Paylocity is an online payroll and human capital management (HCM) software solution that automates time-consuming tasks like payroll processing, tax compliance, and record-keeping. It also offers robust reporting capabilities to give you valuable insights into your business payroll data.

Additionally, the system can grow with your firm’s needs. You can add new modules as your HR requirements evolve. Whether you’re looking for features to improve communication, a way to track applicants and onboard new hires, or employee surveys to boost company culture, Paylocity provides various tools that can address these requirements.

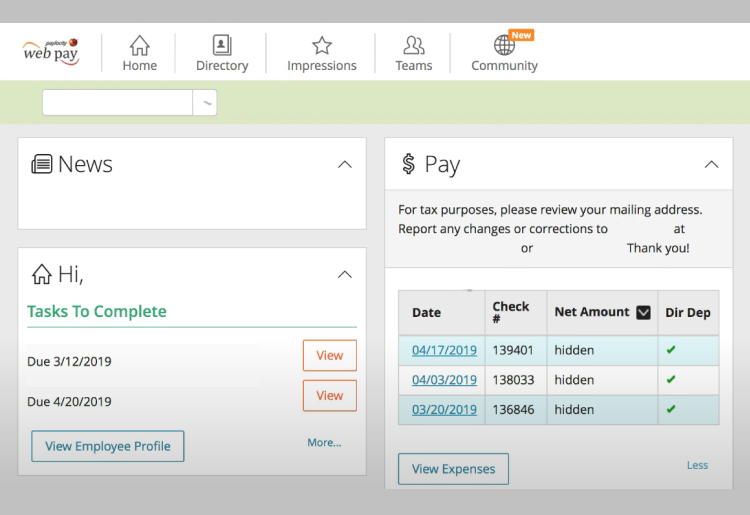

With Paylocity, your employees have immediate access to up-to-date PTO balances via their portals, so they won’t need to consult HR directly. This can save everyone time and decrease confusion. Your workers can also plan their vacations, appointments, and other time off more effectively since they can manage their compensation information in one place.

Paylocity promises its payroll processing is accurate, reliable, and timely. It includes calculating payroll taxes, setting up direct deposits, generating pay stubs, and creating W-2s and 1099s. It also helps your HR department pay your employees correctly and on time.

This service allows you to manage employee time and attendance records, including tracking hours worked, paid time off, and sick leave. Additionally, it assists with scheduling and leave management, making it easier for you to monitor and control your employee attendance.

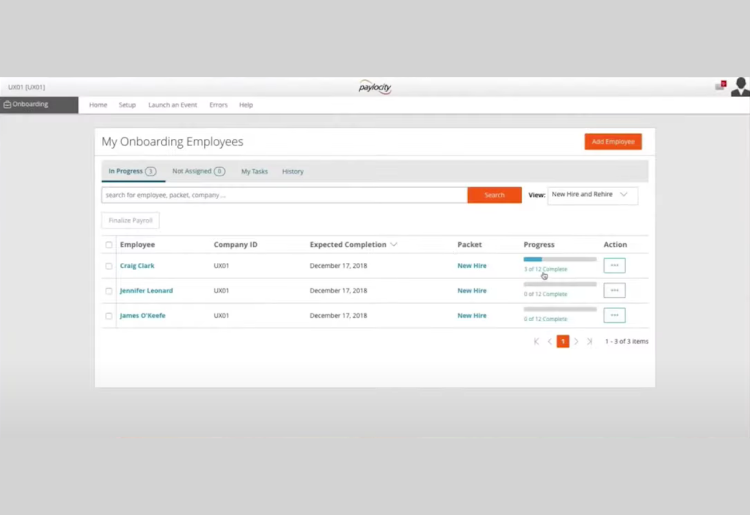

With this functionality, you can handle onboarding for new hires and use e-verification, document management, and compliance tasks. It gives you and your HR department quick access to important employee details like job titles, salaries, and benefits—which helps you stay organized and cooperate with company policies.

Paylocity offers tools to manage healthcare, retirement plans, and wellness programs. You can also access benefit plan information and make changes on your assigned dashboard. Overall, it simplifies administering employee benefits and organizing business finances.

You can use Paylocity’s compliance management services to stay up-to-date with federal, state, and local laws related to payroll and HR. It also assists with navigating tax and labor law compliance to ensure your business meets regulatory requirements.

Paylocity ensures safety and reliability through various efforts. The platform uses encryption to protect your data during transmission and has strict access controls in its data centers. This guarantees that only authorized personnel can access your sensitive information.

Additionally, it conducts regular security audits to make sure its protection strategies meet industry standards and follow best practices. For added safety, the service employs authentication measures to verify users’ identities. It also has backup and recovery procedures to guard you against data loss.

Paylocity simplifies handling payroll and HR tasks. You start by creating an account, logging in, setting up your details, and entering your employee information. From there, the software can calculate wages, taxes, and deductions and even generate pay stubs and tax forms for you. It also tracks work hours to help you accurately supervise each employee’s schedule and compensation.

Paylocity has a straightforward interface with various customizable options. You can personalize your dashboard to show the information you need most, and there are plenty of reporting options to help you better understand your payroll and HR data. Plus, it can integrate with other tools like Clockify and Greenhouse, which can help make your daily tasks more manageable.

To get started with Paylocity, follow these steps:

You can contact Paylocity’s customer service team by phone or email Monday through Friday from 6:00 am to 7:30 pm (CT). To speak with an agent, dial 888-873-8205. But if you require email support, reach out to service@paylocity.com.

For common questions, check out the website. It hosts a massive resource library filled with compliance alerts, tax deadline guides, blogs, webinars, podcasts, e-books, press releases, case studies, and videos. Additionally, product training courses, workshops, and year-end readiness kits are available to help you find the best solutions for your team.

To cancel or pause your subscription, you’ll need to contact the customer support team directly. You can reach them by phone at 888-873-8205 or via email at service@paylocity.com. The reps will guide you through the process and assist with any questions or concerns you may have.

Note that Paylocity doesn’t offer self-service cancellation or pause options through the website. So, it’s best to reach out to customer support as soon as possible if you want to cancel or pause your subscription.

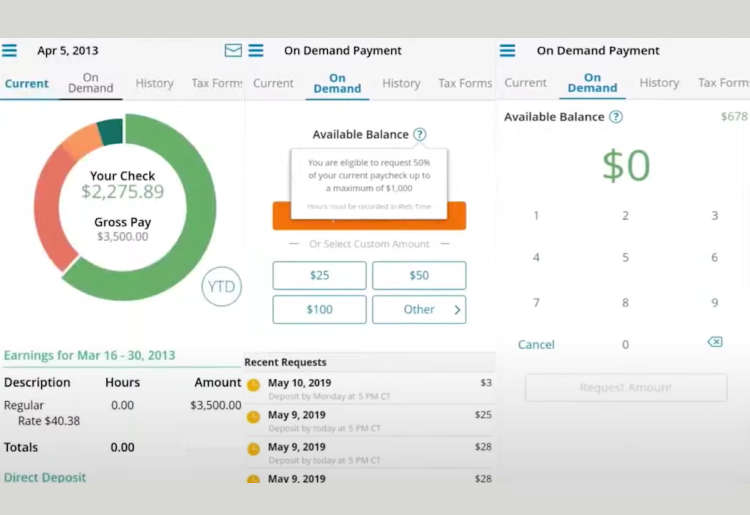

Yes, Paylocity offers a mobile app for both iOS and Android devices. The app allows you to open your account on the go, making it easy to manage payroll and HR tasks from anywhere. You and your employees can also view pay stubs, track time and attendance, put in leave, and communicate with colleagues.

Additionally, the app lets workers request on-demand payments. This gives them access to a portion of their compensation before payday. And since 69% of Americans in urban areas live paycheck to paycheck, this feature can help your team cover sudden costs without needing to apply for loans or credit cards.

The monthly fee is priced per employee per month (PEPM) and depends on the features you select for your plan. While the site doesn’t provide transparent pricing, you can expect to pay $22-32 PEPM. Still, we recommend calling the support center or requesting a demo for more information.

You won’t be able to access the system without a demo or paid subscription. But you can view and use all the full courses Paylocity offers for free. The site has different types of training, like live virtual classes and pre-recorded videos, which you can watch whenever you have time. These resources can help you get the most out of using Paylocity for your business.

Paylocity offers several optional add-ons to enhance your company’s culture and communication, including:

This feature allows your employees to communicate, share files, and stay updated with company news all in one place. Leaders can easily broadcast announcements and track engagement metrics to understand what content resonates most with their teams.

Paylocity’s communication tools replace the need for separate online communication platform apps like Slack or Google Chat. Your employees can join discussion groups, share files, and communicate via text, voice, or video calls.

Employees can publicly commend each other using Impression Badges with labels like “Rockstar.” You and your managers can view these tags in user profiles and use them to build a sense of community. The system also automatically recognizes birthdays and work anniversaries to help employees feel more appreciated and connected to the workplace.

You can easily gather employee feedback using pre-made survey templates to better understand their needs and concerns. It’s quite simple to set due dates and reminders to increase response rates and sync survey data with Paylocity’s Modern Workforce Index. You can also use the software to analyze the information and identify areas for improvement.

| Paylocity | Gusto | ADP | Paychex | |

|---|---|---|---|---|

Price | Contact provider for a quote | Starting from $40 per month + $6 per month per person | Contact provider for a quote | Contact provider for a quote |

Benefits & HR | 401(k) management, worker’s compensation, benefits administration, time off tracking, compliance assistance, onboarding, performance management, payroll processing, integration with 350+ tools | Payroll processing, employee benefits, time tracking, HR compliance, onboarding, employee self-service, HR consulting, integration | Payroll, time & attendance, talent, benefits & insurance, HR services & PEO, compliance services, AI capabilities, integrations | Payroll services, employee benefits, HR services, employee onboarding, time & attendance, integrations, business insurance |

Automatic tax filing | Yes | Yes | Yes | Yes |

Apps | Android/iOS | Android/iOS (mobile app for employees only) | Android/iOS | Android/iOS |

Paylocity and Gusto both handle key tasks like payroll, task filing, and organizing benefits. But Paylocity offers a wider range of services for firms looking to manage talent and assess performance. Gusto, meanwhile, is easier to use and focuses more on employees’ health savings and well-being programs. For costs, Paylocity gives personalized quotes, while Gusto has a transparent subscription structure.

Paylocity can help you meet payroll and HR law requirements at all levels in the US with its compliance and tax alerts. On the other hand, ADP has experience working with global tax laws and filing rules, making it more suitable for international companies. And while both can scale with your business’s growth, ADP takes a more modular approach by letting you pick the functionalities you need.

Paylocity is an all-in-one HCM platform that offers features for managing talent and engaging employees. It’s known for being user-friendly and is suitable for small and medium-sized businesses (SMBs). Paychex provides different HR services, including payroll, consulting, and retirement planning, and caters to small businesses and larger companies. Its system may also be a bit more complex to navigate.

After exploring Paylocity’s features and functionality, we’ve found that it can be a worthwhile investment for smaller firms looking to enhance their HR and payroll operations. While testing the service’s offerings, we noticed that it can help reduce mistakes with paychecks and make managing employee details more straightforward.

We were particularly impressed with the platform’s integration capabilities. Having access to 350+ additional apps can streamline many of your processes by automating certain tasks and creating custom workflows. We also think the mobile app—particularly the option for employees to access their earnings before payday—can help improve worker satisfaction.

Top10.com's editorial staff is a professional team of editors and writers with dozens of years of experience covering consumer, financial and business products and services.