real-time time tracking and syncs with Stride to offer employee benefits. Reporting options cover payroll summaries, tax filings, and timecard storage for compliance, keeping your records organized without extra effort. Customization options include setting up permissions, PTO policies, and approval workflows, allowing you to tailor it to fit your business’s needs without complexity. It’s a setup that works efficiently without the usual payroll headaches.

How to Get Started With Homebase

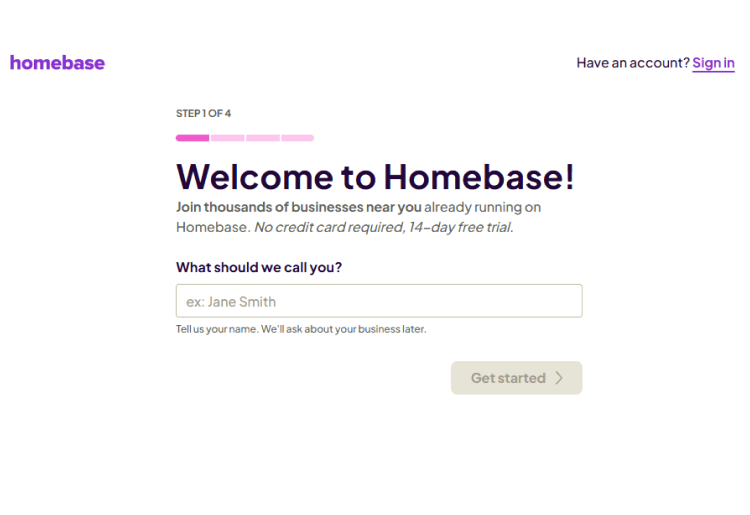

Setting up Homebase for payroll and team management is a quick, guided process that gets you up and running smoothly. Here’s a step-by-step guide to starting with Homebase:

- Sign up: Begin by creating your account on Homebase’s website or mobile app. This includes entering basic company information and selecting payroll as an add-on if it’s part of your setup.

- Initial setup and data transfer: Homebase’s support team assists in transitioning employee records and historical payroll data. You’ll provide essential information, like employee pay rates, tax forms, and direct deposit details—necessary to ensure accurate W-2s and payroll compliance.

- Configure your dashboard: Once your data is in the system, the Homebase dashboard becomes your hub for managing payroll, time-tracking, and PTO policies. Here, you can activate Autopayroll, set payroll schedules, and configure PTO accruals and permissions.

- Set up integrations: Link any POS systems you use, like Clover or Square, to sync employee hours directly to payroll. Additionally, set up access to Stride for health benefits if needed.

- Run payroll: With everything configured, running payroll is as simple as a few clicks, using real-time data and pre-set options for taxes and direct deposits.

![]() Homebase Customer Service

Homebase Customer Service

Homebase keeps support accessible with options to reach out by email, chat, or phone from 8:00 AM to 7:00 PM CST, Monday through Friday. Essentials plan members and higher get access to live chat and callback requests, while emails typically receive responses within 24 hours. For quick answers, the live chat connects you with a real person during business hours. Plus, Homebase’s extensive support library covers everything from setup to payroll tips, making it easy to find solutions and resources.

Is There a Homebase App?

Yes, Homebase offers a mobile app that simplifies payroll, scheduling, and time tracking on the go. Users can manage hours, approve PTO, run payroll, and communicate with the team - all in one place.

Homebase Pricing

Homebase offers four subscription plans - Basic, Essentials, Plus, and All-in-One - each designed to meet different team management needs. You can try the All-in-One plan free for 14 days, and all plans allow payroll as an add-on to simplify wage processing. Plans also offer a 20% discount with annual billing.

Additional Add-Ons:

- Tip manager: $25/month per location for automated tip pooling from POS systems.

- Background checks: $30 per check for convenient, built-in background verification.

- Task manager: $13/month per location to create and track task lists.

- Job post boosts: Starting at $79 per post to expand applicant reach.

Payroll is available as an add-on for any plan, transforming time-tracking data into ready-to-pay wages, taxes, and filings - all automated to reduce payroll errors.

Bottom Line

If you’re running a small business with hourly teams, Homebase is worth a look. It keeps payroll, scheduling, and time tracking simple - no need for juggling separate tools. Payroll runs in a few clicks, and the mobile app is solid for handling things on the go.

Just know that it’s built for smaller teams, so larger businesses might encounter some limitations. Overall, if you need a reliable, affordable way to streamline team management, Homebase does the job without complicating things.

Homebase Customer Service

Homebase Customer Service