The FTC reported 1.4 million identity theft cases in 2023 and 2024 looks set to be no different. From intricate cyber schemes to elaborate real-world cons, the top scams of 2024 reflect a disturbing convergence of innovation and deception. With the prevalence of these scams, it’s essential to stay aware of the scam trends and tips to avoid them.

In this guide, learn about the top scams of 2024, plus tips from experts on how to avoid becoming a victim of identity theft.

Key Takeaways:- The top scams include deep fake identity theft, synthetic identity fraud, and cryptocurrency fraud.

- The FTC reported that victims lost almost $8.8 billion to fraud in 2022.

- Avoid identity theft scams by creating stronger passwords, protecting sensitive information, and educating yourself on the top scams.

1. Deepfake Identity Theft

Deep-fake identity theft is where scammers manipulate identities online using AI. Andy Chang, a financial expert and the founder of The Credit Review, told Top10 that it’s one of the top scams to watch for. He says that these scammers will “utilize hyper-realistic AI-generated images to create false identities” to do things like:

- Access personal or financial accounts by falsifying identification documents

- Change passwords and authorized users of accounts

- Call family or friends of a victim using their voice to request money

For example, the scammer will typically create fake videos or audio recordings of individuals, often using their likeness and voice, to deceive others into believing false information or engaging in fraudulent activities. Scammers will often access this information from your social media accounts, which is known as social media identity theft.

How to avoid: Always be cautious of strange calls from loved ones asking for money or private information. Limit the information you share on social media and consider making your accounts private. Also, be wary of who requests to follow your accounts.

2. Synthetic Identity Fraud

Unlike traditional identity theft, where criminals steal your personal identity, synthetic identity fraud involves the fabrication of entirely new identities. Chang mentioned that synthetic identity fraud is another top scam—he said that “fraudsters combine real and fake information to create entirely new identities.”

To carry out this scam, hackers will use a stolen Social Security number and combine it with a falsified date of birth and name to create a new identity. They’ll use this identity to:

- Apply for new loans or lines of credit

- Hide poor credit to qualify for credit

- Pull out funds from loans or credit cards and then disappear

How to avoid: Routinely monitor your credit reports through AnnualCreditReport.com for any suspicious activity and promptly report any inaccuracies to your credit bureau.

3. Cryptocurrency Fraud

Cryptocurrency fraud involves scammers selling fake crypto tokens or coins. Change advised Top10 that these scammers will “create fake identities with stolen personal information to create crypto exchange accounts.”

With a false identity, scammers can implement schemes that involve transferring your cryptocurrency directly to them. They can also use personal information to gain access to digital wallets and steal funds.

How to avoid: According to the FTC, you should never trust cryptocurrency exchanges that guarantee big returns and profits—this is most likely a scam.

4. Online Dating Scams

As of January 2023, 25% of American adults have fallen victim to online dating scams. Online dating scams involve scammers creating fake identities, known as catfish profiles, on dating platforms to establish romantic relationships to exploit the victims for financial gain or personal information.

Romance scams don’t always happen on dating platforms; they can also occur on social media. Scammers will create fake social media profiles, or catfish profiles, to target their victims, pretend to have romantic feelings for them and get them to send them money.

How to avoid: If you’re on a dating app, consider running a background check to verify who they are.

5. Fake QR Codes

Fake QR codes, also known as “Quishing” scams, are also on the rise. According to cybersecurity professionals at Check Point Quishing scams increased by 587% in 2023.

This code-based phishing scam works by providing a user with a fake QR code that directs them to a site containing malware. The malware could then steal sensitive information, such as credit card numbers and important credentials.

How to avoid: According to the FBI, you should never scan a random QR code, especially ones in texts or emails, unless you know for a fact that they’re reputable.

6. Medicare Scam

With Medicare scams, fraudsters may pose as Medicare representatives and contact individuals through call or text, claiming they need to update or verify personal information such as Social Security numbers, Medicare ID numbers, or bank details. They will often use this information to carry out identity theft or fraudulent billing.

However, Medicare will never call you directly. The scammers will typically ask you to:

- Fill out a survey they’re conducting

- Look into Medicare coverage

- Submit information to receive a new Medicare card

How to avoid: Never give out your Medicare number—the only time you’ll need this number is when you’re enrolling in a plan. They will also never call you or come to your door.

7. Student Loan Scams

With student loan scams, scammers may use stolen personal information, like Social Security numbers, to apply for student loans on behalf of unsuspecting individuals. This can result in victims being held responsible for loans they did not take out.

They will also pretend to be from student loan forgiveness programs and promise to cancel or reduce loan payments in return for personal and bank account information.

In 2023, the FTGC gave over $3 million to consumers affected by student loan debt relief scams. With the rise in these attacks, protect your FSA ID and don’t send it to anyone unless you know it has come from a trusted source.

How to avoid: According to the Office of the U.S. Department of Education, if an offer states that it’s limited and asks you to act urgently, it’s likely a scam. You can also contact the Federal Student Aid Information Center if you’re unsure.

8. Fake iCloud Update Alerts

Scammers have been using a new phishing scam through iCloud to obtain credit card information and credentials. First, the scammer will send their victim a falsified email notifying the customer of an urgent iCloud update with a fake login or checkout page, similar to Apple.

The victim will then enter their iCloud credentials and credit card information, which the hacker steals. Sometimes, the hacker will also set up their page to redirect to Apple’s real website, which makes it harder to detect that you’ve been scammed.

How to avoid: Ensure all notifications and email communications about your iCloud come from Apple directly—you can report suspicious emails or texts to Apple directly.

9. Payday Loan Scams

Payday loan scams involve fraudulent activities related to short-term payday loans, which are high-interest loans typically due on the borrower's next payday. These scams often target individuals who are in urgent need of quick cash to receive money or steal their identities.

Here is how the scam typically works:

- The scammer will pretend to be a loan provider and call or email the victim, saying that they’re eligible for a payday loan

- They will ask for your Social Security number or bank account numbers to obtain the loan

How to avoid: Always do additional research before applying for a lender—you can search your loan on Better Business Bureau to confirm it's legitimate.

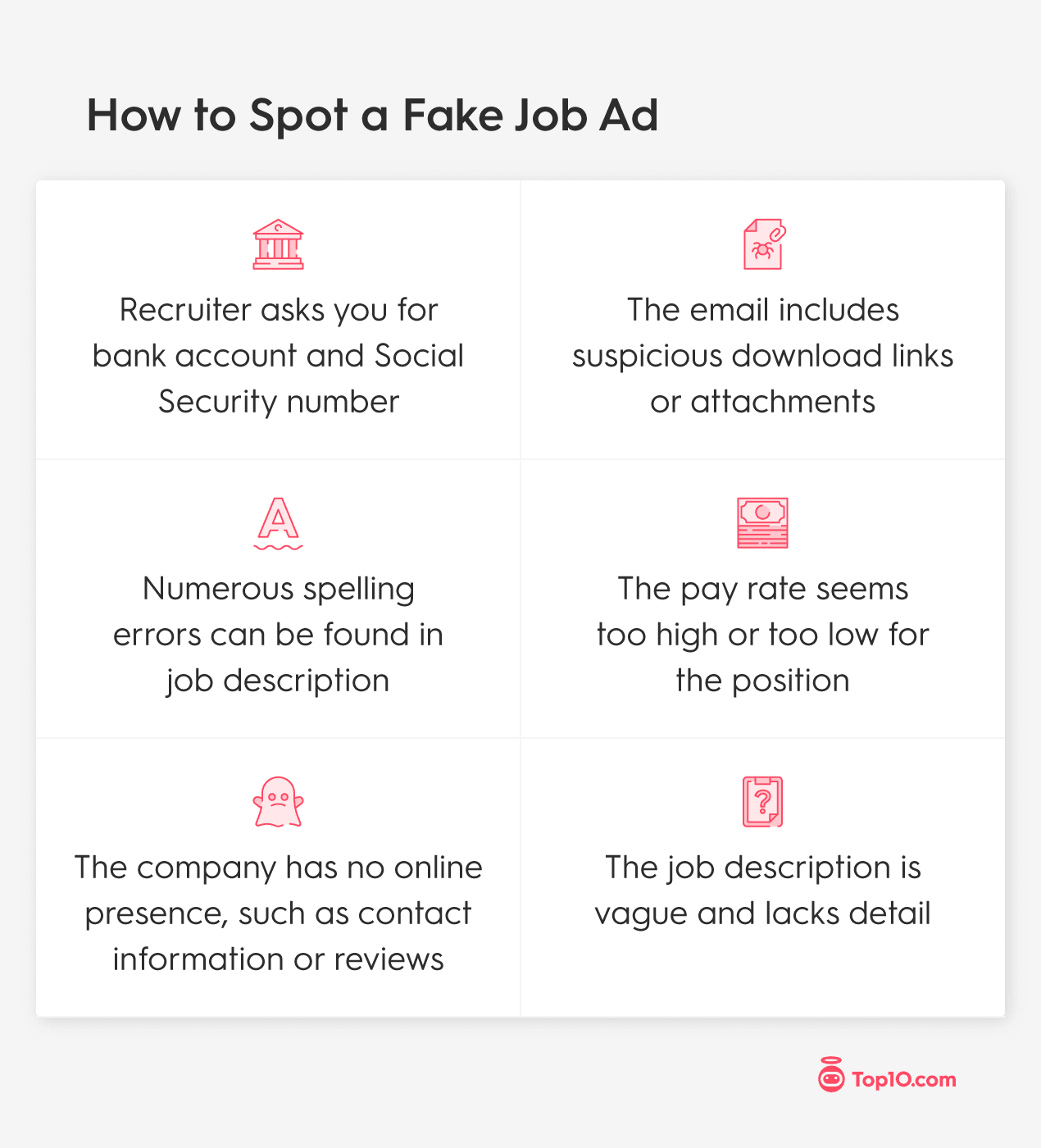

10. False Job Ads

Scammers have begun to impersonate recruiters and employers on popular job search sites like Indeed to steal information. Many of these scams will act as falsified job postings, or the scammer will pretend to be a recruiter and send out a job acceptance email.

They may even send you fake paperwork asking you to fill out important details to accept the job offer, like your Social Security number and your credit card information. The hackers could use this information to steal your identity.

You can also report false job ads directly to the FTC, as well as the website where the posting appeared.

How to avoid: Before applying for any job, research and verify that the company is legitimate and from a reputable job search site. Also, companies will never require you to pay upfront to accept a position.

11. Child Identity Fraud

Children can be a victim of scammers, too—in fact, child identity theft affects over 1 million children a year in America. Child identity theft occurs when someone uses a minor's personal information to commit fraud, typically for financial gain.

Children are attractive targets for identity thieves because their clean credit histories provide a blank slate for fraudulent activities. The theft of a child's identity can go undetected for years, as parents may not regularly check their child's credit report.

How to avoid: Monitor your children’s credit report and use extra caution when giving out your child’s SSN. Also, educate your children about internet safety and consider monitoring their social media use.

12. Charity Fraud

Charity fraud refers to scammers pretending to be charitable organizations or under the guise of fundraising for charitable causes. Scammers will often set up fake charity websites or perform telemarketing scams to get money or information that can be misused and potentially lead to identity theft.

How to avoid: The FTC recommends doing research before donating and doing an internet search to see if there are any scams attached to the name—you can do this through sites like Charity Navigator.

13. Technical Support Scams

Technical support scams are a type of fraud in which scammers trick individuals into believing that their computer or device has a problem and then offer fake technical support services.

These scams often involve:

- Phone calls

- Pop-up messages

- Emails

The scammers will typically pose as representatives of well-known technology companies or antivirus providers to gain access to the victim's computer, steal personal information, or convince the victim to pay for unnecessary services.

How to avoid: According to the FTC, legitimate tech companies will never contact you to tell you something is wrong with your device or provide a pop-up.

14. Grandparent Scams

Grandparent scams, also known as "grandchild scams" or "emergency scams," target older individuals, typically seniors, by exploiting their emotions and concern for their grandchildren.

The scam typically involves a scammer posing as the victim's grandchild or as someone claiming to represent the grandchild, such as a lawyer or law enforcement officer. The scammer then fabricates a scenario, usually over the phone, in which the grandchild is in trouble and urgently needs financial assistance.

The scammer will then steal money or personal information, like a Social Security number.

How to avoid: The FTC recommends staying vigilant with spoof calls and never trusting someone who asks for money over the phone.

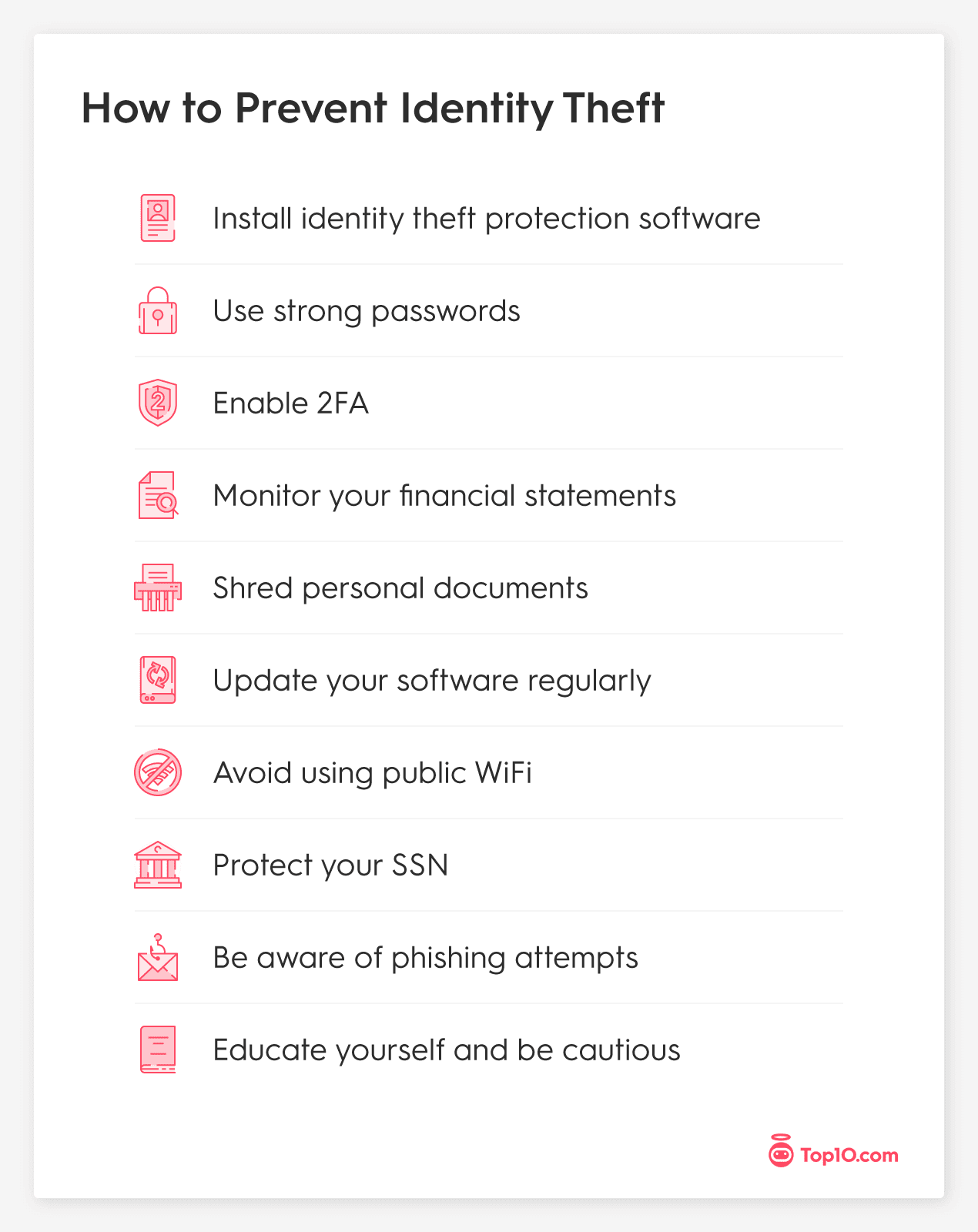

10 Tips to Protect Your Identity

Falling victim to identity theft can greatly impact your day-to-day financial and personal life, so it’s necessary to take steps to protect yourself. Here are 10 tips on how to avoid identity theft scams:

- Install identity theft protection software: Malware and antivirus software can help you become less vulnerable to ID theft attacks and make your information online more secure from scammers.

- Use strong passwords: When creating accounts, use strong passwords that include a mix of uppercase and lowercase letters, numbers, and symbols, as well as a password manager to store them safely.

- Enable multifactor authentication (2FA): Chang suggests enabling 2FA for your online accounts whenever possible. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your mobile device.

- Monitor your financial statements: Chang also stresses the importance of routinely monitoring financial and credit activities for suspicious transactions. To do this, you can set up alerts for unusual or large transactions

- Shred personal documents: Shred sensitive documents before disposing of them, especially those containing personal information like Social Security numbers or financial details.

- Update your software regularly: Keep your operating system, antivirus software, ID theft protection tools, and other applications up to date to patch potential security vulnerabilities.

- Protect your Social Security number: Be cautious about sharing your Social Security number and only provide it when necessary. Avoid carrying your Social Security card in your wallet and store it in a safe place.

- Avoid using public Wi-Fi: Scammers can hack into public Wi-Fi networks to steal the information of any user that’s connected to it. When choosing a Wi-Fi network, opt for those that are password protected.

- Be cautious of phishing attempts: Avoid clicking on suspicious links in emails, text messages, or social media messages in order to protect yourself from phishing attacks. Also, verify the legitimacy of a website by checking the URL before entering any personal information.

- Educate yourself and be cautious: Stay up to date with the top scams of 2024, monitor and check for identity theft signs, and stay cautious about sharing personal information on social media platforms.

Reduce Your Risk of Scams with ID Theft Protection

By keeping these top scams and prevention tips in mind, you can safeguard your identity from hackers. To add an extra layer of protection, invest in an identity theft protection service to monitor and boost your online safety, as well as reduce your risk of scams.