What is Identity Theft Protection?

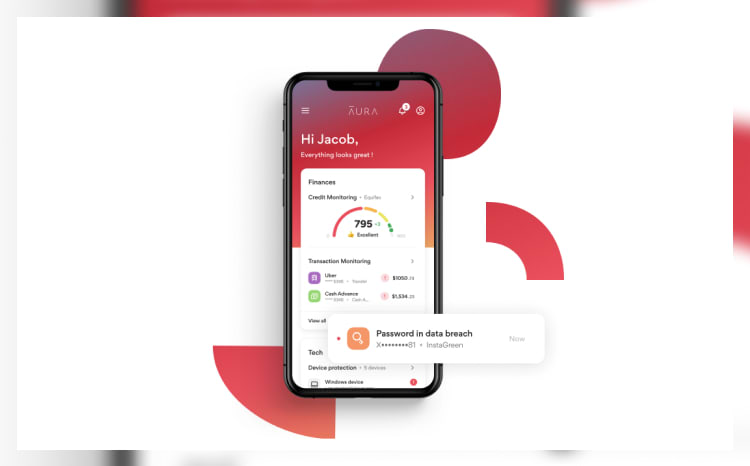

Identity theft protection services aim to safeguard your personal information from fraudulent use, like opening new credit card accounts or taking out loans in your name. Typically, most ID theft services feature identity and credit monitoring, which are designed to detect suspicious activity, such as unauthorized purchases, in real time.

Many also include insurance to mitigate costs if a breach occurs and offer resources to help resolve theft issues and facilitate ID recovery.

How Does Identity Theft Happen?

Most identity thefts occur via the internet when you don’t implement appropriate cybersecurity measures. Weak passwords can be easily guessed or cracked while using outdated antivirus software, leaving your data vulnerable to newer malware.

For example, one common trick is phishing scams, which lure you into submitting your details on fake websites. During these scams, you unknowingly surrender your passwords and personal data while criminals remain undetected. An updated antivirus suite, however, would be able to identify suspicious or unsafe websites.

Some hackers may also infiltrate your device directly using viruses or remote desktop software, while others pry into your accounts using malicious methods, such as keylogging. Additionally, criminals can steal your personal information through a data breach at companies or other organizations that have your details on record.

For example, an alleged leak on a hacker forum exposed over 200 million Twitter users’ emails in 2022. With your data, criminals can commit serious offenses, such as applying for loans in your name, emptying your bank accounts, or selling your information on the dark web or other criminal forums.

If you suspect identity theft, act immediately. The potential damage extends far beyond data loss and can have serious repercussions.

Why Is Identity Theft Protection Important to Have?

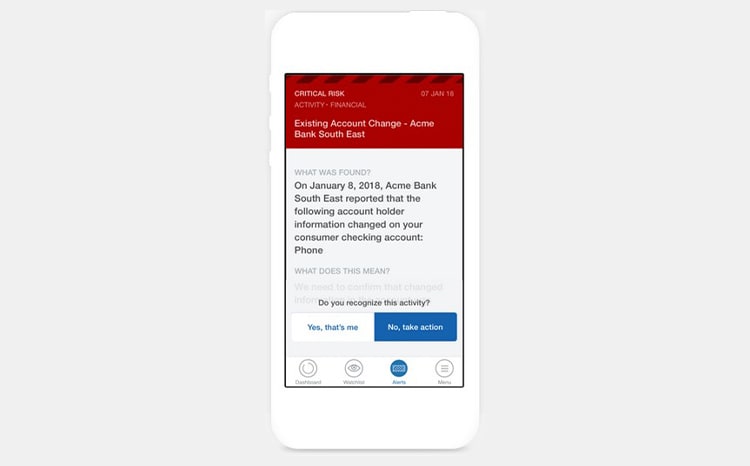

Identity theft protection is essential because it rapidly flags questionable activity, allowing you to take preventative measures. Such mitigating actions may include disputing a fraudulent account or freezing your credit. Every second counts—the longer a criminal has access to your personal information, the more damage they can do.

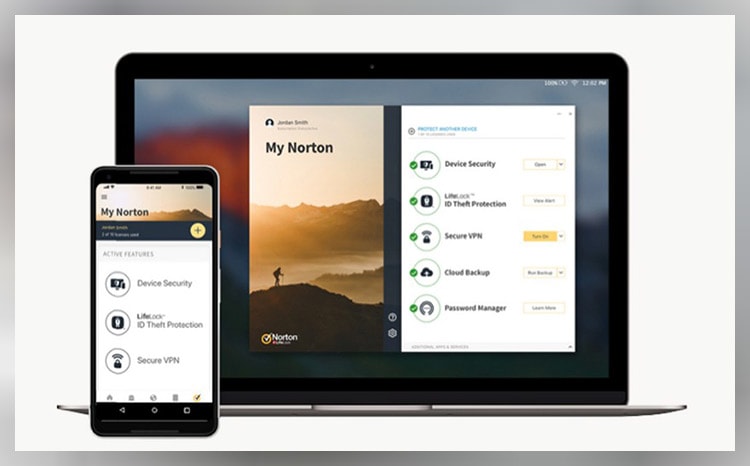

Most identity protection services will handle the heavy lifting, shutting down unauthorized accounts and liaising with your bank and credit agencies to report fraud. They also offer online security tools such as VPNs and antivirus software to thwart hackers, preventing identity theft from the get-go.

Additionally, many of these services include insurance coverage in case of a breach, giving you peace of mind that you’ll recover from any financial losses.

Do I Need an Identity Theft Protection Service?

Ultimately, the decision boils down to personal preference. Would you rather pay a small fee for coverage in case you fall victim to identity theft?

Trusted identity theft prevention services offer valuable protection against financial and identity-related harm caused by criminals and malicious actors.

High-risk individuals, in particular, could significantly benefit from these advanced safeguards against identity theft. This includes prior victims—since their stolen information may be traded or sold between bad actors who could victimize them again—and those who frequently conduct sensitive online transactions.

However, it’s crucial to understand that ID theft protection services don’t entirely prevent identity theft. Given this, it becomes increasingly apparent that you need to be savvy and proactive in protecting your personal information.

How to Prevent Identity Theft

Subscribing to an identity theft protection service doesn’t prevent your personal information from being stolen. Instead, it enables you to take immediate action if fraud is detected. These services monitor various sources, including your credit files, social media accounts, and the dark web, to identify any signs of criminal activity.

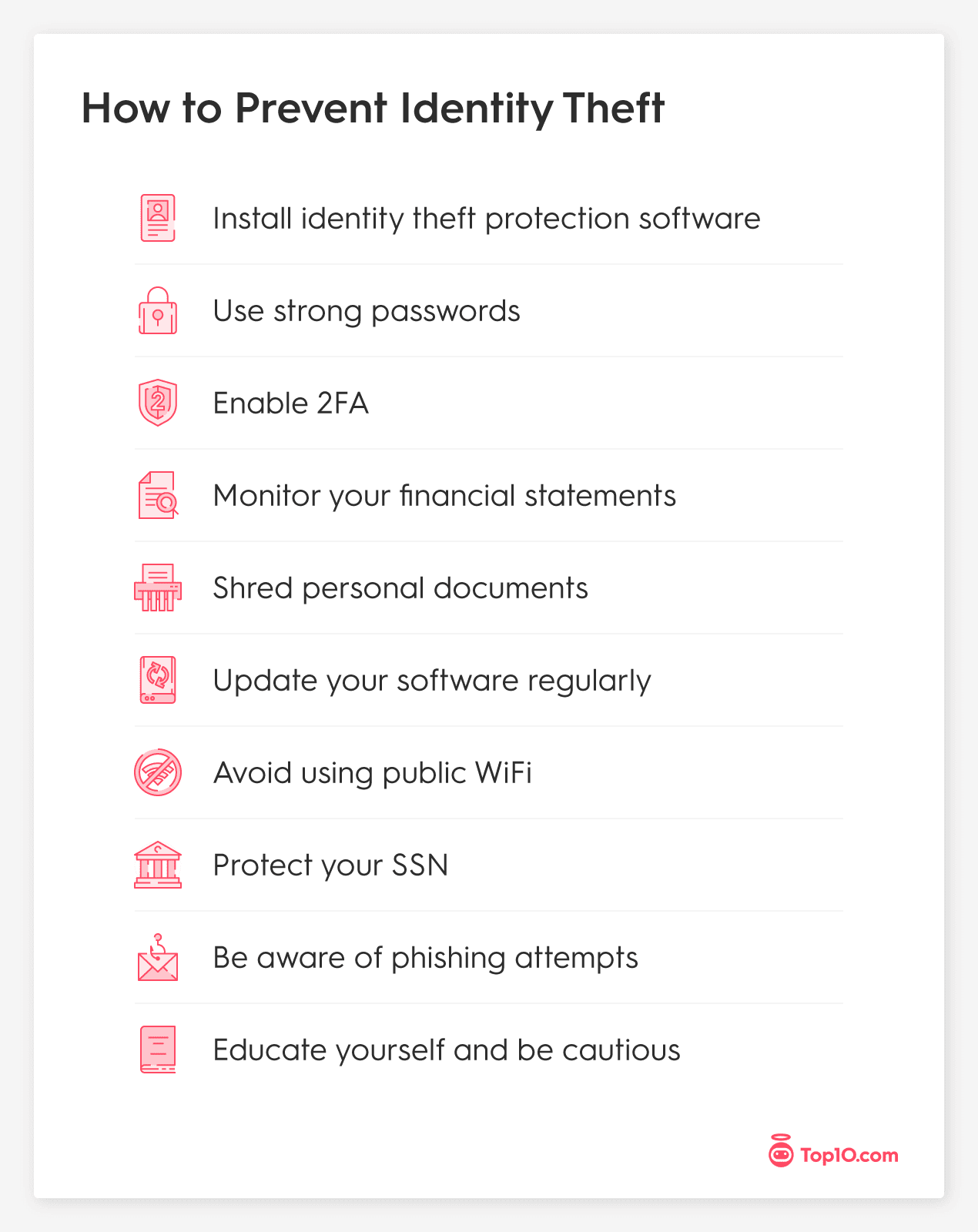

Fortunately, there are a few actions you can take to proactively prevent identity theft. These include the following:

- Regularly check your financial accounts: Frequently review your credit card statements and bank accounts to identify suspicious or unfamiliar expenditures.

- Use strong and unique passwords: By employing robust passwords (think: “SDjcks2347\]LKS":>” vs. “Yourname2025”), you make it harder for criminals to guess or crack them and limit the potential damage if one of your passwords gets leaked or stolen.

- Install up-to-date antivirus software: Hackers often attempt to install malware on devices to gain unauthorized access or steal personal information. Using a reliable antivirus program can detect and block malicious software before it infiltrates your device, reducing the risk of this happening.

- Safeguard physical information: Make sure your mail is delivered to a secure location or locked mailbox. Additionally, shred all personal documents before discarding them so they can’t be stolen from your trash.

While scammers are always coming up with new methods, if you're up-to-date with the latest scams, you'll be better prepared to prevent them happening to you.

Is an ID Theft Protection Tool Worth the Investment?

Yes, ID theft prevention tools are critical to ensuring effective identity safeguarding. As we rely more and more on phones and computers, the threat of digital identity theft continues to rise. If you’ve been a victim of identity theft in the past, you’re particularly vulnerable. And your risk increases every time you engage in sensitive online transactions.

If you want to add an extra layer of security to your life and reduce the risk of identity theft, consider spending a few dollars per month on an ID theft protection service.

What Types of Identity Theft Protection Services Are Out There?

Identity theft protection services offer a spectrum of features and varying degrees of safeguarding measures. Some, like credit report monitoring, deliver basic protection but don’t guarantee full coverage. Others are more comprehensive but also often more expensive.

Here’s a breakdown of these services, with an insight into their specific offerings and advantages:

- Credit report monitoring: Credit report surveillance services essentially track your credit report activity in real time. This function will notify you of changes, including loan applications or new bank accounts opened in your name.

- Identity monitoring: More comprehensive identity monitoring is designed to scan various sources for compromised or stolen personal data that criminals could weaponize. These sources include the dark web, normal websites, and several other databases.

- Identity recovery: Reliable identity recovery services (which usually form a part of an ID theft protection suite) can significantly streamline the process of undoing the damage caused by ID theft. Some companies even provide professional assistance, allowing you to relax while professionals handle the issue.

- Identity theft insurance: Another notable consideration is the type and level of insurance coverage bundled with your identity theft protection service. Some provide a high level of coverage, shielding you from financial losses following identity theft.

Other Types of Identity Theft Protection Services

Tax-Related ID Protection

People who illegally obtain personal information such as a Social Security number can file fraudulent tax returns to the IRS. However, to combat rising tax-related identity theft, the IRS teamed up with tax firms, payroll processors, and state tax administrators. Together, they conduct awareness campaigns to inform citizens about safe practices.

Americans should protect their tax records, store their Social Security cards in safe locations, and use reliable security software and strong passwords when submitting sensitive personal information online.

Medical ID Protection

Though less frequent, medical identity theft is an equally severe threat. It involves the misuse of your personal data to procure medical services or medications. The dark web can trade this information so total strangers can use it, and medical providers can even exploit it by submitting excessive or fabricated claims to insurance providers.

For this reason, merely protecting your data online may not be sufficient. Experts recommend checking health insurance records yearly for potential discrepancies.

Common Types of Identity Theft Scams

Criminals employ various scams with the sole purpose of stealing your identity or personal information. However, not all ID theft cases involve modern technology, as phone scams and physical information theft are still prevalent. In fact, Americans have lost a staggering $39.5 billion to phone scams alone in the past year.

Here are some common identity theft scams to be aware of:

- Phishing: Phishing scams involve criminals posing as legitimate companies or organizations. These scams typically arrive via email or text messages appearing to be from trustworthy entities, such as banks. They often urge immediate action, like updating personal or payment details, but this information is quickly stolen once entered.

- Hacking and data breaches: Even with the most advanced cybersecurity measures, everyone remains vulnerable to ID theft. Hackers employ diverse techniques to gain entry into devices or corporate databases, enabling them to steal vast amounts of personal information.

- Formjacking: Criminals may target unsecured online retailers or other service providers by inserting malicious code designed to help them steal your payment information. This technique often revolves around manipulating a form, so when you complete it, the code sends a copy of your information to the attacker.

- Physical theft: Physical identity theft continues to pose a significant threat. Reportedly, more than 50% of ID theft incidents between 2006 and 2016 were traced back to non-digital vulnerabilities. This form of fraud can occur through various means, including the obvious theft of a purse, wallet, or mail.

Other Kinds of Identity Theft

In addition to the standard types of identity theft mentioned above, you should be aware of a few other less common ones:

- Tax-related identity theft: Criminals can exploit stolen information, such as Social Security numbers, to file fraudulent tax returns with the IRS. Although efforts are made to mitigate this risk, it’s still important to secure your Social Security cards and tax records.

- Medical identity theft: While relatively uncommon, medical identity theft occurs when someone utilizes your personal information to obtain medical services or submit falsified insurance claims.

- Child identity theft: Scammers may steal children’s identities to open unauthorized bank accounts, apply for loans, and engage in other fraudulent activities.

- Synthetic identity theft: This form of identity theft involves combining authentic (often stolen) information with fabricated data to create an entirely fictitious identity.

What Are Some Common Signs of Identity Theft?

Here are a few common indicators of identity theft to watch out for:

- Financial discrepancies: One of the first red flags signaling identity theft is unusual or unauthorized transactions on your credit card or bank records.

- Your mail is going missing: A common tactic criminals use is to reroute your mail to an address of their choosing. This allows them to receive your mail, giving them access to your sensitive information, such as bank statements, credit card details, or other personal information.

- Debt collectors contact you: If someone has been using your identity to take out loans and credit cards but has failed to make their payments, you may find debt collectors chasing you for debts you didn’t know you had.

- Your medical records show discrepancies: Some criminals may use your personal information to access medical treatment. If your benefits don’t add up or you receive an unexpected medical bill, it could indicate that someone’s using your information to receive “free” medical care.

- Your information’s exposed in a data breach: Data breaches are surprisingly common. In fact, such breaches exposed more than six million data records around the globe in the first quarter of 2023. These information leaks often result in personal information being sold on the dark web, which could put you at risk of identity theft.

How Can I Find Out If Someone Is Using My Identity?

One of the most effective ways to detect online identity theft is by regularly monitoring your bank and credit card statements. Financial institutions typically offer access to statements through online platforms or mobile apps, so you can easily review your recent deposits, withdrawals, charges, and payments.

If you notice something you didn’t authorize, consider it a clear warning sign of potential identity theft. Additionally, it’s essential to routinely check your credit report from all three major credit bureaus: Experian, Equifax, and TransUnion. You can access your credit reports for free by visiting www.annualcreditreport.com.

How to Report Identity Theft

If you become a victim of identity theft, it’s crucial to report the incident to the FTC. You can easily do this over the phone or through their online platform; just be sure to provide as much information as possible.

Additionally, contact your bank, credit card provider, and any relevant organizations affected by the fraudulent activity conducted in your name. It’s also recommended to notify one or more of the major credit bureaus—Experian, TransUnion, and Equifax—to place a fraud alert or request a credit freeze if necessary.

Filing a police report is another important step. To do so, you’ll need your ID, proof of your address, your FTC identity theft report, and any evidence supporting the occurrence of identity theft.

How to Choose the Right Identity Theft Protection Service

While all the identity theft protection services listed here are excellent choices, it’s essential to find the one that suits your needs. Begin by considering your budget to eliminate expensive options immediately.

Next, assess your requirements. Do you prefer credit monitoring or comprehensive identity monitoring? What level of insurance coverage do you need? Is professional assistance available if you experience identity theft?

Once you’ve considered these questions, you’ll be better equipped to make an informed decision. Remember, many providers offer free trials that allow you to test their services without any financial commitment.

Identity Theft Is on the Rise

Recent reports indicate a growing concern regarding identity theft. Incidents of credit card fraud, loan fraud, and benefits fraud are alarmingly prevalent. In fact, according to the FTC, identity theft cases in the US grew from over 650,000 to 1.1 million between 2019 and 2022.

This trend can largely be attributed to the increasing digitalization of our lives, which has resulted in numerous data breaches. These breaches have exposed the personal information of countless individuals, enabling criminals and ID thieves to take advantage of them.

Other Identity Theft Protection Services We Reviewed

Beyond the identity theft protection services discussed above, we’ve also researched and compiled a list of other brands that may interest you. Check out this list of identity theft services to gain insight into different pricing options, types of reports, and features offered across the board:

Experian - Best for dark web surveillance

Identity Defense - Best for affordable basic ID theft protection

ReliaShield - Best for family plans and free child coverage

GOFreeCredit - Best for three-bureau credit monitoring and credit alerts

Avira - Best online security tools for Mac users

Credit Karma - Best for free credit report monitoring

Self Financial - Best for building credit

Stop Identity Thieves in Their Tracks

Investing in an online identity protection service is a highly effective way to prevent online identity theft. However, it’s essential to acknowledge that no identity is entirely safe in the digital age. That’s why features like identity resolution services and ID theft insurance provide added peace of mind to those seeking extra protection.

Choose the most robust anti-ID theft tool within your budget to ensure your online safety. Even a basic or free credit monitoring service can go a long way in hindering identity thieves.

LifeLock and Identity Guard are both leading providers of ID theft services and may appeal to different people with different needs. Identity Guard currently has the better deal and compares favorably with the more expensive LifeLock, with 3-bureau credit monitoring and an AI-backed network.

Identity theft is a growing problem in the US and ID theft protection can be one of the best safeguards against it. Those who have been victims already are especially at risk, and those who do lots of banking or conduct other sensitive transactions online may benefit from added protection.

LifeLock's CEO has allegedly been hacked more than a dozen times, including after a publicity stunt in which he publicly shared his social security number as a testament to the strength of his company's security prowess.

Although the terms are often used interchangeably, identity theft protection and credit monitoring are quite different. ID theft protection tools monitor multiple sources, including your credit score, the Dark Web, and various other components, for evidence of fraudulent activity. Credit monitoring services, on the other hand, are solely designed to monitor your credit score and notify you if it changes unexpectedly.

If your identity is stolen, the first step is to report it to the FTC, online or by phone. Based on your circumstances, you may be required to file a police report. You will also need to contact companies to let them know your information has been used fraudulently.

Identify theft insurance is designed to cover any costs incurred when your ID is stolen. This includes paying for a credit report, replacing identification, and covering legal fees if you need to go to court. Without some form of insurance, you will need to pay these costs out of pocket, and they can quickly add up to hundreds or even thousands of dollars.

Yes, credit monitoring is a great idea if you’re worried about fraud, identity theft, or anything related to these. With a decent credit monitoring service, you will be alerted immediately to unexpected changes to your credit score, fraudulent transactions, and more.

The first thing anyone who experiences identity theft should do is report it to the FTC. This can be done over the phone or online, and you may be asked for additional information. You can also contact the police, any companies or organizations where the fraud has occurred, and your bank. You should also freeze your credit report and contact your identity theft insurance provider if you have one.

Identity theft is a serious matter that will always be investigated by the relevant authorities. This can include the police, especially if you make a direct report to your local authorities. However, it’s more often dealt with by federal investigative agencies such as the FBI.