In a Nutshell

pros

- AI detects and records eligible expenses

- Quarterly tax calculator available to estimate tax burdens

- Option to export tax reports to file taxes yourself

cons

- Must upgrade to paid version to file taxes through FlyFin

- No monthly subscription plans available

What is FlyFin?

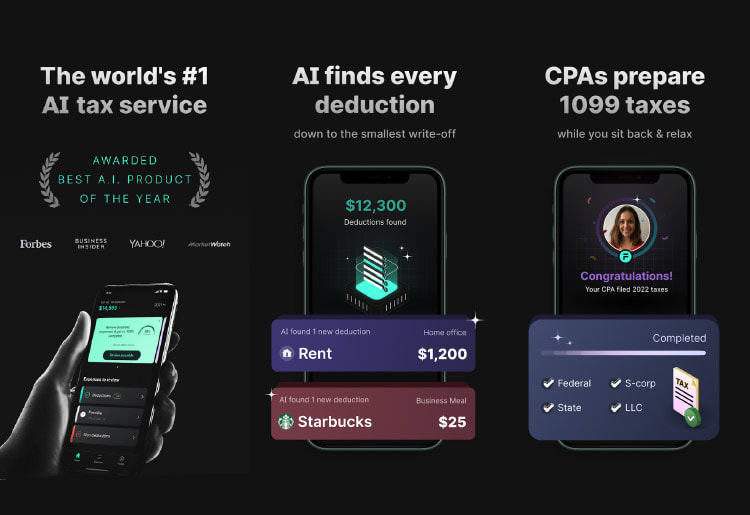

FlyFin is a bookkeeping and tax preparation service specifically geared toward helping freelancers prepare their tax returns accurately and efficiently. The company is unique in that it uses AI to identify, verify, and record all possible deductions. In addition to this, you’ll have access to support from a certified public accountant (CPA).

You can use FlyFin for help with a range of taxes, such as self-employment, small business, non-profit, cryptocurrency, investment, property, payroll, and 1099, as well as general bookkeeping. The AI tool has automatic error detection, so you don’t need to worry about making any careless mistakes when filing your tax return.

FlyFin features

FlyFin offers a range of features to make tax preparation easy. These include:

An AI tool that uses 200+ deduction categories

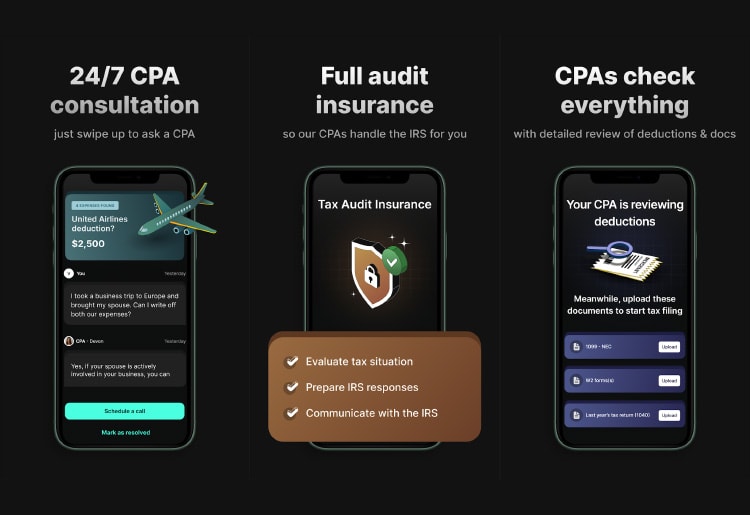

Support from a CPA, who will review your expenses with you, prepare your return, and file it for you after you sign it off

The ability to automatically import your W-2s and 1099s for easy filing

A quarterly tax calculator to help you generate your estimated tax burdens for the year

The option to export reports from FlyFin if you wish to file your taxes yourself

Free audit insurance and support

Is FlyFin Safe and Reliable?

FlyFin is a safe and reliable app powered by Mastercard and Plaid. These have the authority to access your account statements directly, but only periodically. FlyFin does not need to store any information such as passwords, usernames, or account numbers, so there’s no risk of your money being stolen through the app.

The app also uses multi-factor authentication, and you’ll be able to set up FaceID within the app. All personally identifiable information is secured to the highest global standards and is GDPR and CCPA-compliant. FlyFin does not sell your data or share it with any third-party providers.

How FlyFin Works

FlyFin sends you push notifications every time it finds a possible deduction, so you can choose to either accept or reject them. When it’s time to prepare your return, you’ll be connected with a tax assistant to review the deductions before they’re sent to a CPA for filing. If there are any deductions you believe to be incorrect, you can discuss them with the tax assistant at this time.

When you’re ready to file your taxes, you can either export all of the data to file your return on your own, or you can opt to pay for one of FlyFin’s verified CPAs to do it on your behalf.

How To Get Started With FlyFin

To get started with FlyFin, first download the app on your phone or tablet. Once it’s installed, you’ll be prompted to answer a few questions so FlyFin has a better understanding of what you’re looking for from the service. These include what kind of work you do, whether or not you work from home, travel for business, or have business meals, what personal deductions apply to you, and what your income range is.

Next, the AI tool will indicate how many deduction categories you qualify for. FlyFin will then prompt you to connect your email account so you can auto-create an account. Alternatively, you can do this by entering your email and information manually.

Then, you’ll need to connect your bank so FlyFin can begin to track all possible deductions. FlyFin provides a list of the financial institutions it works with, so all you need to do is select yours, then verify it by signing into your bank account.

The AI and the CPAs are now ready to work their magic and find your deductions.

FlyFin Customer Service

Phone and chat support are not available, but you can contact the FlyFin customer service team by email at support@flyfin.tax. Additionally, the FlyFin website and app have a contact form that you can fill out with your name, email address, and inquiry. A customer service representative should reach out via email within 24 hours to answer your question.

FlyFin also has a resources section on its website and app. This includes a blog with articles on various tax-related topics. Additionally, there are several free tax calculators available. Other resources include a detailed itemized tax deduction guide, business tax forms, and self-employment guides.

How To Cancel or Pause a FlyFin Subscription

FlyFin begins charging for your subscription after the seven-day free trial. You may cancel your subscription at any time by emailing security@flyfin.tax. However, if you’ve already paid the annual fee, you won’t get your money back. Rather, FlyFin will allow you to use its app and services for the remainder of the year, and then it will close your account.

Subscription pausing is not available, and you cannot pay for your subscription in monthly installments.

Is There a FlyFin App?

FlyFin’s app is available on both Android and iOS devices. You can use it to do everything you can do on the website, including signing up for your account, tracking your deductions, and filing your taxes. On top of this, you can adjust the settings in the app so that you’re notified every time FlyFin identifies a potential deduction.

The app was easy to navigate. It’s refreshing to see an app make the complicated process of filing taxes easier and more straightforward. When signing up, the app walks the user through the process in an upbeat and clear manner. The CPA resources are an extra bonus, adding a “human” element to the app.

How Much Does FlyFin Cost?

Flyfin offers three annual subscription tiers, with pricing roughly on par or slightly higher than its competitors.

When you sign up, the app will let you know which subscription package is best for your needs. If you’re a freelancer looking for bookkeeping but not tax prep help, the basic tier will do just fine at $84 per year.

Most freelancers and solopreneurs will find that the standard version—$192 annually—is best, as you’ll have everything you get in the basic version plus the option to file your taxes through the app with a certified CPA.

The premium version is best for small business owners and those who have a lot of moving parts to their taxes, as this tier will give you access to a designated CPA and tax audit insurance. This will set you back $348 per year.

Bottom Line

FlyFin is definitely worth it for freelancers who struggle to separate their business and personal finances. Once you link your bank account, the AI tool tracks all of your expenses, offering a headache-free way to keep your potential deductions in order for the coming year. Those who feel most comfortable filing with a CPA will also find the FlyFin app to be worth the price, as you’ll receive unlimited advice from these tax professionals at all pricing tiers.

Users can set up an account after completing just a few straightforward steps, and the app is incredibly easy to use and navigate.

FAQs

Q: How much does FlyFin cost?A: FlyFin offers a seven-day free trial. After this, you’ll be bumped up to the appropriate subscription tier based on the information you gave when filling out your application. The app charges $84 annually for basic bookkeeping, $192 for a standard tax return, and $348 for a premium tax return. You’ll need to opt for the latter if you’re filing for an entity like an LLC or S Corp.

Q: How does FlyFin work?A: Just download the app and link your account to start tracking expenses. The AI engine will automatically scan accounts daily and suggest which category to classify expenses in. Then, you can swipe right or left to accept or reject them as deductible or non-deductible. You can adjust your settings so you’re notified every time there’s a potential deduction.

Q: How do I contact FlyFin?A: You can reach FlyFin customer service at support@flyfin.tax, or you can fill out the contact form on the website or app.