- 3-bureau credit monitoring

- Credit reports and monthly credit scores

- Fraud alerts in real time

- Save up to 68% today

“Aura is a good choice for you if you want a long-list of credit and identity theft monitoring services at a competitive price point.“ (Jan 2024)

- Real-time credit monitoring alerts

- Dark web monitoring & SSN alerts

- Special offer: Save 63% on Ultra Protection

- 60-day money-back guarantee

- Up to $1M reimbursement

- Enjoy 52% off your first year

- Credit monitoring & alerts included

- Get credit for your phone & utility bills

- Updated Experian credit reports every month

- Instant Experian credit file lock feature

- Protection against identity theft

- 3-bureau credit monitoring

- Unlimited credit score access

- Credit alerts for profile changes

- 3-bureau credit monitoring

- 3-bureau credit monitoring

- Credit reports and monthly credit scores

- Fraud alerts in real time

- Save up to 68% today

“Aura is a good choice for you if you want a long-list of credit and identity theft monitoring services at a competitive price point.“ (Jan 2024)

With fraud and identity theft recently on the rise, consumers are learning that they need to be more conscientious about their credit reports in order to protect their credit score. Credit monitoring is the most efficient and convenient way of staying on top of your credit history. Credit monitoring is also helpful on a more practical level, helping you build up your credit score. What is credit monitoring, how does it work, and where can you find the best credit monitoring services that check your credit score and make sure nobody is tampering with your identity? Let's take a closer look.

What is Credit Monitoring to Protect Your Credit Score?

Loosely translated, credit monitoring is any action taken to keep tabs on the factors that affect your credit score. Credit monitoring services tackle specific areas that are generally at risk of being targeted, and we’ll cover more of that in a minute.

In general, credit monitoring keeps an eye on your credit history, watching for any unusual, uncharacteristic, or suspicious behavior that can affect your credit reports. Credit monitoring will usually include regular access to your credit score and credit report from any of the 3 major credit bureaus in the country. This is simple, but key to improving your credit score. Make sure that you regularly check your credit score.

In addition to keeping your identity safe by staying aware of changes that might have been made to your credit report without you consenting to it (such as a credit card taken out under your name or a large withdrawal made from your bank account), credit monitoring is also helpful if you are trying to build your credit score.

A credit report is made up of several factors, including your payment history, loans you’ve taken out, and your employment records. If you have a poor credit score, using credit monitoring can help you highlight which areas need improvement in order to boost your score. It’s actually a valuable educational tool that teaches many consumers a lot about how credit works.

You might want to improve your credit score if you tried applying for a loan but got rejected, want to upgrade your credit card status but are being held back by a poor credit score, or if you are planning to apply for a loan in the near future and want to ensure that you receive the best interest rate possible.

How Does Credit Monitoring Work?

Credit monitoring services watch for changes and/or actions made in your name, and then they notify you of these changes. They go beyond what the best credit score app or credit check companies might give you. For example, if a loan or credit card is applied for under your name or using your Social Security number, the credit monitoring service will raise a red flag. This red flag will trigger an automatic notification to be sent directly to you, so you can confirm whether or not you took this action. If you didn’t take the action (i.e., you didn’t apply for a loan or credit card recently), the credit monitoring service will help you protect yourself from potential harm and fraud.

As mentioned, credit monitoring is also helpful for keeping track of your credit. With a careful eye on your credit report, you can more easily make the improvements needed to raise your credit score. Here’s how that works:

You receive your credit report. This can be monthly, bi-annually, or quarterly, depending on the service.

Most credit monitoring services will give you a breakdown of your credit report, highlighting the areas that need improvement.

Armed with all of this information, you can take action to build up your damaged credit score.

Also, if there is any misinformation on your report, you can quickly amend this, instantly improving your credit score.

Can Monitoring Your Credit Score Protect You?

Monitoring your credit score can help you in several ways, as we've highlighted above. Additionally, keeping a close eye on your credit report can help protect you from dangerous identity theft. Some ways credit monitoring services help protect you include:

3-bureau credit reports along with changes alerts

Monthly credit score

High-risk transaction alerts

Dark web monitoring

Each of these features helps keep your identity more secure. Credit monitoring services all offer additional features to help safeguard your identity and protect you against identity theft. For example:

Anti-phishing mobile apps

Safe browsing extensions

Social insight reports

Risk management score

Stolen funds reimbursement insurance

It can also protect you against all sorts of ID theft, including child ID theft, synthetic ID theft (this is when someone combines some of your real identity information with fabricated information to create a new identity), new account fraud (opening new accounts in your name), credit card fraud (using a stolen credit card to make purchases), account takeover fraud (taking over your account and making changes so that you can’t get in or so that they can maintain control over the account), or tax fraud (using your Social Security number to gain control of your tax refund).

Our Top 3 Picks

- 1

very good8.6

very good8.6 All-in-one ID, financial, and device protection

All-in-one ID, financial, and device protection- Best for - Best identity theft protection company overall

- Starting price - $9/monthly or $108/year

- Free trial - 60-day money-back guarantee

All-in-one ID, financial, and device protectionRead Aura ReviewAura - Best identity theft protection company overall

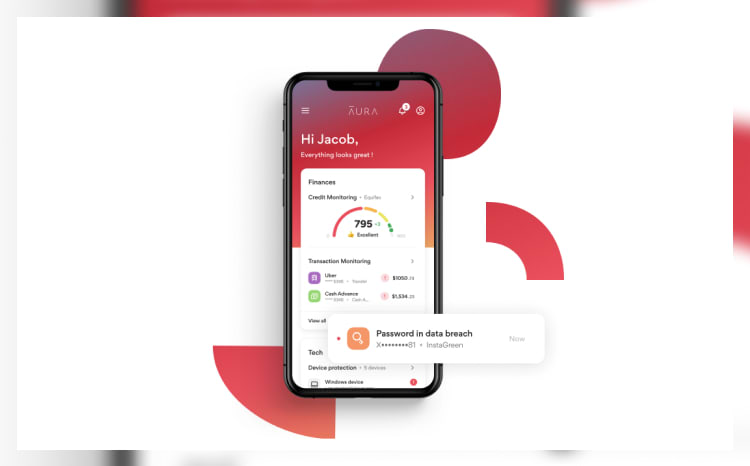

Aura provides robust protections against identity theft, including online account surveillance, financial transaction monitoring, and a secure digital "vault" for storing sensitive personal data.

The suite also features a password manager that simplifies the generation and storage of multiple robust passwords. Moreover, Aura's VPN utilizes high-grade encryption to safeguard your online activity, particularly on public Wi-Fi networks. Additionally, they offer AI-powered antivirus and safe browsing tools, which serve as a digital fortress against unwanted site trackers and fraudulent sites.

Aura monitors all three credit bureaus—Experian, Equifax, and TransUnion—as the Consumer Financial Protection Bureau (CFPB) recommends to detect identity theft. The CFPB also advises vigilance for credit check inquiries from unfamiliar companies and suspicious accounts, all of which Aura can oversee for you.

Why we chose Aura: In the event of a data breach, Aura promptly intervenes with security alerts, comprehensive fraud resolution services, and up to $1 million per person in premium identity theft insurance. The platform's sleek, user-friendly interface also showcases a "Protection Summary," conveniently displaying active anti-identity theft measures on a central dashboard.

Our experience: We were impressed with Aura's 24/7 customer support service. We appreciated that their U.S.-based fraud resolution team was always ready to assist us personally in the event of fraudulent incidents. If a breach occurs, the team would collaborate directly with us to develop a recovery plan and resolve the issue.

Aura Pros & Cons

PROS

Full suite of tools to protect your identity and finances60-day money-back guarantee for annual plan24/7 U.S.-based customer supportCONS

Fixed plans, no mixing, and matching - 2

good8.4

good8.4 Effortless AI-backed data protection

Effortless AI-backed data protection- Best for - Best for full-spectrum protection

- Starting price - $7.20/monthly or $79.99/year

- Free trial - Free trial: Yes

Effortless AI-backed data protectionRead Identity Guard ReviewIdentity Guard - Best for full-spectrum protection

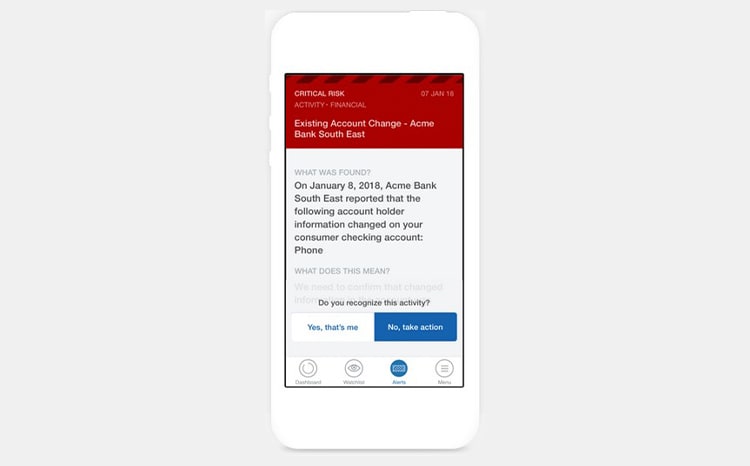

Identity Guard has safeguarded over 45 million identities and resolved more than 140,000 cases to date. They collaborate with IBM Watson's AI technology, leveraging its advanced data analysis and predictive capabilities to enhance threat detection.

The service protects your online identity by monitoring the dark web (a notorious hub for cybercrime activities) and alerting you if criminals are selling your personal information. Identity Guard also continuously monitors your personal and financial data, with their U.S.-based support team always at the ready to handle any emerging issues.

Why we chose Identity Guard: With 20 years of industry experience, Identity Guard stands out for providing effective identity theft protection and monitoring services, powered by AI. These services promptly alert you to a wide range of potential threats. They also offer up to $1 million in insurance coverage per adult to cover legal fees and replace lost funds.

Our experience: We found that even Identity Guard's most budget-friendly plan provides top-tier protection from ID fraud. We were particularly impressed by the inclusion of dark web monitoring in this entry-level subscription package.

Identity Guard Pros & Cons

PROS

Monitors credit score with all 3 credit bureausUtilizes IBM’s Watson AI tech for optimal performance$2,000 emergency cash fundCONS

No 24/7 customer service3-credit reporting only with premier plans - 3

very good8.5

very good8.5 Full-spectrum protection from Norton

Full-spectrum protection from Norton- Best for - Best for Norton antivirus users

- Starting price - $9.99

- Free trial - 60-day money-back guarantee

Full-spectrum protection from NortonRead LifeLock ReviewLifeLock - Best for Norton antivirus users

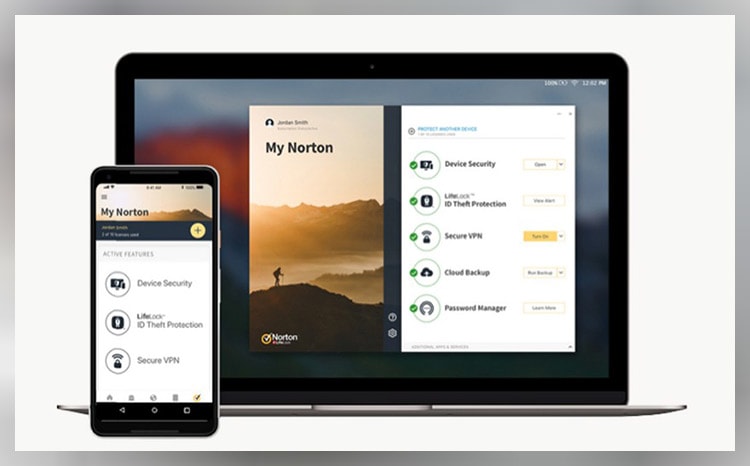

A product of anti-virus heavyweight Norton, LifeLock boasts the tech, accessibility, and ease that you’d expect from the industry-leading company. Most impressive are the plans themselves, which not only blend online security and ID theft protection but offer more flexibility than usual.

Lifelock’s plans include ID and Social Security number alerts and are offered in tandem with Norton’s 360 suite. This means that combo plans net you VPN services plus solid ID theft features like stolen funds reimbursement that ranges from $25,000 to $1 million dollars, bank account and credit card activity alerts, and even 401(k) investment account alerts on the Ultimate Plus plan.

LifeLock also offers LifeLock Junior, an affordable add-on for children under 18 that includes

Dark web monitoring and file-sharing network searches. All plans include 24/7 live member support and the aide of US-based identity restoration specialists.

LifeLock Pros & Cons

PROS

Reimbursement up to $1 millionAntivirus and protection from cyber threats60-day money-back guaranteeCONS

Only worth it if you want Norton 360Pricing can be confusing