In a Nutshell

pros

- Searches for over 500 possible tax deductions and credits

- Option to have an expert file for you

- Easy way to file small business taxes

cons

- Extra cost for state tax returns

- Generally more expensive than alternatives

TurboTax Live Premium at a Glance

Pricing

Expert Help

Mobile app

Customer Support

Filing Fees

TurboTax Premium: Plans & Pricing

TurboTax Premium

Best for filing with expert help

Live Assisted Premium

Best for filing with an expert final review

Cost

$89-$129

$169-$219

Additional cost for state taxes

N/A

$49 per state

Easy tax filing

✅

✅

Unlimited expert advice

❌

✅

Expert final review

❌

✅

Access to tax experts all year

❌

✅

How much does TurboTax Premium cost?

TurboTax Premium is available for $89 if you file before February 28. After this date, the price goes up to $129. This is a bit higher than the industry average.

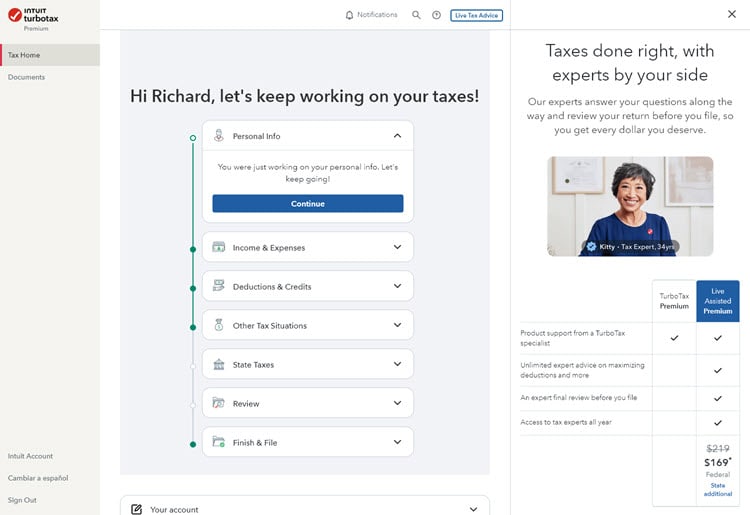

Throughout the process, you can upgrade to a Live Assisted Premium plan. This adds unlimited access to tax experts who can help you with queries you have while filing and help you maximize deductions. They will review your tax return before you file to ensure you haven’t missed anything.

Optional add-ons

If you choose the Live Assisted Premium plan, you can file your state tax returns once your federal return is complete. This costs an additional $49 per state.

All the information will be transferred to your state return, saving you from re-entering the details. TurboTax will also check if you qualify for state tax credits or deductions.

How Does TurboTax Premium Work?

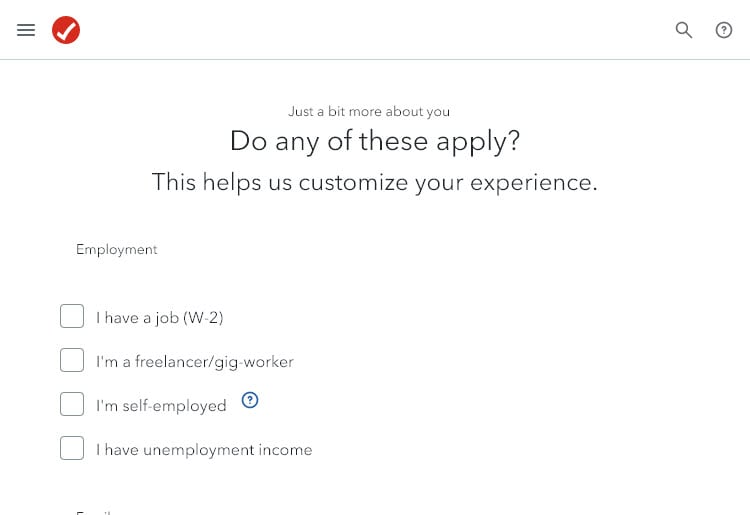

TurboTax eases you into filing your taxes, getting you to create an account by supplying your name, date of birth, and email, and then verifying your phone number with a text. Next, you’ll be asked whether you filed your taxes last year, the types of employment you have (none, employed, freelancer, self-employed), whether you own or rent a home, whether you have dependents and the types of investments you have.

From there, you’ll be asked further questions to help you complete your tax return. The full tax return can be completed within around 90 minutes, depending on the complexity of your tax situation.

You’re always given the option to upgrade to the Live Assisted Premium plan, where you can get assistance from a TurboTax specialist to complete the process. However, completing a tax return with TurboTax Premium is so easy that many people won’t require this upgrade.

Is TurboTax Premium Reliable and Safe?

TurboTax is the U.S.'s most widely used tax preparation service, handling more than double the number of returns than its closest competitor does. If any mistakes are made on your return due to TurboTax’s fault, the company will pay any penalties and interest you incur.

Still, you shouldn’t ignore that TurboTax has poor customer satisfaction ratings on third-party rating sites like Trustpilot. It currently sits at a low rating of 1.2 out of 5, with most complaints about difficulties dealing with customer service support. TurboTax does have an A+ rating from the Better Business Bureau, however.

Intuit says every part of TurboTax has been built with security in mind, with all data encrypted when stored on its servers and in transit. You can choose to securely access your account by entering a code sent to your mobile device, and there’s support for fingerprint or facial recognition through the TurboTax app.

Help and Support

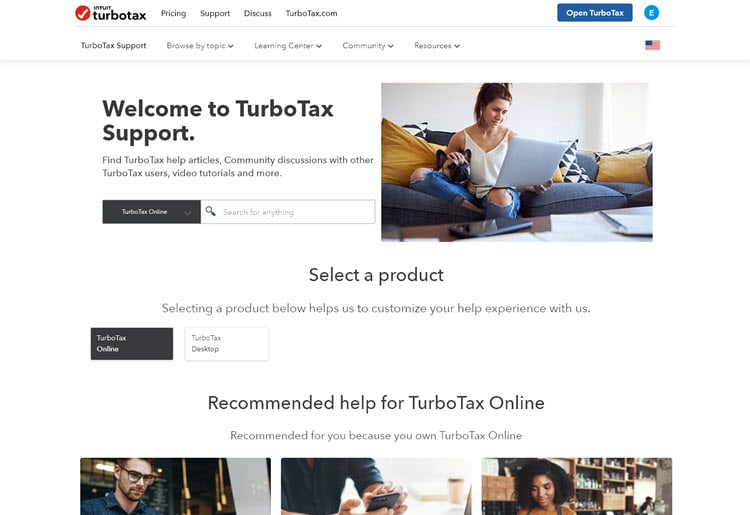

Choose TurboTax Premium without the Live Assisted Premium upgrade, and you’ll still have access to a wealth of information on the TurboTax support site. Articles, videos, community posts, blog posts, and tax tools can all help answer your questions when filing your tax returns. TurboTax Premium also has an AI assistant available within its interface, and general phone support is available Monday-Sunday 5am to 9pm PST.

Opt for the Live Assisted Premium upgrade, and you’ll add the ability to get unlimited phone callbacks from tax experts who can offer more detailed advice on how to fill out your return and maximize your deductions. Typically, you’ll get a callback within five minutes.

What about the TurboTax Premium App?

TurboTax offers a free app for both iOS and Android, available from their respective stores. The app is well reviewed on both stores, receiving an average of 4.6/5 from over 11,400 users on the Google Play store.

The TurboTax app functions similarly to the TurboTax website, with the only major exception being that the tax tools aren’t available on the app. Using the app on your phone or tablet can be a convenient way to file your tax returns.

Bottom Line

TurboTax Premium is an intuitive tax filing solution, particularly for those with more complex tax scenarios, such as the self-employed or freelancers. Its comprehensive search for over 500 tax deductions and credits can make it a worthwhile investment for users seeking to maximize their returns with minimal hassle. However, additional fees for state returns and higher costs compared to competitors are points to consider.

TurboTax Premium could be a compelling choice for individuals or small business owners who prioritize ease of use and access to expert advice. The option to upgrade to a Live Assisted Premium plan for expert filing assistance and year-round support adds a level of confidence to the process, ensuring accuracy and potentially uncovering additional savings.

FAQs

Does TurboTax Premium handle state tax returns?

TurboTax Premium includes the option to prepare and file your state tax return. However, while federal e-file is included in the purchase price, state filing requires an additional fee per state return.

What’s the difference between TurboTax Premium and Live Business?

TurboTax Premium is primarily designed for sole proprietors, freelancers, and single-member LLCs, while Live Business caters to partnerships, corporations, and multi-member LLCs, providing more specialized business tax support.

Will TurboTax Premium automatically import my tax documents?

Yes, TurboTax Premium offers the capability to automatically import tax documents from hundreds of financial institutions and employers, making it easier to ensure accuracy and save time on data entry. This includes W-2s, investment and mortgage information, and the previous year's tax return data if you used TurboTax that year.